Is crypto safe?

Is crypto safe, you ask? Well cryptocurrency payments on the top blockchain networks such as Bitcoin, Litecoin or even Ethereum are safe and work without hiccups. That’s not the focus of this writeup. Instead, I’ll discuss financial history, both old and new, the lessons we can learn from it and responsible finances. Stick around and read till the end. Here’s what I’ll discuss:

- Finance scams

- Cryptofinance scams

- Lessons learned

- Your funds, your responsibility

- Is ‘safety’ the right optics?

1. Finance scams

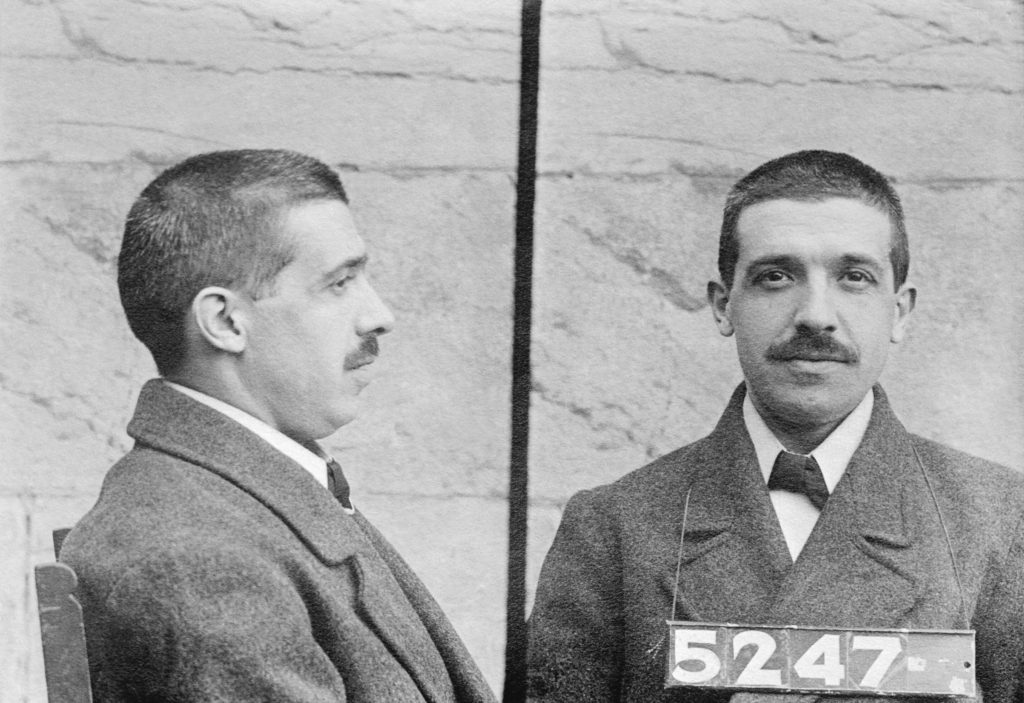

The Ponzi scheme creator – Charles Ponzi

The Ponzi scheme is named after Charles Ponzi, whose infamous technique turned heads in the 1920s. The scheme involved a promise of future returns on investment by using fresh funds from new investors to pay off earlier participants instead of investing it. This is a classic ponzi scheme.

Eventually there weren’t enough new investors (victims) to pay off earlier investors. His infamy arose because Charles Ponzi used the media to promote his fraud. He promised 50% returns in 45 days, which is why millions of dollars in capital came rushing in in the first place.

Once the Ponzi mechanics became clear, the Ponzi scheme collapsed in the early 1920s, just a couple years before the Great Depression. Ponzi was charged with fraud and sent to prison. His scheme paled in comparison to Bernie Madoff’s master scheme.

The Bernie Madoff scandal

One of the biggest financial frauds in history is Bernie Madoff’s Ponzi scheme, which many consider the largest ever record. Madoff leveraged his status as a reputable businessman and advisors to draw in crowds of investors, including high profile organisations and individuals.

He offered consistent returns on investment, supposedly from stock market trading, but in reality he used investors’ money to pay off earlier ones – sticking to the tried and tested Ponzinomics model of his predecessor. Still, Madoff was smarter than Ponzi because he offered reasonable returns; an unwavering 10% per annum, instead of the exorbitant returns showcased by most fraudsters.

The deception worked for decades before its collapse. Its downfall started in 2008 during the great financial crisis, prompting scrutiny of banks, investment firms and global finances more broadly. The 2015 film ‘The Big Short’ provides sobering insight as to the level of degeneracy markets had sunk to before the inevitable collapse.

It’s estimated that Madoff had amassed around $65 billion before his eventual arrest. Madoff received a 150-year prison sentence and passed away in 2021.

Theranos fraud

Another infamous fraud came from a biotech company that claimed to have ground breaking blood testing technology when it didn’t. Elizabeth Holmes, the founder of Theranos mislead investors and the public about the company’s capabilities, and in 2016, the scandal began to unravel.

A series of investigative reports revealed that Theranos was using traditional blood testing methods for its tests, and that the advertised technology was extremely inaccurate. Many wonder why it took so long to discover the truth, but ultimately the chickens came home to roost. Along with her business partner, Sunny Balwani, the pair were charged with fraud in 2018 and the company shut down. Hundreds of millions, if not billions were lost in the fraud.

Wirecard scandal

There was a time when Germany’s Wirecard processed $27 billion in payments. When the numbers didn’t add up anymore, it was found that the company effectively committed accounting fraud to inflate revenue and profits, thereby creating a false impression of profitability.

The Wirecard scandal came to light in 2018 following reports by the Financial times that raised concerns as to the company’s accounting processes. Shortly after, it was revealed that Wirecard had been boosting its revenues for years, and that a significant portion of its business was based on fraudulent activity. It appears that AML and KYC laws didn’t save them after all!

The company collapsed, and Netflix even launched a documentary about it called “Skandal! Bringing down Wirecard”

2. Cryptofinance scams

Do Kwon Terra Luna fraud

Terra was a crypto project which was supposed to be an algorithmic stablecoin (UST), which was supposed to be pegged to the dollar on a 1:1 basis. The only problem was that UST was backed by Terra Luna’s own token which was created out of thin air. In May 2022, the price of UST dropped over 70% in just a few hours. A 99% drawdown ensued and its founder Do Kwon was eventually arrested in Montenegro on charges of fraud to the tune of $40 billion.

FTX fraud

Due to the politically charged nature of the FTX scandal, some traditional media outlets tend to report Sam Bankman Fried’s (SBF) fraudulent enterprise as a ‘collapse’ instead of outright criminal behaviour. Those of us who are in the market 24/7 were never in any doubt of what actually happened, however.

FTX was a cryptocurrency exchange that went by the slogan “platform for traders, by traders”. Founded in 2019, it grew at a rapid pace, with SBF being worth $16 billion before his downfall. It was revealed that the FTX exchange and its sister trading arm Alameda Research were using user funds to bet on markets, and had multiple fraudulent operations including market manipulation and insider trading.

The scam unravelled in late 2022 when a report revealed that a significant portion of FTX’s balance sheet (30%) was made of the exchange’s own illiquid token, FTT. Concerns grew, people withdrew funds and a growing multi-billion-dollar hole caused slaughter, ultimately leading to financial contagion and the collapse of Silvergate bank, which serviced FTX.

3. Lessons learned

It goes without saying that these incidents are not exhaustive. And yet, it’s prudent to not get carried away and treat every project that fails as a fraudulent enterprise. After all, failure is fine, fraud is not.

Cryptofinance is still a young and emerging market brimming with potential. So the allure for risk takers, visionaries, and predators is certainly there.

A common theme of scams is the promise of outrageous returns on investment. ‘Mini-scams’ and projects which claim to be revolutionary tend to be a red flag. They tend to be built on a ‘get rich quick’ mentality without putting in the work. Suffice it to say, if it’s too good to be true, it probably is.

Another common theme is using deception to mislead investors into giving away their hard-earned, infinite fiat coupons. Scammers use sophisticated marketing techniques to make projects appear legitimate and trustworthy, when in fact it’s all a front. This was certainly the case with FTX and Sam Bankman Fried.

In many cases, regulators are slow to catch on, or are potentially compromised themselves. The United States’ abrasive stance against cryptofinance has many questioning regulators’ intentions, since guidelines are non-existent or incoherent at best (as of Q2 2023). The tug of war between innovators and regulators is partly a consequence of bad actors which muddy the waters to defraud unsuspecting investors.

That said, financial scams are part of human history. They’ve been with us for centuries and come part and parcel with the human condition. Fraud won’t disappear anytime soon, but these incidents serve as a reminder of the inescapable risks associated with money, and investing in particular.

4. Your funds, your responsibility

Everything in life is a bet of sorts. There is no such thing as a risk-free investment or decision. Government/corporate bonds are not risk free either, even though we like to delude ourselves that an authority figure in a suit knows a risk profile to a near-certainty. Nobody knows the future, especially regulators who believe they can contain entropy, or in Bitcoin’s case, profound monetary innovation akin to the discovery of fire, or the invention of the wheel.

So as an individual navigating the most interesting time in financial history, all you can do is learn, have the foresight and courage to act on your convictions, and accept the outcome, whatever it may be. Two thousand years ago, Roman emperor Marcus Aurelius set the tone for accepting outcomes as they appear. That’s not an excuse for mediocrity or being pathetic, but a reality check. The lessons we learn over and over again are deeply embedded in human history, and much can be learned from studying it.

Margin call

Having said that, it’s more relatable to look at recent history, and more fun to look at entertainment for these lessons.

In the 2011 film Margin Call, there is a scene where veteran trader Will Emerson and Seth Bergman, a novice trader, are driving back from the home of their recently fired co-worker, Eric Dale, after trying, unsuccessfully, to get him back to go back to the company. The scene follows the larger movie plot in which Eric Dale, the former risk analyst at a financial conglomerate, stumbled upon data sets which indicated a global financial crisis was imminent, and he was the first to know. As you can imagine, being first in any line of business can be highly lucrative, and it’s no different in finance.

As the two casually chat about the impending financial crisis in an Aston Martin DB9 Volante, Seth tells Will the meltdown will ‘really affect normal people’, to which Will Emerson responds with a cold hard reality check.

People want to live like this in their cars and their houses they can’t pay for, then you’re necessary. The only reason they all get to continue living like kings is because we got our fingers on the scales in their favour. I take my hand off, well then the whole world gets really fair really quickly and nobody actually wants that. They say they do but they don’t. They want what we have to give them, but they also want to play innocent and pretend they have no idea where it came from; well that’s more hypocrisy that I’m willing to swallow.

5. Is ‘safety’ is the right optics?

The lesson isn’t so much whether Will Emerson is correct as it is that everyone is responsible for his actions or inaction. The scene sets a context which acknowledges that practically nobody is innocent, not least because fear and greed are universal emotions that drive behaviour, but also because everyone has individual agency. This sets a tone for humility instead of indignation when things don’t go our way. At the same time, scammers and fraudsters cannot go unpunished, which brings us full circle to the previous point: failure is fine, fraud is not.

By this point, the question as to whether ‘crypto is safe’ begins to look a bit silly, or merely something for search engines to pick up on. Thinking in terms of ‘safety’ in a financial environment that’s out of your control is less practical than thinking in terms of trade-offs. At the end of the day, there is no safety an authority can provide that beats self-custodied, sovereign bearer assets. While there are custodians which have demonstrated their trustworthiness throughout the years in cryptofinance, sovereign assets like Bitcoin and Litecoin are a radical game changer.

Find out about the crypto basics here.

No information will be seen or construed as financial advice.