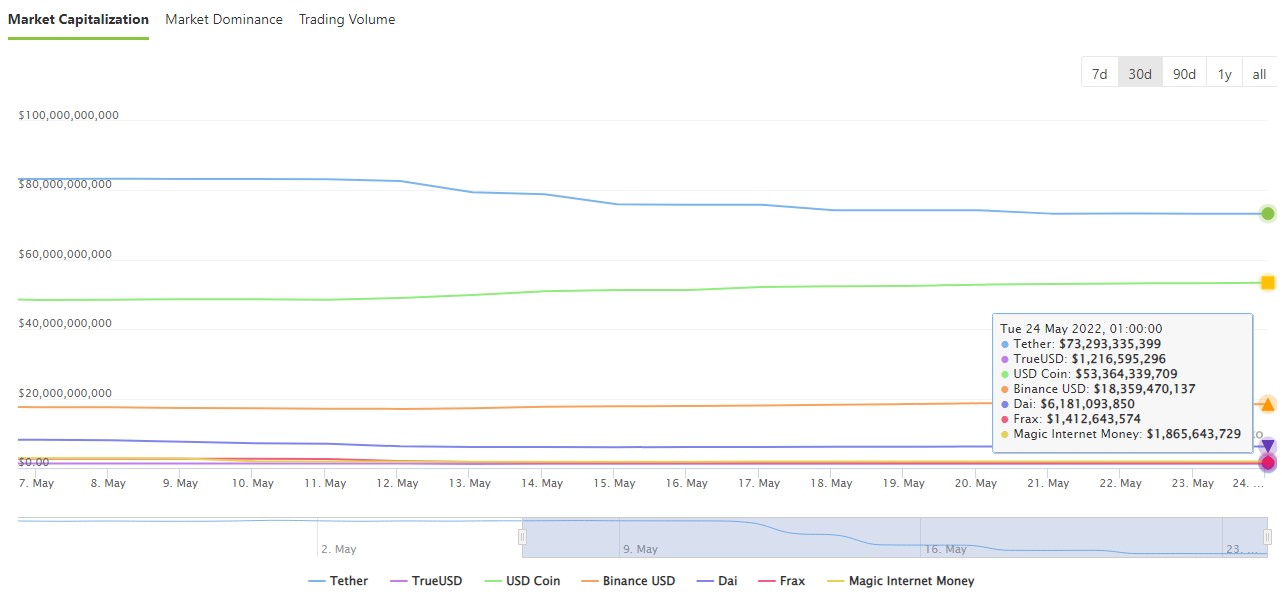

Tether has witnessed some $10 billion worth of redemptions since the TerraUSD (UST) implosion, all the while USDC and BUSD experienced relative growth year-to-date.

Tether and Bitfinex CTO Paolo Ardoino made light of the then-snowballing redemptions, asking the next up-and-coming algorithmic stablecoin on Twitter to “use another letter at the end of it’ name that’s not a ‘T’.

Cryptocurrencies aren’t going away. Buy Bitcoin & Litecoin here.

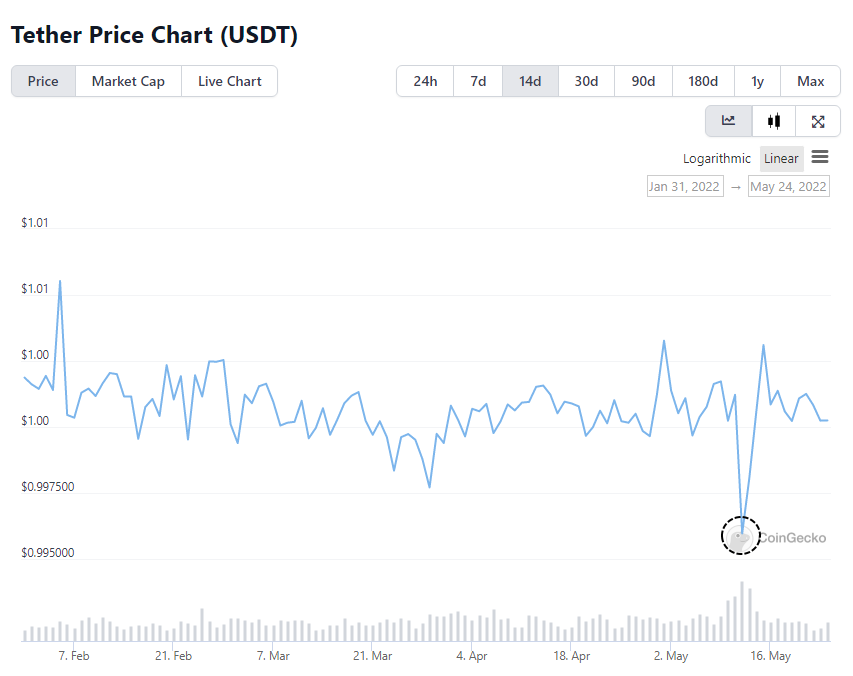

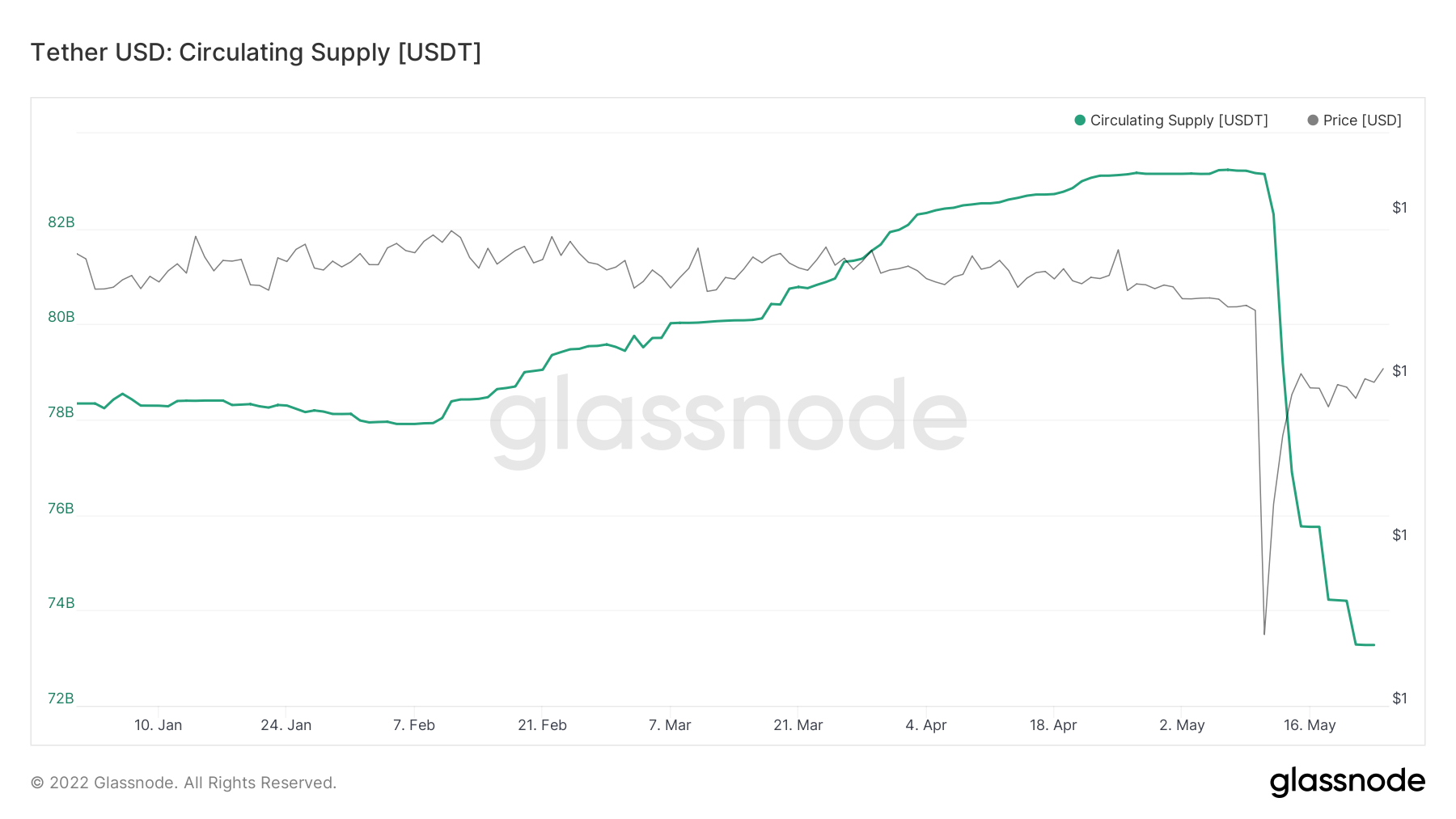

Last week, Tether experienced a bout of redemptions to the tune of $10 billion. Speculation circled around a probable contagion effect from the confusion between UST (Terra USD) and USDT (US Dollar Tether). The redemptions briefly caused an arbitrage opportunity that initially appeared to challenge the Tether peg ($0.995:$1), but as the panic calmed and the mini-bank run slowed, order was restored quickly restored.

All in all, the supply of Tether in circulation is down 6.5% year-to-date (YTD), from $78.3 billion to $73.2 billion today. However, the panic was not solely confined to Tether. Other stablecoins (USDC) also witnessed a brief downturn, indicating that the systemic risk event had a rippling effect on the entire crypto ecosystem.

USDC and BUSD Experience Relative Growth YTD

On the flip side, USDC and BUSD saw growth in May. USDC’s circulating supply is up 26% YTD, while BUSD is up 28% YTD. These stablecoins saw similar peg deviations during the UST-insolvency panic and a macro crypto reshuffle.

USDC is presently backed by 23% cash reserves and 77% short-duration US Treasuries. On the other hand, BUSD, issued by Paxos in partnership with Binance. While the composition of assets is not clear and effectively in the same water as Tether, USDP and BUSD is audited monthly and fully backed by cash and short-term US treasuries.

Tether is Still Fully Backed

Tether’s reserves include include various assets, but are predominantly (85.7%) stored as cash and cash equivalents, per the March 2021 transparency report. In fact, 55.5% of Tether’s reserves are in US Treasuries, while 5.8% are in cash & bank deposits.

All in all, Tether is fully backed by a basket of assets that has so far provided robust market stability as a safe-haven USD peg. Tether’s capacity to maintain billions of redemptions was tested last week, with the company vying for a further concentration of assets in US treasuries and cash deposits this year.

Tether remains the most widely used stablecoin, ranked coming in only after Bitcoin and Ethereum in terms of market cap. The lingering question isn’t whether Tether is solvent as much as whether it will retain its top dog stablecoin position in the future.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!