Tether’s market dominance is approaching all time highs following the collapse of crypto-markets due to FTX’s black swan insolvency crisis.

Almost $70 billion in USDT currently circulates in the crypto ecosystem, making up nearly 9% of the entire digital asset market capitalisation (including Bitcoin, Ether, Litecoin etc.)

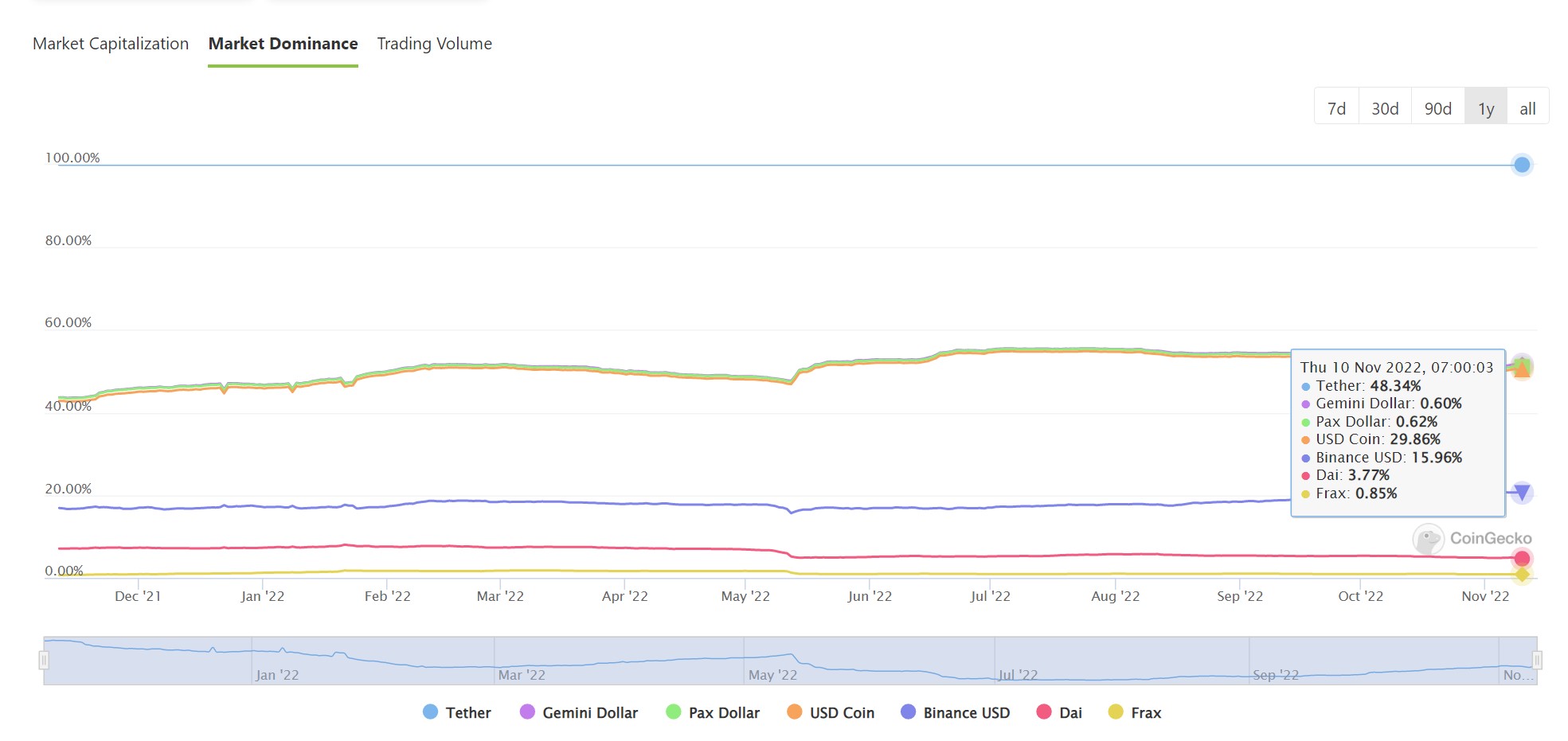

While still shy of reaching its record high of 9.49%, USDT’s market dominance is up 25% since Friday. The leading stablecoin consolidated its position during this week’s ongoing carnage, with USDT dominance approaching all-time highs following the collapse of FTX. USDT boasted higher supply back in April too, several months before the historic Tether $10 billion bank run in the wake of failed algorithmic stablecoin Terra-Luna in May.

Following the rivalry between Changpeng Zhao and Sam Bankman-Fried, it became apparent that FTX’s exchange practiced fractional reserve banking and used customer funds to rescue its sister hedge-fund Alameda research. A fresh report indicates that the FTX-Alameda crash was a left-over consequence of the Terra-Luna-collapse; at which time FTX threw Alameda research a $4 billion life-line via FTT token collateral. These were likely user funds. Allegations of fraud have led to an investigation of the crypto-mogul SBF by the US Department of Justice.

Regardless, It’s clear that investors have fled to the safety of US dollar-denominated tokens, with USDT being the prime beneficiary of this capital flight. Bitcoin, the largest cryptocurrency by market-cap touted as a safe-haven asset tanked 20% over the last 5 days. Bitcoin/Dollar lost over 77% of its value from its peak.

BTC’s market cap is now $320 billion, its lowest point in two years; its market dominance rests at 39%. In December 2020, that figure was as high as 71%.

USDC growth reverses

Meanwhile, Tether’s rival, Circle-backed USDC also saw an increase in its market cap, leaping to $43 billion in circulation – $11 billion less than at the start of August when supply rested around $56 billion.

The number two stablecoin originally increased following the downfall of Terra. For a few weeks throughout May and June, Tether witnessed a large reduction to the tune of $16 billion in redemptions. This was the largest supply run on Tether in history, partly spurred on by confusion between UST and USDT.

But in September, Binance announced that it would replace user’s USDC with BUSD while also delisting rival USDC trading pairs. The move undercut demand for Circle’s stablecoin on September 29. Following the development, JPMorgan noted that Binance’s decision to auto-convert USDC deposits to BUSD would make Tether even more important when it comes to trading.

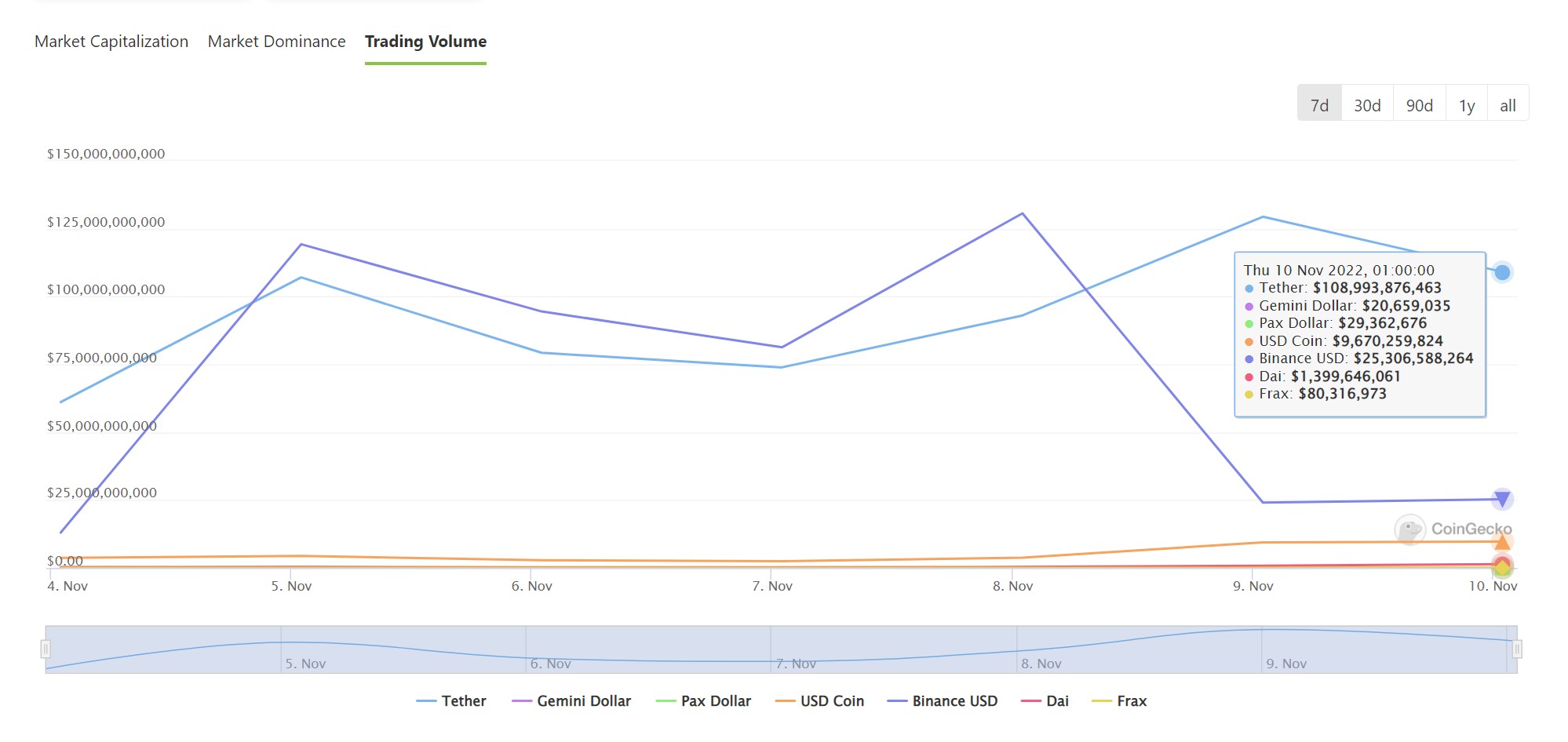

Tether’s trading volumes are roughly ten times larger than its nearest competitor.

Binance also removed trading fees for bitcoin and ether, massively increasing users and the exchange’s trading volumes, all the while burning USDC supply. BUSD issued an additional $5.1 billion, representing almost 30% growth in three months.

Still, at 15%, BUSD market dominance remains small in comparison to USDT (48%) and USDC (29%).

Tether retains strategic dominance

All things considered, Tether remains the most preferred stablecoin with little indication of budging. On the contrary, Tether’s relative strength compared to its competitors during this stressful time-period indicates confidence in the veteran OG stablecoin issuer.

Despite highly critical coverage in the media, partly driven by lingering concerns about Tether’s reserves, the company has made efforts to tidy up. Specifically, Tether settled lawsuits with the New York Attorney General, issues detailed transparency reports, and went through the biggest 24-hour redemption cycle ($10 billion) without any hiccups.

Tether is used more than any other stablecoin in crypto. Of the $173.5 billion in stablecoin volume over the past day, USDT makes up 75%; BUSD 17%; and USDC 6.5%, although BUSD’s volume has increased significantly – spurred in part by Binance’s dominant market position in trading volumes.

Building trust

In a press release issued on Nov. 9, Tether revealed that it has zero exposure to FTX. The press release noted that over the years, Tether both dispelled ‘FUD’ surrounding its reserves while highlighting the ironic cloud of cynicism which follows the company to this day, despite its strengthening position.

In some ways, it is ironic that critics have been waiting for years to see Tether fail in the way so many others have. Not only has Tether continued to navigate countless black swan’s without issues, but these same critics missed countless massive failures while focusing on Tether. Maybe they will one day ask themselves the question of why Tether continues to serve its users and the communities when few others can.

Regardless, more is expected of stablecoin issuers. CZ’s pledge to incorporate a proof-of-reserves standard to ameliorate customer jitters will be welcomed by all stablecoin users. In August, Binance pledged to begin offering monthly breakdowns of its reserves via BUSD’s actual issuer, Paxos. According to its latest disclosure, BUSD is backed entirely by US Treasury bills and US Treasury debt, the latter in the form of reverse repurchase agreements.

This is a similar make-up for both leading stablecoins USDC & USDT.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!