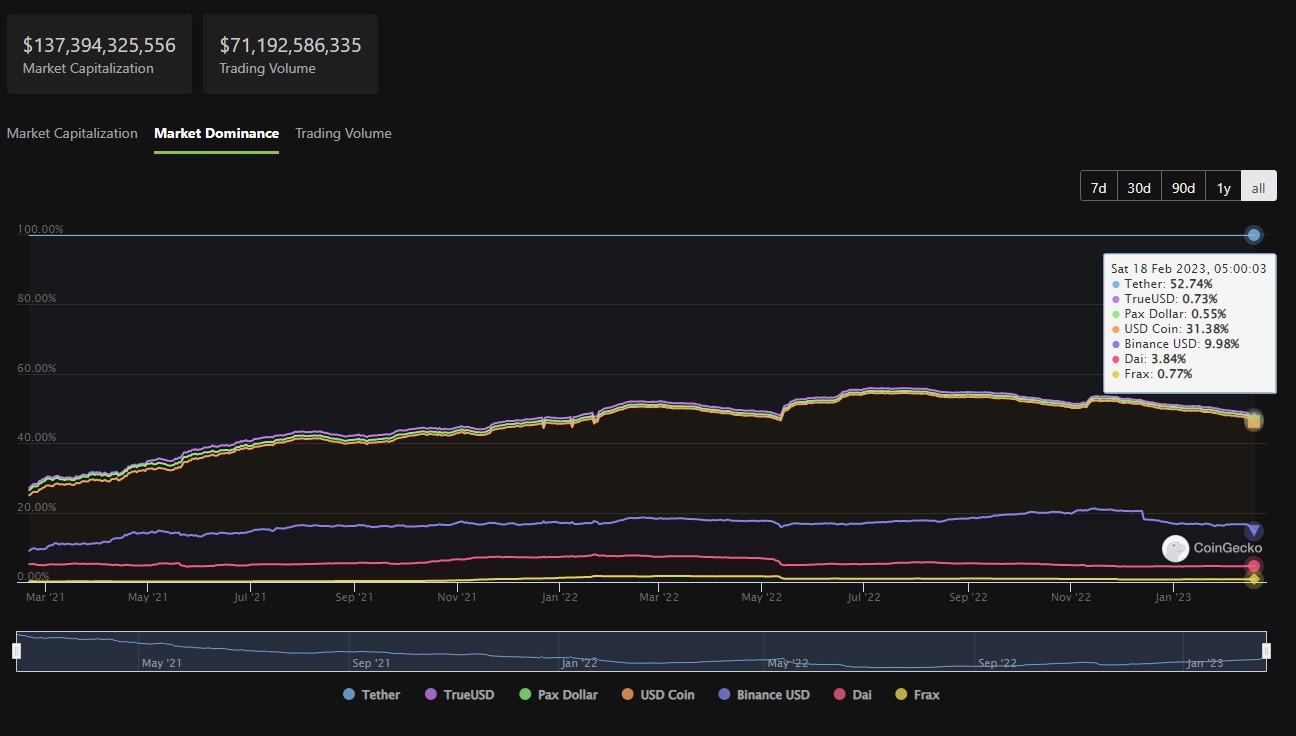

As the US Securities and Exchange Commission (SEC) takes aim at the crypto industry, the longest standing stablecoin, Tether, dominates the landscape.

Tether (USDT) is yet again proving to be the stablecoin of choice, with its market share rocketing passed 50% for the first time since December 2021.

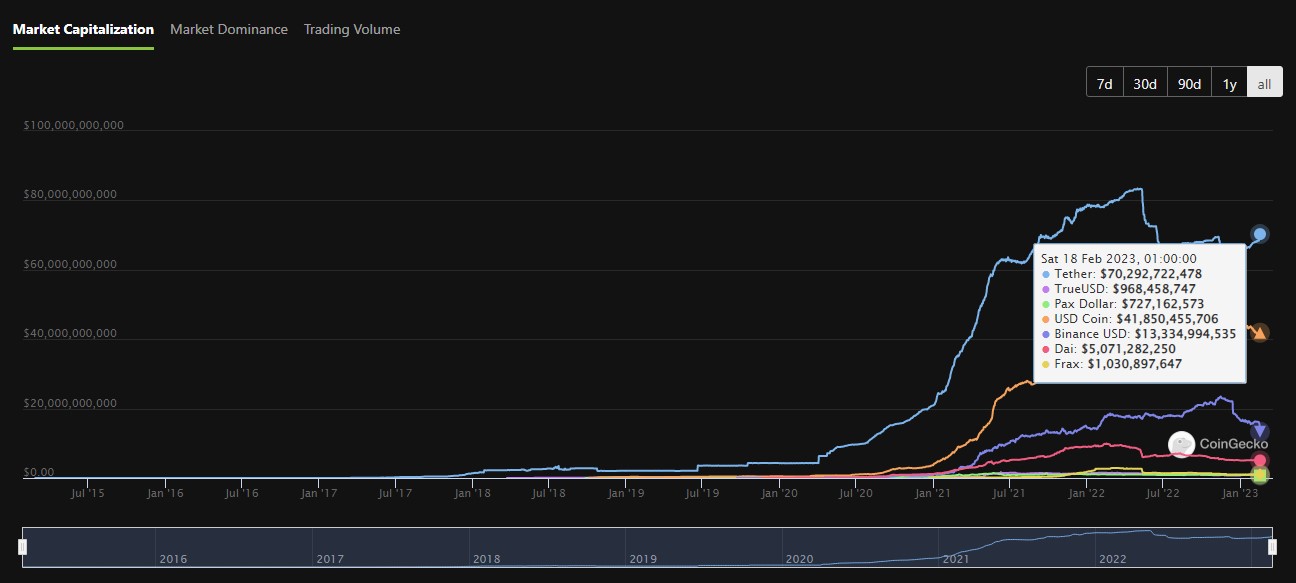

The top stablecoin issuer has deployed another $4 billion USDT this year, accruing a circulating supply of $70.2 billion, representing about a 4% growth at the time of writing. Tether’s compounding growth accelerated after the FTX fraud-ridden implosion last November.

In July 2022, the stablecoin issuer switched its auditing firm to BDO Italia, the 5th largest accounting firm in the world. Following the new arrangement, the issuer changed its attestation report schedule from a quarterly to a monthly basis.

JP Morgan analysts expected Tether’s dominance and staying power to increase following Binance’s decision to auto-convert USDC deposits to BUSD in September 2022.

Meanwhile, Circle’s offering, USDC shed over $3.3 billion in supply year-to-date. There’s now $41.8 billion USDC in the crypto ecosystem, down 7.5%.

BUSD did not fair well following the recent SEC crackdown on BUSD issuer Paxos, a New York firm. BUSD comes in third registering $13 billion in market cap.

BUSD has burned over $700 million supply since the start of the year. The SEC’s intent to sue Binance has made market participants skittish and hesitant about holding the token. The regulator has claimed that BUSD is an unregistered security.

Notably, a stablecoin is a 1:1 representation of fiat currency; in that there is no expectation of profit, nor is there interest-bearing due to the $1 peg. Nevertheless, Paxos will stop minting the stablecoin by Feb 21, and markets are watching the SEC’s aggressive rulings against crypto closely.

The total stablecoin market capitalisation currently stands at around $137.3 billion, per CoinGecko data.

- Tether: 52.7%,

- USDC: 31.3%,

- BUSD: 9.9%

Tether, Circle and Paxos, account for the majority of stablecoin distributors. All three allow token holders to exchange coins for US dollars. Their token supplies increase and decrease depending on market participation, whereby users acquire or redeem tokens directly from the issuers.

Expansion in the stablecoin market capitalisation happens when users convert fiat or crypto assets into the stablecoin, either to realise a profit or a loss.

Conversely, the stablecoin supply shrinks when issuers burn tokens (on behalf of users), although tokens are sometimes reissued to other users without using the burning mechanism.

Meanwhile, the decentralised stablecoin DAI, by MakerDAO takes fourth place with a $5 billion market cap. DAI has taken on the largest losses of the top-tier stablecoins. It has lost $563 million in market cap in 2023, equal to 10% of its supply.

DAI’s competitor, FRAX has remained relative steady since November, taking fifth place.

FRAX, DAI’s direct competitor with an algorithmic element, has remained stable over the last three months, taking fifth place.

Overall, the stablecoin market has shrunk in size by around 1.5%, losing around $2.5 billion. Stablecoin dominance reached a record high just under 20% as FTX collapsed, but has since retreated to 14% as crypto markets recovered.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!