According to the latest data, there has been a significant uptick in activity within the Litecoin network as a result of a growing number of Ordinal inscription minting events. Over the last week, Litecoin’s value increased 15%, in-keeping with a trend of recently-discovered market strength first observed in June 2022. Litecoin’s network is anticipated to reduce its block reward by half in less than 76 days.

Activity surges

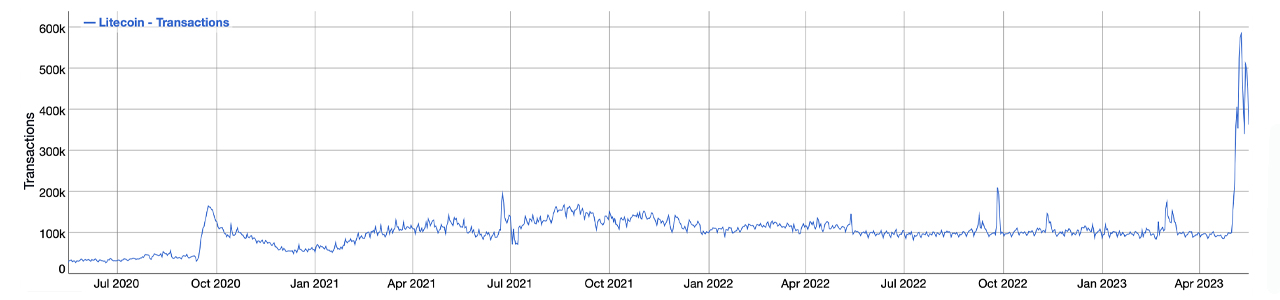

Litecoin experienced significant volumes this week, mirroring the activity on the Dogecoin network. The increased activity is partly driven by an uptick of Ordinal inscriptions, with Litecoin registering over 2.58 million inscriptions to date. The growing number has driven LTC’s daily transaction count significantly this week.

On May 6, daily transactions pushed beyond 400,000. Just four days later, LTC processed over 584,000 transactions. On May 15, Litecoin miners verified above 500,000 transactions. Since February 22, 2023, the proof of work registered over 13,000 ordinal inscriptions, following Bitcoin’s lead. That figure has increased by a whopping 198,694% in just 85 days.

Litecoin network undervaluation

As CoinDesk reports, the ‘silver to bitcoin’s gold‘ rallied 15% in the last 7 days. The rally has put LTC as the second best-performing cryptocurrency with at least $1 billion by market-cap. Litecoin’s Bitcoin and Ethereum-denominated value have registered 27% and $32% increased in the last 10 days, respectively.

$LTC is a vacuum imploder. pic.twitter.com/OSWsMR90zl

— Chris on Crypto⏫Ł₿Ⓜ️🕸 (@ChrisOnCrypto1) May 17, 2023

Litecoin is currently testing daily resistance levels against the two top cryptocurrencies. The crypto has witnessed something of a resurgence since June 2022, gaining ground against both Bitcoin and Ethereum as the market imploded due to fraud. At the time, it was speculated that one reason why LTC outperformed other assets was because it was not held on company balance sheets to the same extent as Bitcoin or Ether. When the market unravelled, Litecoin was less affected as it is predominantly held by ‘retail’, not centralised companies which tend to blow up by the dozens every market cycle.

Technically, the long-term 200-weekly exponential moving average has held the asset’s USD-price back, but EMA tests are increasing in size and duration. This suggests that the growing cohort of Litecoin holders are less inclined to swap Litecoin for Bitcoin or Ethereum at current valuations ahead of the Litecoin halving.

The trend indicates that Litecoin’s unrealised value potential is becoming a serious consideration.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!