Florida Governor Ron DeSantis has signed an anti-CBDC bill into state law, banning the usage of an American or foreign central bank digital currency (CBDC) in the state.

No CBDC in Florida

In a press conference on Friday, DeSantis appeared to allude to what many have called ‘operation chokepoint 2.0’, accusing the US President Joe Biden of wanting to “crowd out and eliminate other types of digital assets, like cryptocurrency.”

The bill now-made-law aims to protect consumers and businesses in Florida by “Expressly prohibiting the use of a federally adopted Central Bank Digital Currency as money within Florida’s Uniform Commercial Code (UCC); instituting protections against a central global currency by prohibiting any CBDC issued by a foreign reserve or foreign sanctioned central bank; and calling on likeminded states to join Florida in adopting similar prohibitions within their respective Commercial Codes to fight back against this concept nationwide.”

Florida is standing firm and protecting our consumers against the efforts to impose a central bank digital currency, which would shift purchasing power from consumers to the government.

Florida is siding with individual consumers. pic.twitter.com/FssjDbJVw8

— Ron DeSantis (@GovRonDeSantis) May 12, 2023

The bill was first announced on March 20 as DeSantis stood in front of a podium which read “Big Brother’s Digital Dollar”. At the time, he said the creation of the so-called digital dollar would grant “more power” to the government.

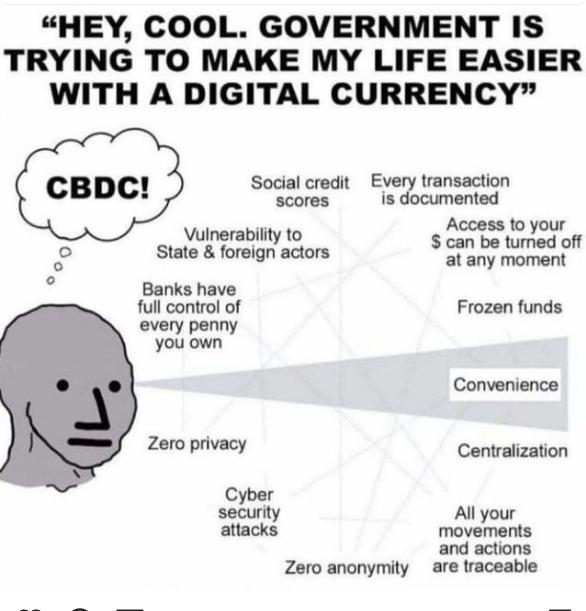

The Florida Governor said: “[A CBDC] provides the government with a direct view of all consumer activities. Anyway if they can get into society to exercise their agenda, they will do it. So, what the central bank digital currency is all about is surveiling Americans and controlling [the] behaviour of Americans.”

The Republican presidential hopeful cited concerns over inflation in the US, increasing interest rates, and the pressure on banks as examples of how government policies have directly impacted US consumers.

“You’re opening up a major can of worms and you’re handing a central bank huge, huge amounts of power,” he cautioned.

DeSantis also said that the “reckless adoption of a ‘centralised digital dollar’ will stifle innovation and promote government-sanctioned surveillance.”

As opposed to decentralised cryptocurrencies such as Bitcoin and Litecoin, CBDCs are issued and controlled by governments, giving them the ability to directly see influence, and potentially coerce and limit consumer purchases.

DeSantis also highlighted the effect a CBDC could have on commercial banks, saying it could “diminish the role of community banks and credit unions in our financial system as CBDC currency would be a direct liability of the Federal government, rather than of a chartered financial institution, shrinking market lending power.”

Anti-CBDC sentiment gains steam

The Floridian is not alone in his anti-CBDC pushback in the United States. On May 3, North Carolina’s House of Representatives unanimously voted to ban the state’s agencies and institutions from accepting any CBDC payments.

Additionally, the bill bans the state from participating in CBDC development, including test and pilot programs like Project Cedar, the New York Fed’s CBDC pilot which moved from research to the development phase.

On March 9, South Dakota Dovernor Kristi Noem vetoed House Bill 1193, which aimed to amend the state’s Uniform Commercial Code to exclude decentralised cryptocurrencies like Bitcoin and Litecoin from the legal definition of money, all the while creating an exception for CBDCs.

In an interview with Tucker Carlson, Noem said “as we started reading through it, we saw the section of the bill that changed the definition of currency.”

Noem said the bill would “pave the way for a government-led CBDC” while effectively banning other forms of cryptocurrency like Bitcoin. “So for me, it very clearly was a threat to our freedom,” she said.

The same language was embedded in bills working their way through 20 other states, underlining an emerging plot to sneak the dystopian technology in through the back door.

I believe it’s to pave a way for the federal government to control our currency, and thus control people. It should be alarming to people and it’s being sold as a UCC guidelines update.

Dissent across the political spectrum

There is consensus and dissent across the US political spectrum against CBDCs, given their propensity to remove privacy and downgrade money to a coupon code with an expiration date. In fact, democratic presidential hopeful Robert F. Kennedy has expressed anti-CBDC opinions as well.

His first criticism came on April 5, where he criticised the US FedNow program.

The Fed just announced it will introduce its “FedNow” Central Bank Digital Currency (CBDC) in July. CBDCs grease the slippery slope to financial slavery and political tyranny.

While cash transactions are anonymous, a #CBDC will allow the government to surveil all our private…

— Robert F. Kennedy Jr (@RobertKennedyJr) April 5, 2023

Kennedy also understands environmental nuances about Bitcoin and Litecoin proof-of-work mining. On May 3, he condemned Biden’s proposed tax on mining, calling the 30% tax on energy used by miners “a bad idea”.

The environmental argument is a selective pretext to suppress anything that threatens elite power structures. Bitcoin, for example.

Kennedy developed a theme that governments are attempting to exercise draconian financial control on citizens, which is not far fetched. Using the Canadian truckers’ anti-vaccination protests in Ottawa in 2022 as an example, he lamented that the government had locked the bank accounts of people supporting the protesters. Kennedy said:

It’s not outlandish to imagine that even here in America, your bank account could one day be frozen because of your politics, or comments you’ve made on social media.

More than 114 governments and central banks are at some stage in the exploration of creating a CBDC, including the United States, but there appears to be a clear consensus among US lawmakers about the gaping concerns: protecting privacy and financial rights, limiting the impact on commercial banking, and ensuring fair access citizens.

The Florida CBDC ban is scheduled to take effect on July 1, 2023. Despite the ban, however, there is no law passed by man that can ever be more absolute than a decentralised proof-of-work consensus mechanism which cannot be altered. Good money has immutable properties based on fairness, privacy, fungibility, and hard-capped limits.

European bureaucrats prepare for Capital Controls

Meanwhile, CBDC development is accelerating in Europe. The ECB issued a set of directives in December 2022 to limit cash transactions to €10,000 while exerting ‘oversight’ for crypto transactions of over €1,000.

In a recent speech, CBDC project executive Fabio Panetta emphasised the need to steer “consensus among all involved stakeholders”. Indeed, the long speech was more about the mechanism of reaching ‘buy-in’ rather than the core merits of a Euro-CBDC, because there are none.

Even Eurocrats admit their proposed Euro-coin is a solution in search of a problem. Speaking to the Financial Times Paschal Donohoe, president of the Eurogroup said: “I accept that we may not yet have made the use case sufficiently clear for consumers. The value of concepts like financial stability [is] sometimes only understood in their absence… if a decision is made to move towards the realisation phase, more will need to be done to educate and explain to consumers.”

This time last year, Europe witnessed extreme inflation, higher than the 1970s on average as a consequence of rampant easy-money policies. Eurozone inflation was at 7% in April 2023, up 0.1% from the month prior per Eurostat figures. Given that this happened under their watch, it is unclear whether this is what ECB officials are referring to when they talk about ‘financial stability’.

European regulators have also been consistently abrasive towards emerging technologies, encryption and open-source tech, promoting bills for blanket mass surveillance on the population, as well as attempting to ban proof-of-work mining in the bloc, among other things. Indeed, the pearl-clutching dinosaurs in suits cannot even come up with a believable reason to introduce a Euro-cbdc token; probably because it is in direct opposition to the public good.

Dissent in the United States has clearly gained a foothold. The question is: where is the anger and dissent against a proposed Euro-shitcoin, pardon my French?

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!