For years, investment advisors have hyped up Bitcoin as the gold standard of the cryptocurrency space, and Litecoin as complimentary digital silver. This relationship has faced pressure and scrutiny over the years, but earlier epochal arguments are just as true now as they were back then, if not more.

Despite the bear market fostering typical infighting and a tendency for negative media spin, often in favour of blockchains which are turned off every other month, Litecoin’s network growth remains steadfast, undaunted and on an unmistakeable upward trajectory.

This write-up won’t delve into Litecoin’s inner workings per se. You can learn about that here. Instead, we’ll dive into a comprehensive list of reasons why Litecoin’s secular success story is both ongoing and eminently desirable. Additionally, we’ll look into how detractors have misled market participants to internalise a fact-free narrative that does not stand up to the most basic scrutiny, as you will soon find out. So without further ado, here’s a list of tailwinds, direct or otherwise, for why Litecoin should be on your radar – permanently.

1. Robust Adoption

Adoption comes in many forms, and indeed, Litecoin has already achieved widespread recognition given that it is accepted and used practically everywhere and anywhere Bitcoin is. This recognition has come part and parcel with increasing usage, a healthy indicator for network growth. In 2023, the Litecoin network hit a yearly milestone registering 46 million transactions in August, an 18% increase over the previous year. The record came as the network processed its 175th millionth transaction since inception that same month. In other words, not only is incremental Litecoin adoption undeniable, but increasing in pace.

2. Recognised Brand

Like Coca Cola and Pepsi, Bitcoin and Litecoin are recognised and trusted brand names. Litecoin’s history of being a reliable cryptocurrency didn’t come from the aether, nor was it conjured out of thin air by meaningless word salad marketers. Litecoin’s established brand name came with over a decade’s worth of continuous, unmitigated functioning with 100% uptime. The Litecoin brand is both recognised and trusted. Needless to say, trust is a crucial factor for long-term success.

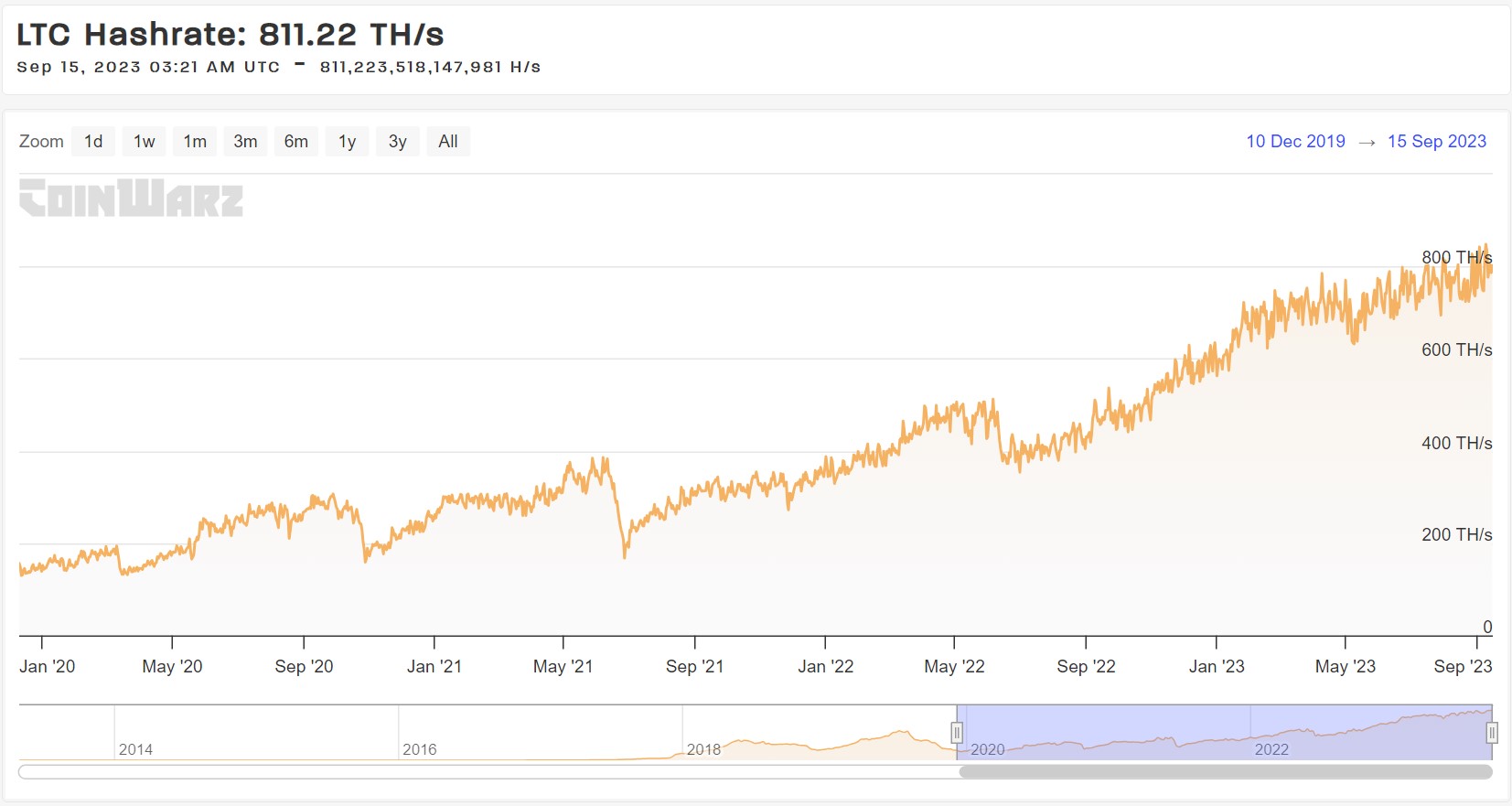

3. Security

As is commonly known, Litecoin benefits from the security of its proof-of-work consensus algorithm, which has been battle-hardened over its 12 year-plus existence. Since inception, the network’s Hashrate, a proxy data-point for its security-level, has increased from 1TH/s to over 850TH/s. Since the fourth quarter of 2019, Litecoin’s hashing power increased by 615%.

Another little known fact about Litecoin’s robust security model is that it is merge-mined with Dogecoin. As explained by lookintolitecoin.com, this symbiotic relationship between the two cryptos came about in 2014, whereby Dogecoin’s significant security risks are reduced, all the while Litecoin miners gain an additional revenue stream via DOGE, which helps maintain profitability. In fact, Litecoin Scrypt miners are more profitable than BTC SHA-256 miners – a tailwind for Litecoin’s long-term security model.

4. Redundancy Plus

Redundancy is an engineering concept which constitutes the intentional duplication of critical components or functions of a system with the goal of increasing reliability of said system; a fail safe, if you will. Should Bitcoin reach a point where it’s compromised, or neglects its decentralisation ethos and mandate, Litecoin is already running in parallel (keeping BTC in check).

But technically, Litecoin is more than just a fail-safe, as its Layer one (L1) network throughput iterates on Bitcoin in several key ways, such as transaction speed (2.5 minutes per block) and cheaper network fees. This makes LTC suitable for everyday transactions. More importantly, Litecoin’s untarnished 12-year history of utility and high integrity cannot be reliably replicated across blockchains. This is Litecoin’s ‘Redundancy Plus’ model, which uniquely positions the asset for perpetual and most importantly, justified, growth – a concept unfamiliar to most projects in the space.

5. Baked-in Scalability

The Litecoin community has been actively working on improving scalability throughout its lifetime. Segregated Witness (SegWit), a protocol upgrade that increases transaction capacity and reduces fees, was first launched on Litecoin. Similarly, the first Lightning Network transaction, a layer two (L2) solution to enable faster and cheaper off-chain payments, took place on LTC too. This spirit of innovation is characteristic of Litecoin, which earned a reputation as being the first through the door when it comes to scalability upgrades. As it stands, Litecoin is akin to an all-purpose, pristine and well-oiled engine, ready to be installed and used as the need arises, and as more people join the network. In other words, scalability will not be an issue the next time around, provided UX designs keep apace with the underlying tech.

6. Active Development

Litecoin development is best thought of as a long-term turtle game, prioritising vetted and deliberate code updates as opposed to quick wins, which ride on the latest flavour of the month only to fade away shortly thereafter. In February 2022, at a time when Canadians faced political persecution and had their bank accounts shuttered, Litecoin was on the cusp of releasing MimbleWimble Extension Blocks (MWEB), with the community foreseeing such an event years ahead of time. This feature enabled optional wallet confidentiality, increased coin fungibility (where so-called tainted coins are no longer an issue), while also promising scalability on an unprecedented level.

Front-end data tools have also been deployed. Litecoinspace.org, a brand new block-exploration tool provides users, developers and miners a user-friendly view at Litecoin’s mempool (unconfirmed transactions), block capacity, utility, fee rates and transaction history, among other things. The resource opens the door for real-time data exploration of the Litecoin network. In other words, accessible data for enthusiasts, on-chain analysts, data aggregators and developers. A similar tool is available for MWEB via its own block explorer. Beyond that, developers are currently working on releasing Litecoin Core v24.

That’s the 60,000 foot view for active development. You’ll notice that contrary to the unending litany of vitriol by perpetually outraged or dismissive mobs, Litecoin is levelling up, lending credence to the already compelling, evidence-based idea of a gaping price-fundamentals mismatch. But there’s more.

7. Halving Events

Similar to Bitcoin, Litecoin has a halving event roughly every four years. This reduces the rate at which new LTC is issued, leading to increased scarcity and value over a long time horizon. In August 2023, Litecoin witnessed its third halving event, which reduced the miner block subsidy from 12.5 LTC to 6.25, permanently decreasing potential sell-pressure. Unlike Ethereum and other Central-bank-esque blockchains, there is no variable roll-back or change in the supply schedule. Still, these deflationary effects are drawn out over a long time horizon, but certainly add to the cryptocurrency’s value proposition in 2023.

8. Cross-Chain Compatibility

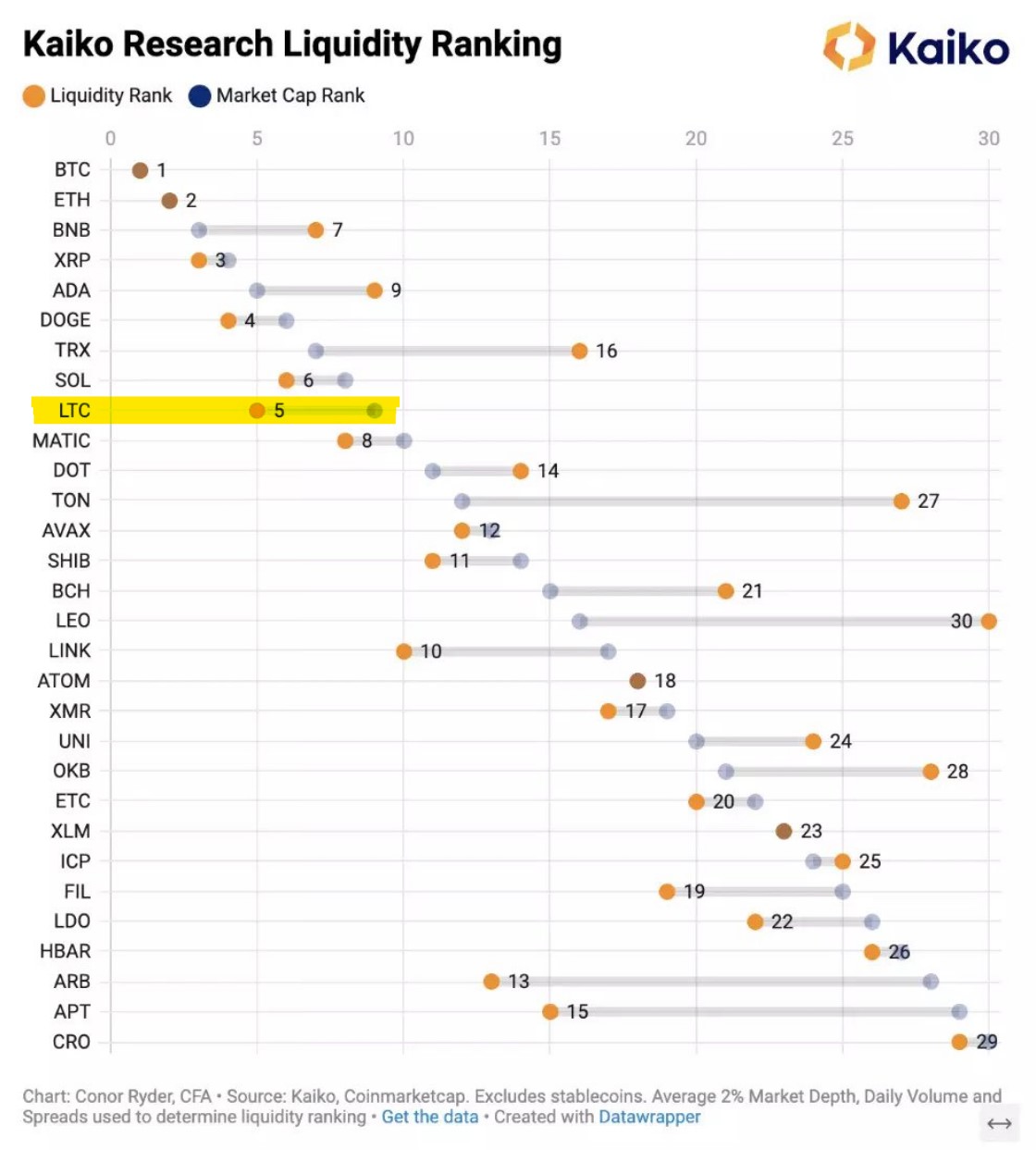

Besides being backwards compatible with Bitcoin (and vice versa), which means that code deployments can be easily ported to either blockchain, Litecoin has also been integrated into the cryptocurrency ecosystem. This means that LTC is fully supported by both centralised and decentralised exchanges, and enjoys cross-chain interoperability across the ecosystem. To be clear, backwards compatibility refers to development updates, while cross-chain combability refers to Litecoin’s ubiquitous acceptance as a money protocol across businesses, exchanges and crypto financial services. This enhances Litecoin’s appeal, usability and liquidity status. LTC is in fact a top-ranked coin in terms of liquidity too, per recent Kaiko research.

9. Deep liquidity

In ‘bear’ markets, liquidity concerns tend to be amplified. When liquidity is low, price volatility increases. As such, liquidity conditions are a vital metric for investors to accurately assess the state of each individual asset, providing a deeper understanding of how short term volatility could play out. On this front, Litecoin fairs better than 99% of the competition. According to a liquidity research report by Kaiko smart data, Litecoin’s liquidity ranking for Q2 2023 came in a no. 5.

Noticeably, the coin’s liquidity relative to its market capitalisation gives a fairly comprehensive picture: Litecoin’s deep liquidity status remains attractive for traders, investors and users in 2023.

10. Institutional adoption

This data is not without precedent. As noted, Litecoin is an established asset with a pristine, non-replicable track record as far as uptime, decentralisation and network integrity is concerned (unlike Solana, for .e.g.). It has outlasted all bear markets, gained users and market depth, despite millions of vapourware coins coming and going each cycle. Coupled with its liquidity is the onset of institutional players entering the scene. This staying power was further embedded with the launch of EDX exchange in June, backed by finance giants Charles Schwab, Fidelity and Citadel Securities, all of which see where this is going.

In other words, not only is Litecoin an established powerhouse inside the crypto space, but it is now a recognised asset in traditional finance. This means that it is not going to go away, just like Bitcoin.

11. Regulatory clarity

For what it’s worth, Litecoin’s recognition also comes in terms of regulatory clarity. Litecoin is not a security, making it one of a handful of cryptocurrencies without a sword of Damocles dangling over its head. To be clear, it wouldn’t matter because no court order can ever stop the Litecoin blockchain from ticking on.

12. Practical Money Over Internet Protocol (MoIP)

It goes without saying that transacting freely with no strings attached is necessary for a functioning economy. And with looming Central Bank Digital Currencies, so lovingly crafted by 21st century aristocrats for us peasants, who they might imagine as opaque, dirty figures skulking about in hovels and mud huts, maybe even grunting at each other to pass the salt, Litecoin is positioned as a monetary layer that guarantees the freedom to exchange goods and services in perpetuity.

Twenty-five years ago, telecoms firms went bankrupt because they failed to adapt to the impact of VoIP (Voice over Internet Protocol). While the landscape is changing, a majority of traditional financial institutions, in particular global sovereigns are in a similar boat today, thwarting the increasing practicality of MoIP while promoting worse versions.

This hasn’t stopped the industry’s continued ascendency. For better or for worse, crypto has trended towards cross-chain interoperability. At this time, a number of blockchains, some of great repute – others not so much – are in the process of neutering censorious monetary layers for good.

Litecoin is at the forefront of this transition.

All in all, the onset of MoIP is an iterative phase of human emancipation worldwide. Litecoin is freedom technology, grander in scope than the internet because it is part of a bedrock layer for fair global trade, which is sorely needed. As it stands, Litecoin exists within this basket of monetary layers that are spearheading an open rebellion against a decadent elite who have the audacity to dictate where and when you can spend your money.

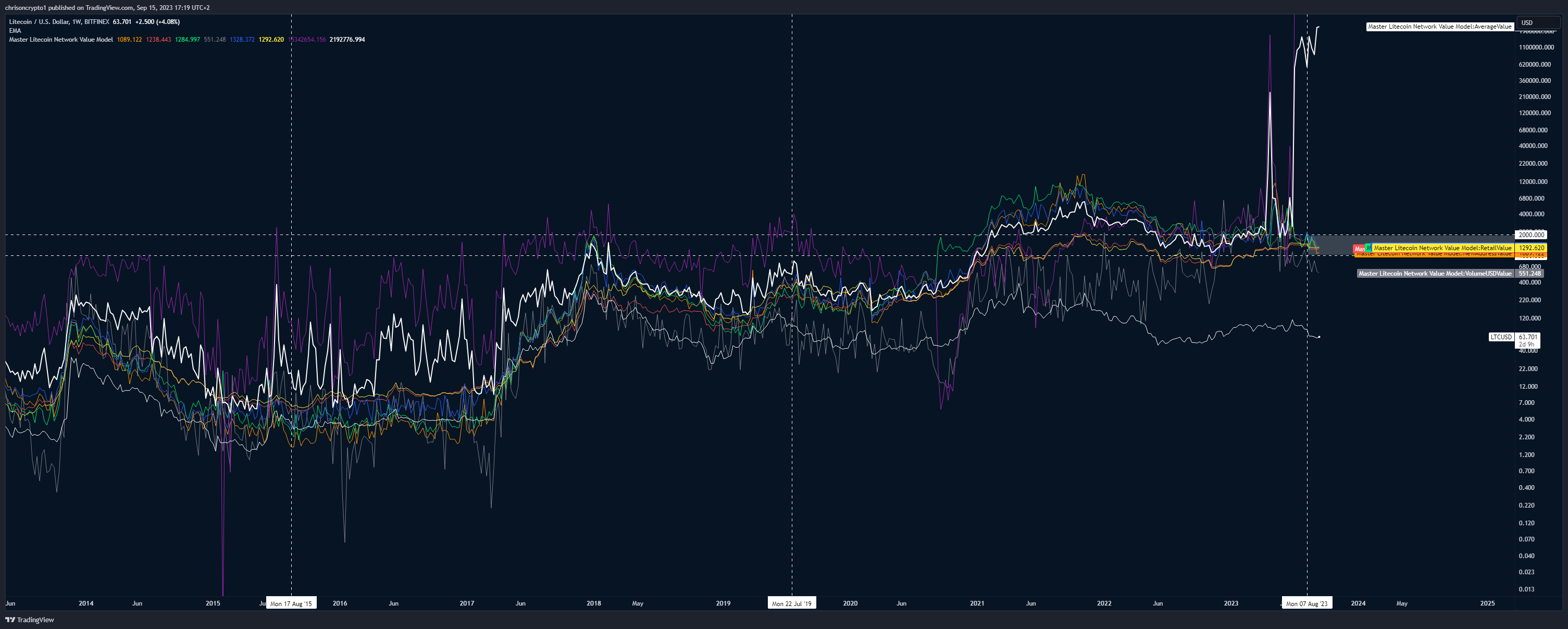

13. Price-fundamentals mismatch

When considering this purposely condensed information dump, does Litecoin truly strike you as a cryptocurrency without a future? If internal consistency, integrity and decentralisation (no theatre) are important, then the opportunity ahead could not be more straightforward.

Litecoin boasts non-replicable and confluent data points which are the hallmark of a compelling asymmetric bet.

Indeed, while other chains might have one or two of such characteristics, none come close to the tailwinds Litecoin has going for it; not least due to its already established network effects and brand recognition, but also because its history cannot be replicated.

As a grass-roots cryptocurrency, Litecoin’s provably fair launch which was supported by “OGs” who were neither politically nor financially motivated at the time, there simply aren’t any contenders for Litecoin’s as yet unrealised status.

The future for Litecoin is not just undimmed before the breaking of fiat and its adjacent psyop projects, but shining brightly in response to it.

The author owns Litecoin and Bitcoin at the time of writing this article. This write-up is a personal opinion and will not be seen or construed as financial advice.

Did you like the article? Share it!

Help keep this content free.

LTC MWEB:

ltcmweb1qqt793qmlrvmj2ldu50ecxaud358fegsayls59wttgxc3f8cahdu7jq6np8le3g88q9p77w2dr2ennh2nuxzjg5ujkvq8x434pg74std0yg7kc4g6