Gold has remained an important asset for countries’ financial reserves, and despite being a shiny rock, its attraction has persisted for thousands of years.

This is illustrated by the fact that a massive portion of gold is held by a number of foreign banks relative to total foreign reserves.

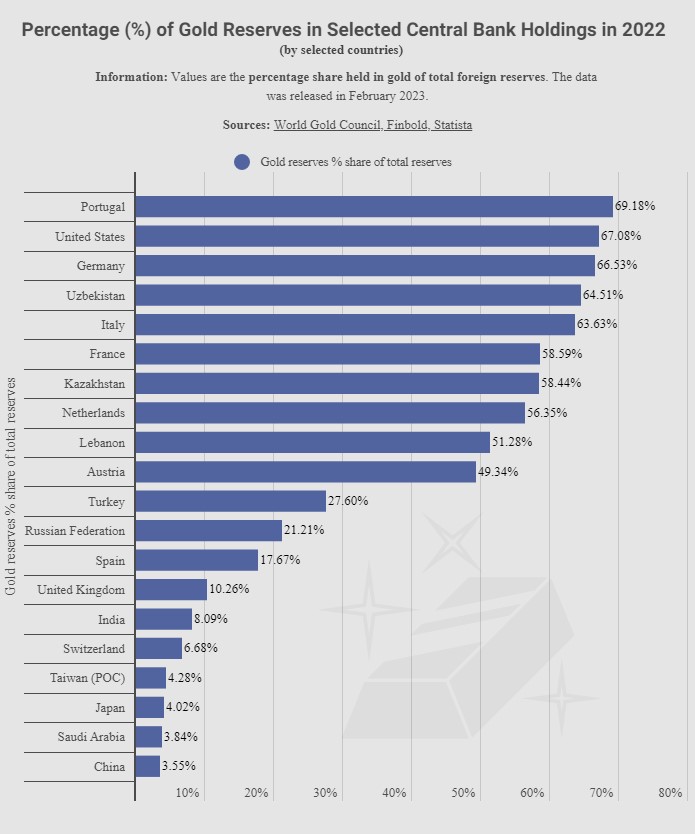

According to data from the World Gold Council, Finbold and Statista, Portugal has the highest gold to foreign reserves ratio at 69.18%, followed by the United States at 67.08% in 2022.

Meanwhile, China occupies the 20th position with a ratio of 3.55%, while Russia holds 21.21% relative to foreign reserves. Overall, the top 20 countries are more or less dominated by countries inside Europe, which account for over 50%.

Gold reserve drivers

While countries have different gold reserve ratios, the motives driving gold stacking are the same across the board. Gold is a safe haven asset, historically. While it’s rivalled by an emerging 21st century competitor – Bitcoin, which holds similar properties, the two statements are not mutually exclusive. In fact, gold bugs and bitcoiners tend to share views on current affairs, particularly when it comes to unsustainable modern monetary policy, monetary debasement and broader economic undertones.

Gold also holds an important role in central bank reserve balance sheets as it lends credibility to monetary policy-makers. However, the percentage of reserves held varies widely across countries, and while far from perfect, Western audits are more believable than audits done in authoritarian regimes, whose checks and balances aren’t worth the paper they’re printed on.

Taken at face value, China’s gold reserves are still relatively low compared to other major economies. But China’s Communist Party has been stockpiling reserves in recent years. This is part of a grander strategy to diversify its foreign exchange reserves away from the US Dollar – the dominant world reserve currency.

China has been known to accumulate gold covertly due to the precarious nature of the regime. As such, uncertainties regarding its reserves are omnipresent.

US gold reserves dominance

The United States remains a dominant player on the global stage, driven in part by the dollar’s unrivalled position in global finance, resilient economy, and relative political stability. Still, it remains to be seen whether the country will maintain its position following the Fed’s latest move to open liquidity taps in response to failing banks in the midst of a rate-hike regime.

Gold’s role has been elevated following the $9-trillion-plus money printing spree spurred on by the bait-and-switch lockdown scam on 2020; the biggest scandal since the Iraq war. As inflation remains elevated at 6% (year-on-year), gold’s (XAUt) value as a familiar safe-haven asset pushed to $2,000 on Monday. Owing to their fundamental similarities, gold and bitcoin have diverged from the stock market. The same could be said for silver and Litecoin, which form part of a ‘hard asset’ basket.

#Bitcoin and #Gold are diverging from stocks. pic.twitter.com/kIH4nryoRD

— Chris on Crypto⏫Ł₿ (@ChrisOnCrypto1) March 15, 2023

With financial markets and economies in a perpetual state of crisis, partly perpetuated by a NATO-Russian war in Ukraine, countries and institutions are incentivised to seek protection via hard assets in the event of a catastrophic currency collapse; a global fiat-currency race to the bottom.

Gold may prove to be an ’emerging stablecoin’ that increasingly takes on the mantle of fiat currencies due to its inherent stability and familiarity. Or at least, that’s what Bitfinex CTO, Paolo Ardoino believes:

BTC>GOLD>USD

Gold actually doesn’t compete with BTC, #bitcoin is far superior. Gold competes with USD.

Eventually $XAUt will be the most used stablecoin.

— Paolo Ardoino 🍐 (@paoloardoino) March 21, 2023

The sound money basket

Gold is seen as an important asset, especially in Europe where it compliments and buffers reserves. During times of financial and geopolitical instability, as well as structural global gyrations, the asset’s historical resiliency is certainly attractive. However, the same can be said for a basket of time-tested proof-of-work assets in the cryptoverse, which share similar properties of scarcity, fungibility, and immutability, with the added benefit of having a superior transport layer, among other things.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!