Murmurs about a possible CBDC dystopia in the near future, where money can be switched off, are increasingly becoming common place. Inspired by Bitcoin, Central Bank Digital Currencies (CBDCs) are the antithesis of the cryptocurrency ethos; they centralise power, influence and control to a singular entity whose objectives might not be in line with yours or mine.

In recent months, CBDC development has accelerated. In conjunction with a steady stream of political blunders coming to light, including the mishandling of the health crisis, hostility and public condemnation against CBDC development has emerged.

While CBDC proponents outline benefits such as greater financial inclusion and efficiency, deep concerns about their threat to personal sovereignty and their potential for snuffing out dissent and propensity for human rights abuses aren’t going away. Quite the opposite – concerns are increasing.

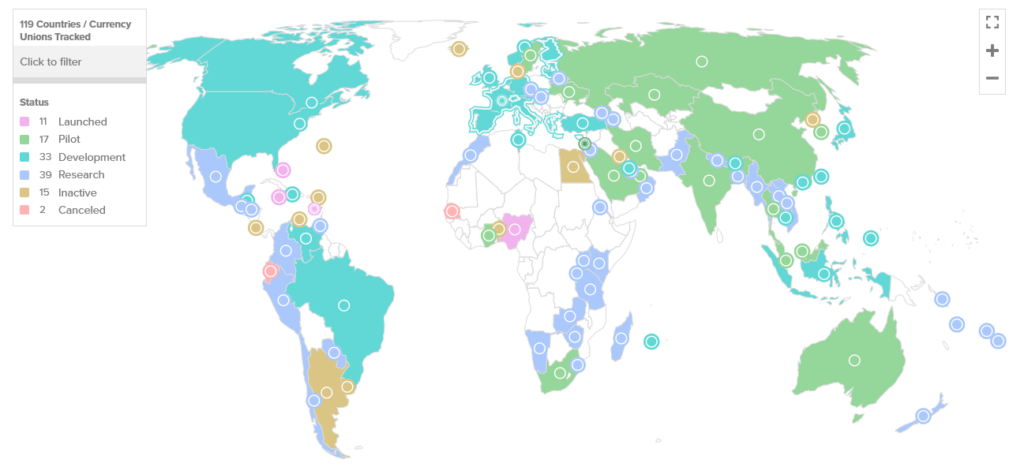

A global CBDC network

According to data from the Atlantic Council, most countries have either launched or in the process of launching a Central Bank Digital Currency (CBDC), with some African nations being outliers.

Advocates argue that reducing currency costs and increasing cross-border payment speeds, as well as tackling counterfeit currency are valid reasons to implement CBDCs.

The Bank of International Settlements (BIS) General Manager, Augustin Carsten, echoed such sentiment in 2022, saying CBDCs can potentially bring about global financial stability while minimising risks. Additionally, Carsten implied in an eerily sounding tone that only central banks have the right to oversee money systems, not ‘big tech’ or private companies.

“the soul of money belongs neither to a big tech nor to an anonymous ledger.”

Recently, all G7 countries have stepped up their development programs. Mexico revised its rollout date to 2024, and the digital rouble is operating a test pilot – indicating that momentum towards its eventual rollout is growing.

The CBDC dystopia

Speaking on Fox News, former US government official and investment banker Catherine Fitts detailed a scathing account of CBDCs, labelling their implementation “the last shutting of the gate.”

Fitts underlined a general apathy and ignorance towards the dystopian future that awaits, and how many are effectively sleepwalking into a system where our assets become the central banks’ assets – thereby rendering each citizen an extension of the state.

“we don’t understand that when this gate closes on us, we will literally be sitting in a system where the central banks believe our assets belong to them…”

Under a CBDC system, authorities will have direct control on any individual’s spending habits. Some examples include blocking specific purchases or merchants, limiting transfer amounts or spending, and even imposing expiration dates on money. This would be a monumental step backwards from current money standards, which hold no such restrictions, relatively speaking. As such, CBDCs cannot honestly be described as currency, but instead they are merely a “financial transaction control grid,” Fitts warned.

She concluded that we cannot let propaganda persuade us that CBDCs are convenient or needed, since they are neither.

The digital pound to limit transfers; disallow savings

While Fitts’ account was somewhat hypothetical, factual instances exist and buttress her points.

For example, on February 4, the Bank of England (BoE) and the UK Treasury released a CBDC roadmap, revealing a four-month consultation period to figure out public opinion on the digital pound.

According to the Telegraph, the Treasury’s initial plans limit user transfers to a couple thousand pounds to prevent the possibility of bank runs and rapid outflows. The Treasury said that limits encourage adoption, while supposedly balancing implementation risk. But it added that “these limits could be amended in the future.”

While the Treasury may remove limits in the future, it may also restrict access. Also, the initial imposition hardly inspires confidence among those who are sick and tired of political doublespeak. This sense is compounded when heavy-hitting commentators such as Fitts, whose words carry significant weight, emphasise the CBDC dystopia that accompanies their development.

The digital yuan testing program

The People’s Bank of China (PBoC) started its digital yuan program back in 2014. Since then, the program has gone through several iterations of testing and development. In November 2020, a public test was launched in Shenzhen, and then more cities were added in April 2022. Eventually, the Chinese government will flip the switch to this system, removing physical cash entirely.

Chinese participants enter the program by entering a lottery via China’s top four banks and selected winners receive a portion of funds. During the Shenzhen trial, 50,000 winners were given digital ‘red envelopes’ worth 200 yuan ($30) each. Recipients were able to spend these coupons a local stores.

By September 2022, the program extended to more provinces, with testing starting in Guangdong, Hebei, Jiangsu, and Sichuan. In March 2023, the Fujian province was included in the program.

Social credit scores

Fitts’ comments on financial tyranny were not made in a vacuum. When combined with a social credit system which China has already implemented, there is no other fitting description.

The Chinese Communist Party’s social credit system first came to light in 2014. Its launch coincided with the launch of a digital yuan research group. The plan documented and stressed the importance of administering “comprehensive credit information” and pushing social cohesion, supposedly to foster trust in society.

It is an effective method to strengthen social sincerity, stimulate mutual trust in society, and reducing social contradictions, and is an urgent requirement for strengthening and innovating social governance, and building a Socialist harmonious society.

The system applies to both individuals and businesses. Points are added and deducted based on behavioural criteria, entirely determined by the state. For instance, if tax is not paid on time, social credit is deducted.

Since the system is in a testing phase, consequences of low scores are not fully known. However, based on available reports, the state banned millions of people from using public transport, trains, planes or any means of travel in 2018 due to their low social credit scores. Children of low-scoring parents were stopped from attending universities, were informed upon to potential employers, and had a higher likelihood of audits, inspections and public shaming.

If you are on the blacklist of #socialcreditsysterm, you cannot travel by plane/train, eat at fancy restaurant, play golf, get insurance, even rent a house in China.

If you are on the blacklist, restrictions are imposed EVERYWHERE on you! https://t.co/0ICT5dzmmS pic.twitter.com/IFhqqFgYVo

— Songpinganq (@songpinganq) March 4, 2023

Some reports indicate that scoring differs between regions, resulting in points being deducted in some cities and not others. This abusive relationship between the state and the Chinese people has been in development, presumably with the intention of bringing more people into the loving embrace of state actors.

Suffice it to say there is no logical consistency to punishments and deterring crimes. Citizens say that even trivial offenses such as jaywalking, walking a dog without a leash, cheating in video-games or not visiting parents often enough are punished – raising serious concerns about statecraft and political overreach into the everyday-minutia of people’s behaviours, and individual agency.

Notably, a lite version of such overreach was inadvertently seen in many Western countries during the ill-conceived and unscientific lockdown policies (barring Sweden, Florida and various other countries and states), which obliged people to remain indoors, wear useless masks or face penalties and possibly arrest. The right to freedom of assembly was also ‘suspended’ due to supposed safety concerns, none of which were outlined in any Western pandemic preparedness programs specifically designed for such a scenario.

Chief Strategy Officer at the Human Rights Foundation, Alex Gladstein, said an integrated CBDC social credit system sets a frightening precedent. In this dystopian paradigm, concerns are not only warranted, but eminently desirable considering the Communist Party’s history of human rights abuses, absent transparency and wrongful behaviour.

When the government can take financial privileges away for posting the wrong word on social media, saying the wrong thing in a call to parents, or sending the wrong photo to relatives, individuals self‐censor and exercise extreme caution. In this way, control over money can create a social chilling effect.

Sceptics might trivialise the matter especially since these draconian systems go against everything the ‘democratic’ West stands for. Yet, in December 2022, the Italian government initiated its digital ID program in Rome and Bologna to promote ‘Net Zero’ practices. In other words, the marriage between political leanings and being ‘a person’ in society is taking place in Europe. Some would argue that digital IDs are a prerequisite to a social credit program.

The only missing piece to a CBDC dystopia and social credit program is marrying money to the citizenry’s state profile, after which direct influence on the population is available. Constitutions in practically all Western countries underline the importance of separation of state powers, yet the proliferation of such programs indicate that public servants may no longer be in agreement on such principles.

The end of liberty?

In the first quarter of 2023, many individuals have voiced arguments over a coordinated attack against the cryptocurrency sector via the legacy banking system and regulators. Within cryptocurrency circles, the attack has been unofficially branded as “Operation Chokepoint 2.0.”

While the program is not directly linked to CBDCs, former Coinbase CTO Balaji Srinivasan is certain that the two are directly related.

In a tweet, Srinivasan said the incoming FedNow payment system is a build-up to an American CBDC system, warning that those who are not prepared will be locked into a financial system that no longer champions relative free markets.

As news spread about the apparent public-private anti-cryptocurrency and anti-freedom cabal, law firm Cooper and Kirk called on Congress to investigate the “backroom war on crypto.” The law firm argued that regulatory actions were both unlawful and unconstitutional, with a clear intent on hindering the digital asset industry.

The law firm recommended a number of steps to hold regulators accountable, including reminding government agencies that they are public servants who are subject to the Administrative Procedure Act, and must follow due process, and proving whether regulators have intentionally attacked and undermined private sector innovation.

Fighting back

Decentralisation advocate and CEO of the Blec Report, Chris Blec has said that there is a mismatch between what CBDCs are sold as, and what they are. The bait-and-switch system is sold on efficiency, convenience and bettering society, and underneath the surface, the hopeful message is overshadowed by an overt attempt to “eliminate our financial privacy and micro-manage our lives.”

Regardless, the war is not lost, and it is up to each individual to recognise this adversary and actively fight back, without loss of courage or momentum:

- Grass-roots ground-up action – buying and using decentralised cryptocurrencies like Bitcoin and Litecoin.

- Top-down action – using the political system to support anti-CBDC representatives.

Bottom-up is buying stateless and incorruptible currencies like Bitcoin. Top-down is supporting politicians like Ron DeSantis, who have vowed to use the violent force of government to fight government itself.

This two-pronged approach may slowdown CBDC implementation, but Blec is unsure whether it can be completely halted. He alluded to the fact that completely vanquishing CBDCs would require major societal changes, especially in the realm of governance and the way in which we treat one another.

Blec holds a bleak view on society putting an end to a CBDC dystopia. But he remains optimistic that there will be an opportunity for positive change following severe societal collapse as the current cycle comes to an end.

I’m not sure if that’s realistic within our current society. However, I’m feeling increasingly optimistic about our NEXT society.

What’s next?

As someone who actively participated in thwarting state overreach to suspend civil liberties via unscientific and illegal lockdown policies during the supposed 2020 health crisis, it’s hard to imagine normal people uniting in opposition to CBDCs, or against creeping authoritarianism more broadly (despite our differences).

Efforts have emerged in France, Holland and other places in Europe, but the future appears to be one of discomfort and friction between governments and citizenry. Unfortunately, many are still under the spell of disunity over trivial matters, some of which erroneously pit men and women against each other, for example. Others are afraid to stand up and be counted. Others still have seemingly given in to nihilism.

Regardless, whether people choose to comply with this CBDC dystopia or resist it, either choice will include pain – the pain of submission or that of resistance.

At the end of the day, the very fabric of society, freedoms, basic privacy and human progress are at stake. Our rights exist only to the degree that we’re willing to defend them; so will you avert the CBDC dystopia that awaits?

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!