A member of the US House of Representatives from the state of Minnesota has introduced a piece of legislation that aims to prevent the Federal Reserve from directly issuing a central bank digital currency (CBDC).

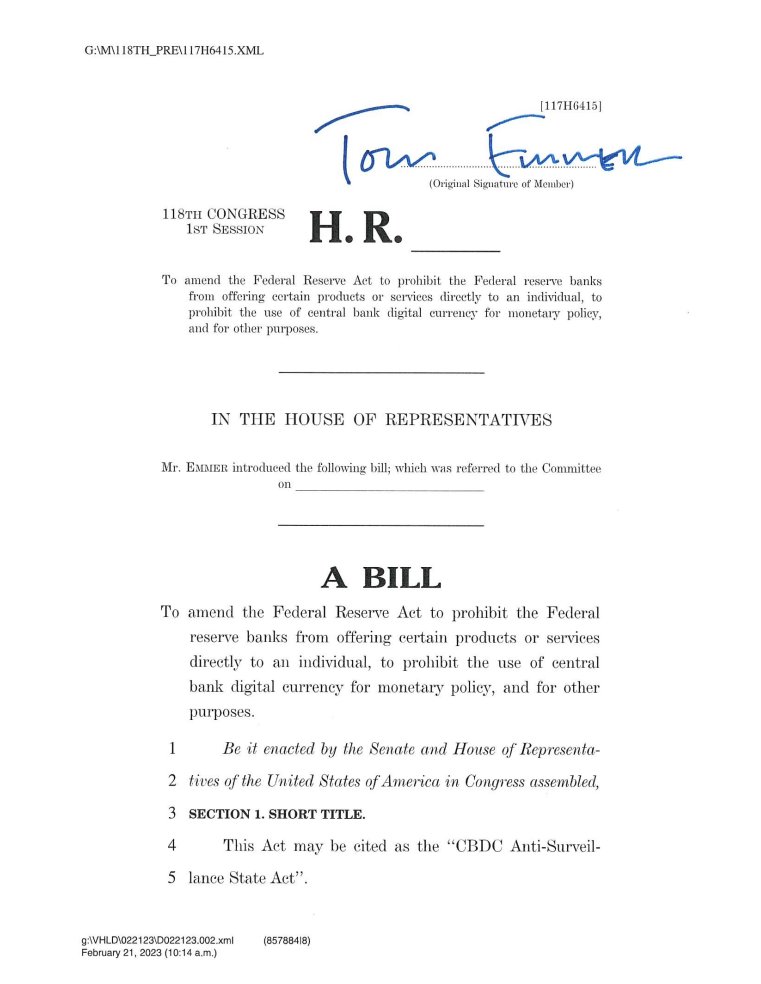

The announcment was released on Twitter on Wednesday, and included a screenshot of the bill titled: ‘CBDC Anti-Surveillance State Act’. The bill was written “to halt efforts of unelected bureaucrats in Washington, DC from stripping Americans of their right to financial privacy.”

The bill states that it seeks to “to amend the Federal Reserve Act to prohibit the Federal reserve banks from offering certain products or services directly to an individual, to prohibit the use of central bank digital currency for monetary policy, and for other purposes.”

The bill has three objectives:

1. Prohibits the Fed from issuing a CBDC directly to anyone.

2. Bars the Fed from using a CBDC to implement monetary policy and control the economy.

3. Requires the Fed’s CBDC projects to be transparent to Congress and the American people— Tom Emmer (@GOPMajorityWhip) February 22, 2023

Section two of the bill reads:

Except as specifically authorized under this Act, a Federal reserve bank may not offer products or services directly to an individual, maintain an account on behalf of an individual, or issue a central bank digital currency directly to an individual.

The third section proposes to amend Section ten of the Federal Reserve Act by inserting the following paragraph:

Prohibition on the use of central bank digital currency for monetary policy. – The Board of Governors of the Federal Reserve System and the Federal Open Market Committee may not use any central bank digital currency to implement monetary policy.

The Board of Governors of the Federal Reserve System is required by Section 4 to confer with each Federal Reserve bank regarding any CBDC studies or pilot programmes, and to report any conclusions and recommendations to Congress on a quarterly basis.

In a follow-up comment, Emmer added that “any digital version of the dollar must uphold our American values of privacy, individual sovereignty, and free market competitiveness. Anything less opens the door to the development of a dangerous surveillance tool.”

If the bill is approved by both the House and Senate, and is subsequently signed into law by the US President, then the Federal Reserve Act would be amended to include the limitations on the Fed’s authority in regard to the digital dollar.

Will EU member states table a similar bill in the near future, or will Europe continue to mimic a China-esque anti-liberty surveillance state in its crypto deliberations?

Bill won’t protect privacy: Advocacy group

However, Fight for Future advocacy group took issue with Emmer’s alternative to the Fed’s possible handling of CBDC transactions: private financial companies.

They said:

Rep. Emmer is correct that a poorly-built digital dollar would cement surveillance and extremely concerning economic controls into our daily lives. We also agree on the need for the government to be transparent about CBDC projects — but where this bill falls short is in positioning the private sector as the sole option for intermediating digital dollar transactions.

Invasive surveillance and morality policing are pervasive in various financial institutions such as Well Fargo and Venmo, the non-profit said in a statement. Fight for the Future believes the bill would endanger vulnerable communities, including activists.

They continued:

The well-executed digital dollar the US deserves would provide the same level of privacy that cash has offered for millennia, by design. We need real alternatives with end-to-end encryption level privacy baked into the code itself.

Financial surveillance, whether done by the government or financial institutions, treats everyone as if we are guilty until proven innocent and as if privacy is not a fundamental human right.

Incidentally, the advocacy group appears to have made the case for Bitcoin and Litecoin without mentioning Bitcoin and Litecoin.

The group said that major financial corporations might resist implementing cash-level privacy, as this could impact profits derived from exploiting personal data (order flows, for e.g.)

Still, the legal process for Emmer’s bill has only just started.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!