Ark Invest’s monthly Bitcoin report details several fundamental tailwinds for the asset which indicate high conviction buyers have created floor price-signals not seen since 2018.

In brief

- Ark Invest’s monthly Bitcoin report details several bullish undertones for the asset.

- The firm notes that Bitcoin is oversold and undervalued.

- Short-term-holder cost basis crossed below the long-term-holder equivalent for the first time since late 2018.

- Long-term holder supply hit an all-time high of 13.7 mn BTC, accounting for 71.5% of the outstanding supply.

Cryptocurrencies aren’t going away. Buy Bitcoin & Litecoin here.

Robust HODL tailwinds

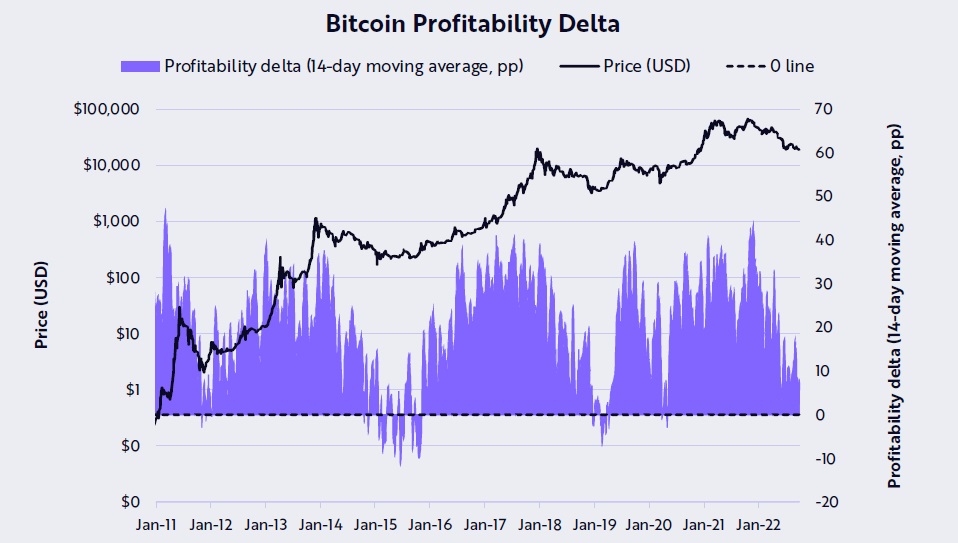

According to Ark Invest, the Bitcoin market has found a bottom. To support this thesis, researchers noted that the digital asset’s short-term-holder cost basis crossed below its long-term-holder cost basis for the first time since late 2018.

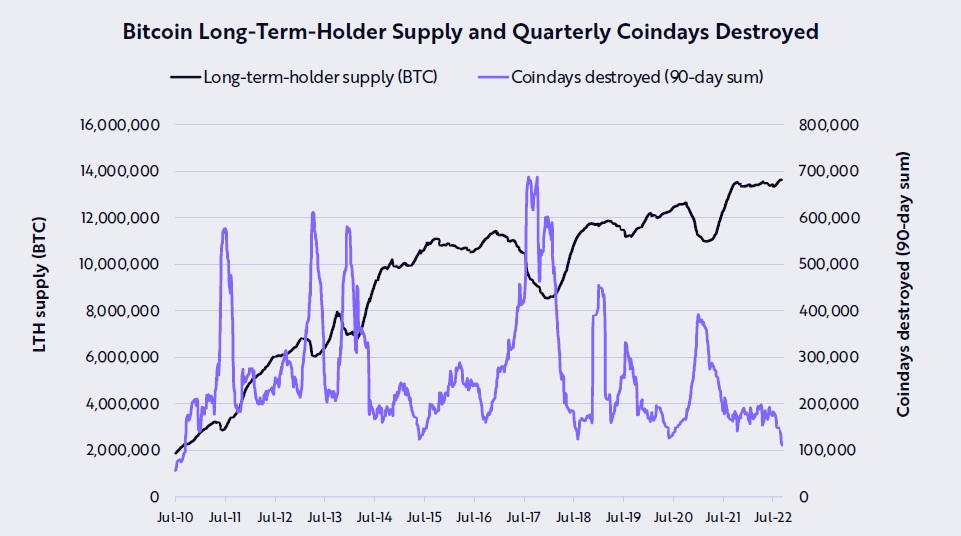

More notably, the investment firm found that Bitcoin’s long-term holder supply reached an all-time high of 13.7 million BTC. In total, this accounts for 71.5% of the outstanding Bitcoin supply. Long-term holders are defined as those who have held Bitcoin in their wallets for over 155 days.

This figure has increased by 2.19% year-over-year.

Ark Invest also underlines Bitcoin’s locked supply as another tailwind for the top digital asset. This statistic currently sits at 14.18 million BTC, which is a 5.39% increase over the past year. The firm also believes that Bitcoin is undervalued and oversold, pointing to the profitability delta being next to zero. The indicator suggests that seller-trading activity is mostly exhausted.

Per on-chain indicators from Ark Invest’s deck, Bitcoin price does not yet reflect the fundamentally positive data. However, macroeconomic headwinds are bearish influences on the market which may be holding the asset on the ground for the time being. In the last year, crypto has seemingly become more closely correlated with traditional finance as Central Bankers insist on tightening monetary conditions. A recent UN report notes that such pressures could push the nations into a deep recession if interest rate hikes persist.

Mining statistics turn positive

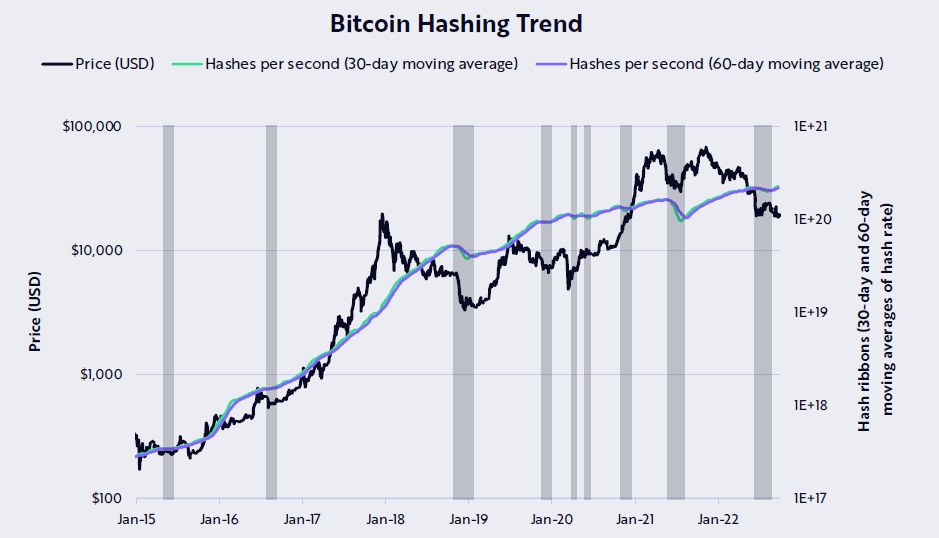

Ark Invest also highlights positive undertones in the bitcoin mining market, stating that miners are “no longer in capitulation mode,” pointing to new all-time highs of the hashrate. This is in line with a Blockware intelligence report which found that miner capitulation was likely to end in Q3. Bitcoin’s hashrate is presently 272.81 million TH/s.

Hashrate spiked ahead of the Ethereum proof-of-stake merge in the second week of September, and has maintained an uptrend ever since. Various blockchains such as Litecoin have experienced an uptick in hashrate as miners shifted operations post-merge.

Regardless, investors will be keen to see price-action reflect this internal network growth, the continuation of which underlines rallying user conviction in the sector. Ark Invest and Cathie Wood have advocated a $500,000 Bitcoin price for some time.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!