As the crypto landscape faces off with hostile regulators in the US, Litecoin is gearing up for its automated halving event, slated for August 10, 2023.

The crypto space is buzzing with speculation on blue chip cryptos:

- How will the halving event impact supply, demand and price dynamics?

- What does the latest 160 million transaction milestone mean for LTC’s 12-year history?

- Is Litecoin positioned for all regulatory outcomes, despite hostilities?

Blockchain analytics firm, Santiment, offered some insight as to the potential impact of the halving event.

The Litecoin halving

According to Santiment analysts, the halving will take place on block 2,140,000, where mining rewards will fall from 12.5 LTC to 6.25 LTC. The reward change could induce significant changes in Litecoin’s Dollar-denominated price. This echoes a pattern that has historically been observed in Bitcoin halving events, suggesting that Litecoin – which is the only mainstream blockchain with a 100% uptime history – might follow a similar trajectory.

Santiment explains that this feature halves the amount of Litecoin created every time a block is mined and added to the blockchain. The event stimulates two noteworthy effects:

- A surge in Litecoin mining activity in the run up to the event.

- An increasing fiat valuation of circulating LTC due to the universally slower production and distribution of coins post-halving.

According to Santiment, these factors tend to be tailwinds for price increases, the timing of which tends to align with increasing enthusiasm and awareness of the bearer asset and event. Recent on-chain transaction trends, as analysed by the intelligence firm, appear to buttress this expectation too. Since May 8, a steady rise in volumes – in part spurred due to the LTC20 ordinals update – shows increased usage and investment activity on Litecoin, likely in anticipation of the halving.

Notably, Santiment also underlined a sharp uptick in the number of unique addresses using the Litecoin network, which reached a one-year high just as price was bottoming out.

The trend suggests that new wallet addresses started accumulating the cryptocurrency ahead of the halving.

Beware influencers

While Santiment observes that normal traders seem to be doing well, the firm suggests a careful approach, anticipating a cooling off period for profit-taking over the coming week or two.

Finally, the intelligence platform advises market participants to pay close attention to news cycles, in particular influencers with heavy clout aggressively discussing Litecoin out of the blue. While there could be optimal price-points to put money into Litecoin, the firm warns against picking tops and bottoms, which could result in missed opportunities. Instead, Santiment concludes with a strategy of dollar-cost averaging into the asset, or any asset one believes will increase in price.

Regulators cede ground

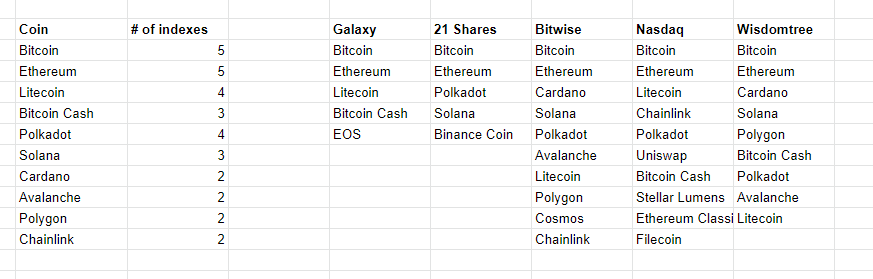

Due to its long-standing history, Litecoin is among a handful of cryptocurrencies which has not been deemed a security in the United states. In fact, Litecoin has attained commodity status, per a recent CFTC lawsuit in the United States. Meanwhile, in the East, Hong Kong regulators have listed a series of coins which retail investors will be able to purchase on exchanges starting June 1.

In February, Gemini co-founder Cameron Winklevoss said that the next bull run would start in Asia.

Litecoin currently exchanges hands at $85, down 8% since Monday at the time of writing.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!