In a stunning turn of events, several central banks announced a coordinated effort to increase liquidity conditions in the banking system amidst the largest banking meltdown since the great financial crisis in 2008.

The Federal Reserve and five other central banks announced the coordinated effort on Sunday, which will introduce US Dollar swap arrangements in an attempt to ease strains on the global financial system.

US FED SAYS FED AND CENTRAL BANKS OF ENGLAND, CANADA, JAPAN, ECB AND SWITZERLAND ANNOUNCE COORDINATED ACTION TO ENHANCE THE PROVISION OF LIQUIDITY VIA THE STANDING U.S. DOLLAR LIQUIDITY SWAP LINES.

— CN Wire (@Sino_Market) March 19, 2023

The idea is aimed at maintaining US Dollar liquidity as banking blowouts spiral out of control in the US and in Europe. The Fed announcement came on march 19, hours after Swiss-based bank Credit Suisse was acquired by UBS for $3.25 billion as part of a panicked and impromptu plan led by Swiss authorities to maintain the country’s financial stability.

According to the Fed, this plan includes ‘swap lines’, which is an inter-bank arrangement to settle currencies at a given rate.

Swap lines had served as emergency-like action for the Federal Reserve in the 2007-2008 global financial meltdown, as well as the 2020 answer to the knee-jerk reactions to a seasonal virus by way of illegal and irrational lockdown policies. Federal Reserve swap lines are a roundabout way of adding liquidity to the market (i.e. printing money), which serve to cushion spiralling margin calls in the globally regulated fiat funny-money scheme.

All centrals banks are in this business, and actively perpetuate a financial system where ‘saving’ is not possible. In fact, an attempt by Caitlin Long of Custodia Bank to create a bank with high customer deposits in reserve (108%) was denied by the Federal Reserve.

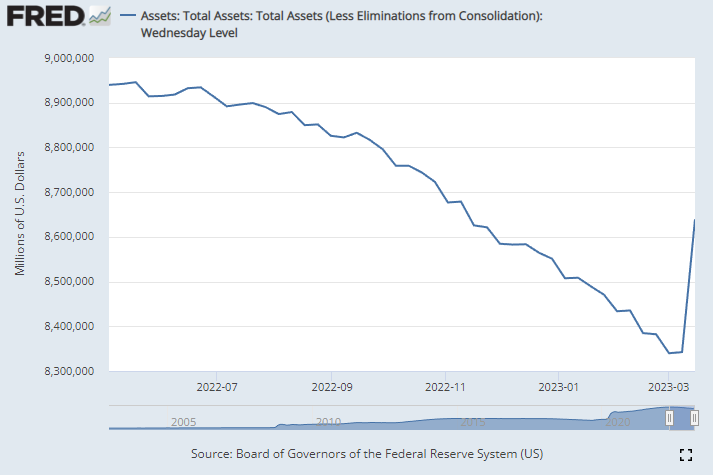

The coordinated effort comes as negative outlooks on the Western banking sector persist across the board, with Silvergate Bank and Silicon Valley Bank collapsing and the New York District of Financial Services taking control of Signature Bank. The Fed has effectively thrown out its discourse about attempts to quell inflation via interest rate hikes (cost of capital) and central-bank balance sheet tapering, reversing a year-long policy in just one week after printing $300 billion.

The Fed has set up a funding program to the tune of $25 billion program in order to ensure traditional banks have available funds to cover bank runs. Such programs allow depositors to withdraw funds, but the trade-off is increased currency debasement in a historically high inflationary environment. In turn, this perpetuates the cycle for fiat money to ‘chase’ valuable scarce assets which cannot be printed out of thin air.

A recent analysis by several economists on the SVB collapse found that up to 186 US banks are at risk of insolvency:

Even if only half of uninsured depositors decide to withdraw, almost 190 banks are at a potential risk of impairment to insured depositors, with potentially $300 billion of insured deposits at risk.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!