After creating a litany of moral hazards by printing $9 trillion in 2020, central banks are on the war path against the free-market crypto-finance space as they attempt to choke out the sector in preparation for a CBDC roll-out. The all-out war comes in the wake of Fed-induced legacy banking implosions, and as a show of force to impel compliance with a banking regime that is not fit for purpose.

It’s no accident that the new Fed CBDC paper was launched on Wednesday.

Anti-free market practices

Regional banks and cryptocurrencies are at risk of centralised financial control and central bank digital currency implementation. This would make the Western banking regime comparable to authoritarian regimes like China or Russia, where your personal finances are subject to arbitrary decisions made by geriatrics in suits.

Since the crypto-finance space, which has provided millions of people all over the world (Turkey, Lebanon, South America, among others) with access to stable finance, won’t back down, their systemic elimination has commenced. A financial regime based on CBDCs has wide-ranging implications. These include potential human rights abuses and violations. In fact, such programs are an affront to Western values, particularly with regards to privacy rights physical cash users enjoy.

Yesterday, the ECB’s Lagarde said that a ‘Digital Euro‘ has a key role in payment autonomy and that “payment apps, cards aren’t necessarily European. Digital Euro is intended to be safe, sovereign and available.”

This is a non-sequitur as Fiat currencies are already digital; but unlike privatised stablecoins, they function on 40-50-year old database technology, which have created a self-serving modern-day gerontocracy that promotes economic stagnation through bad debt obligations.

Maybe ‘the great reset’ isn’t a conspiracy after all?

Printing Trillions while hiking rates

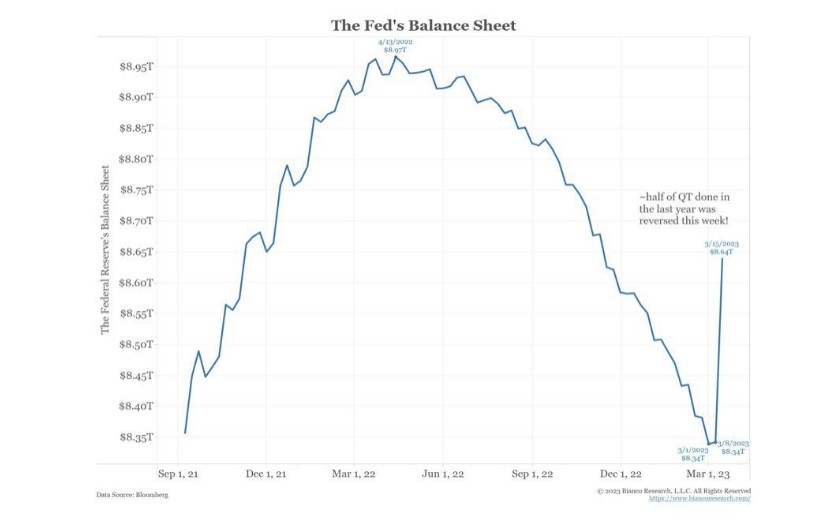

Meanwhile, the Federal Reserve continues to lose credibility. Within two weeks the Fed reversed quantitative tightening (QT) across the board, all the while upping interest rates:

- $300 billion were printed in one week.

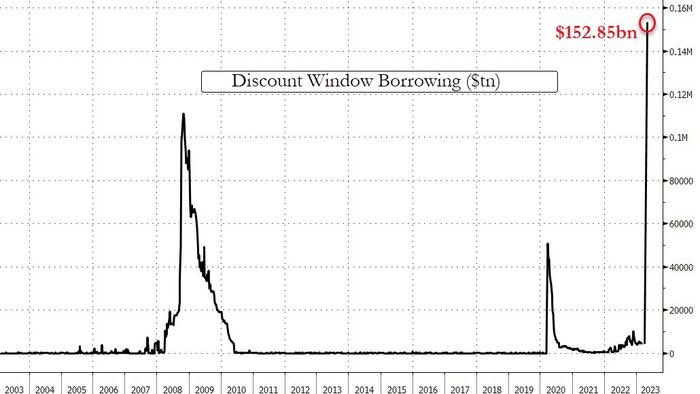

- $150 billion were added to the ‘discount window borrowing’.

- $2 trillion were added for BTFP.

- $18 trillion were added for FedDIC.

Following a 0.25% rate hike on Wednesday, the Fed is now following a policy whereby it is both raising interest rates and printing trillions. The two policies are never deployed in tandem.

Why pursue these contradictory policies?

Covering up systemic banking insolvencies

In short, the Fed is hiking rates to trick low-information voters into thinking that the last two weeks were simply an isolated incident rather than a systemic risk event in which a series of multi-hundred-billion-dollar banks failed (and more are insolvent, per the WSJ). Of course, there’s nothing to worry about, the banking system is ‘resilient‘, and it’s completely fine to have five banking failures in ten days or so, with hundreds more on the precipice. So after blowing up regional banks, and making hundreds more insolvent, while also catalysing financial contagion across European banks (Credit Suisse), the Fed created programs that break the relationship between ‘interest rate hikes’ and ‘monetary policy tightening’.

Consequently, insolvent banks do not shutter their operations following bank runs. Instead, even as rate hikes slowly push banking stocks closer to zero, these banks know their losses are fully covered. On top of that, with the release of this ‘digital currency’ paper, we are witnessing the simultaneous rollout of stealth quantitative easing (money printing), and CBDCs.

The Bank Term Funding Program (BTFP), swap lines, and FedDIC policy are finance-speak abstractions which mean ‘infinite money’.

This begs the question, why would anyone want to own infinitely available fiat currency?

The numbers are so enormously incomprehensible that the Fed has had to work over the weekends, publishing multiple joint statements assuring people that the ‘system is resilient’, all the while Moody’s has downgraded the entire US banking system. By monetising debt, and choking out crypto free markets and blocking off the retail exits, the Fed is sinking to parity with authoritarian central banking regimes that solely serve the oligarchical elite.

Led by the Federal Reserve, central banks in Europe, Japan, England, Canada, and Switzerland are printing trillions even as the Fed hikes interest rates. The trillions printed are in response to the consequences of hiking rates at the fastest pace ever (to fight the inflation they created in 2020). This is a vicious circular cycle which causes an exponential expansion in the money supply, increasing the rich-poor-divide while perpetuating economic stagnation.

Scarce assets such as Bitcoin and Litecoin cannot be printed. There is a hard-coded limit, a set monetary policy known decades into the future which does not rely on human decision making and error.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!