Inflation is the big theme that’s dominated the last couple of years. Markets have begun to properly price in the combination of obscene money printing and the supply chain disruption that followed the needless and extensive lockdowns which started in 2020.

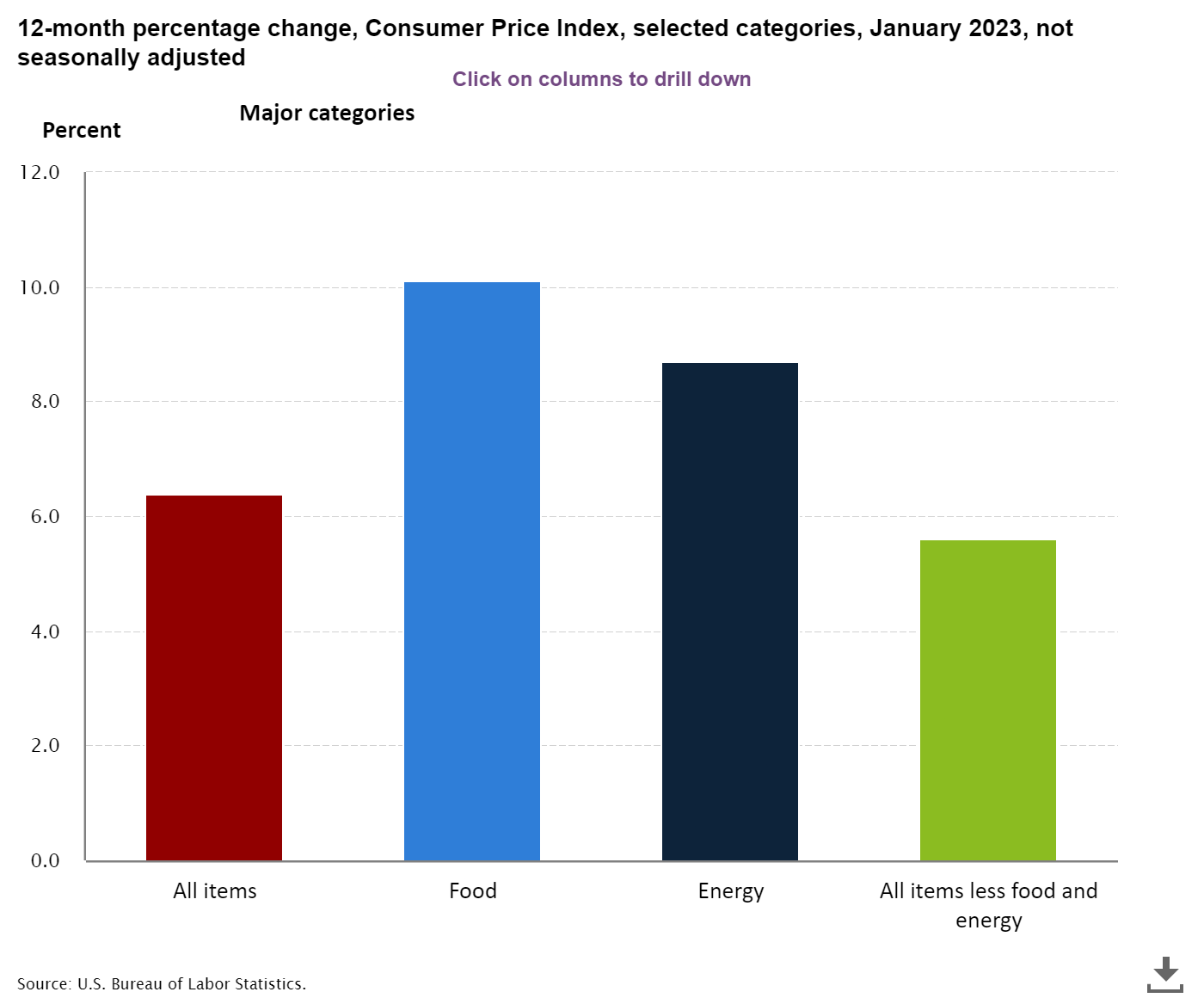

Many economists are starting to point at the Consumer Price Index prints that have finally begun rolling in over the last few readings as a sign that inflation pressures are starting to subside. Current inflation figures place official US Dollar inflation at 6.4% year-on-year. Naturally, no self-respecting individual takes these numbers at face value, except when considering some segments of utterly disconnected financial markets (e.g. penny stocks and many useless cryptocurrencies and NFT-jpegs).

But if you divert your attention from the official figures and narratives to the actual goods purchased throughout the economy, the disconnect becomes even more apparent. One notable nugget of information is that inflation figures (US) are building on higher bases across the board. Specifically, the December-January ~6.5% CPI might be on par with last year’s reading, but food and energy prices are rising, with January’s numbers coming in at 10.1% and 8.7%, respectively.

The Dollar and US-economy is the poster-child for most fiat currencies, all of which are experiencing equal or worse levels of monetary debasement.

Furthermore, CPI readings do not fully capture the story of what’s really happening to the Fiat-currency purchasing power. One aspect which is not accounted for in these readings is the quality and quantity of goods that are delivered to consumers. Consumer prices are going up, and the amount of goods a consumer receives is shrinking. Shrinkflation is real and it’s gathering steam as companies are forced to figure out new ways to maximise margins on the back of exploding raw input costs.

Here are a couple of recent examples from Twitter:

How does measurements of inflation take into account shrinkflation? 20% less product same or even higher price. pic.twitter.com/26yPSaQrkh

— Darrin Birtciel (@DBirtciel) March 4, 2023

Dawn dish soap 573mL to 532mL same price …#shrinkflation = stealth inflation pic.twitter.com/5O4cVm5lPb

— Wall Street Silver (@WallStreetSilv) March 5, 2023

Shrinkflation strikes again. 200ml for the price of 250ml. #sure #unilever pic.twitter.com/CNX9DdtKcz

— Stephen Landry (@slcymru) March 6, 2023

I see you shrinkflation 😏

Brought one month apart, for the same price with 25% less toothpaste pic.twitter.com/Q7nvLZeLOd

— CalamityCalling playing #TheLastofUs (@Calamitycalls) March 1, 2023

In other words, monetary debasement is far worse than the official statistics suggest. Inflation is much like toothpaste; easy to get out, but hard to put back in.

As central banks attempt to wrestle with the inflation they created via needless global lockdowns, one digital asset continues to be a Bulwark for normality with its hard-coded deflationary monetary policy. Bitcoin’s inflation rate stands at 1.79% as of March 4, at least three times less than the US Dollar’s official stats.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!