A survey by finanial services giant Fidelity found that institutions are more invested in the cryptocurrency sector than a year ago despite the severe market downturn. Some investors cited price volatility as a barrier to entry, but under the current fiat-money doom loop regime, volatility appears inescapable.

In brief

- Investors cited decentralisation, uncorrelation to other assets and the macro environment as reasons to get involved in crypto.

- About 35% of respondents believe cryptocurrencies should be seen as their own asset class, up from 23% in 2021.

- As a consequence of the fiat money doom-loop, the crypto sector is increasingly in the spotlight as an ‘uncorrelated’ asset class.

Cryptocurrencies aren’t going away. Buy Bitcoin & Litecoin here.

Fidelity found that 58% of surveyed investors said they owend cryptocurrencies in the first two quarters of 2022, representing a 6% increase year-over year. This is according to Fidelity Digital Assets’ fourth annual Institutional Investor Digital Assets Study published Thursday.

In a statement, Fidelity Digital Assets President Tom Jessop said:

While the markets have faced headwinds in recent months, we believe that digital assets fundamentals remain strong and that the institutionalisation of the market over the past several years has positioned it to weather recent events.

Crypto ownership was highest in Asia, with 69% of institutions reporting investments. The number was lower in Europe (69%) and the US (42%), though figures showed a respective 11-point and 9-point increase YoY.

Which institutions are doubling down on crypto?

Confluent with other surveys, high-net-worth investors drove capital in Europe and the US, while financial advisors also added to the increase in flows in Europe.

Overall, global digital asset usage is highest among venture capital funds (87%), followed by high-net-worth individuals (82%) and advisors (73%).

Chief Operating Officer at Ark Invest Tom Staudt told media outlets earlier this month that the financial advisory segment will be critical for crypto to reach mass adoption. Ark and other investment companies and banks like BNY Mellon launched crypto-focused accounts for investment professionals throughout 2021-2022.

Despite the market meltdown, investors have established a deeper understanding of the technology and value propositions of cryptocurrencies, said Digital Assets’ director of research Chris Kuiper. He added that increasing infrastructure has helped with adoption rates.

Investors surveyed cited the high potential upside and innovative technology play of this emerging industry, along with enabling decentralisation, uncorrelation to other assets, and the current macro/inflation environment, as appealing characteristics of the asset class.

About 40% of the institutions buy cryptocurrencies directly, with bitcoin and ether being the most popular assets. Fidelity’s digital assets division is expected to roll out trading products for institutional clients on Oct. 28, per Blockworks reports. Of those surveyed, 35% said they buy investment products holding crypto, while 30% buy investment products holding digital assets companies and 20% gain exposure via futures products.

Fidelity survey shows growing respect for crypto

Around 35% of respondents believe cryptocurrencies should be seen as an independent investment class, up from 23% in 2021.

“This is one of many data points that validate trends we’re seeing within our own business: increased institutional participation and acknowledgement of the maturation of the digital asset market and infrastructure,” Kuiper said.

Notably, about 74% of the surveyed institutions said they plan on purchasing cryptocurrencies in the future. This is indicative of the industry’s staying power and growth trajectory, which is all the more pronounced given that such answers are coming in the depths of a bear market.

The future preference to buy remained consistent year-over-year globally for financial advisors, family offices, pensions, crypto hedge funds and venture capital funds, as well as endowments and foundations.

Half of respondents cited price volatility as the biggest barrier to investing in crypto — consistent with the 2021 Fidelity report. But given that traditional markets are experiencing extreme volatility, with Facebook’s META and other major stocks down 75% from all time highs, price volatility has become normal.

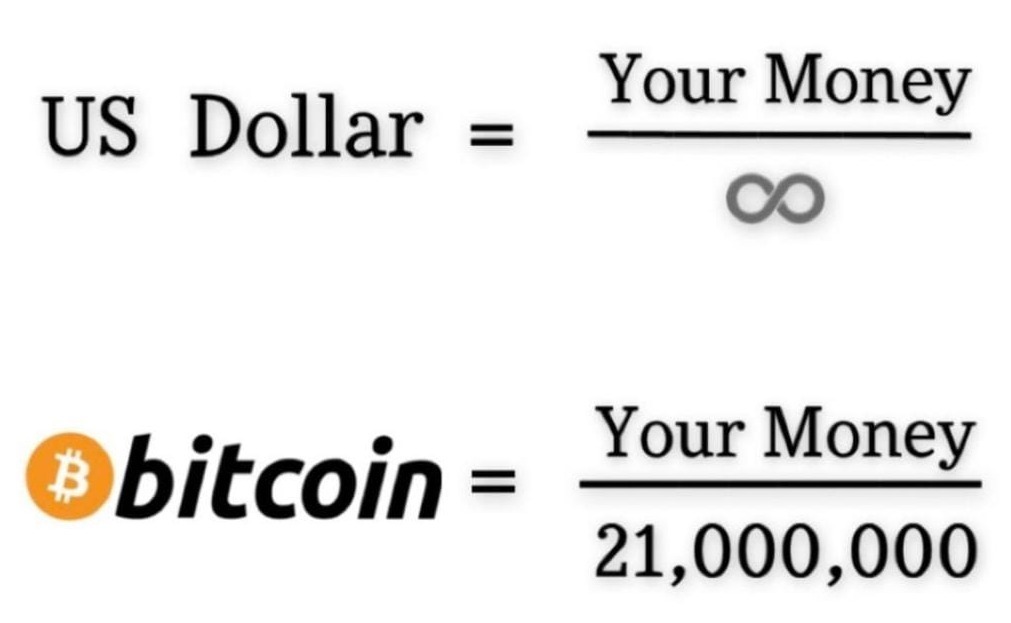

Concerns surrounding the fiat-money doom loop has made cryptocurrency investments more attractive, especially as an uncorrelated asset class. If there is no underlying collateral besides debt, then the dash for real assets like Bitcoin may be all the more pronounced.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!