Proof-of-work is the consensus mechanism used by protocols like Bitcoin and Litecoin. Fundamentally, this means that energy, not well-capitalised human decision makers must be used to prove that transactions on the network are valid.

Proof-of-work

Bitcoin and Litecoin’s proof-of-work algorithm functions with specialised ‘computers’ known as application-specific integrated circuits (ASICs). These computers input transaction data from the previous block and randomised numbers to guess the outcome of the next hash functions. Hash functions are uni-directional math equations, for which ASICs are engineered to compute. It’s impossible to pinpoint an output from a publicly visible input without ASICs hashing (guessing).

‘Miners’ are people, typically organisations of all sizes, who operate these machines. Their goal is to increase the amount of guesses (hashing power) their machines produce per second. This is called the hash rate. Miners are on the look out for cheap and reliable energy sources in order to maximise profitability, reduce operating costs and cover other expenses. The highly competitive industry is modulated by Bitcoin’s difficulty adjustment, i.e. the complexity level of the hash function, which increases and decreases according to the hashes per second on the network. Global network hash rate is averaged out every 10 minutes (every block).

Blocks are merely a collection of the transactional data which are added to a chain of prior blocks on the network once the hash function is discovered, creating what’s known as the blockchain. Miners are rewarded for this work by receiving transaction fees paid both by network users and a block subsidy hard-coded in the protocol. Originally, the subsidy was 50 BTC, but halves every 210,000 blocks (about four years). Currently, the block pay out is 6.25 BTC per block. Litecoin’s subsidy is 12.5 LTC. The Bitcoin protocol has a maximum issuance of 21 million bitcoin, meaning subsidy will run out by the year 2140 and all rewards will be paid in transaction fees. Similarly, Litecoin’s rewards will be paid out in 2142.

Proof of work fundamentals are designed to be unchanging and reliable. These attributes include:

- A real-world cost to producing Bitcoin and Litecoin (i.e. there is no such thing as something for nothing, fundamentally).

- A real-world cost to protecting integrity and accuracy of the networks.

- A notion called ‘unforgeable costliness‘, which means ‘faking’ or adding new coins would require redoing the entirety of the proof-of-work that came before, and at a speed which outpaces the current hash rate on the network.

This is a 51% attack and it is unfeasible even for governments.

Proof-of-stake

Contrast this system with proof-of-stake, which serves as an alternative consensus mechanism spearheaded by Ethereum, Cardano and various quasi-vapourware projects which have been marketed as alternatives to time-tested proof-of-work blockchains.

Proof-of-stake works through ‘staking’, or locking tokens into a protocol so that they cannot be spent. The more tokens staked, the better the odds of validating a transaction block. In other words, the frequency of rewards depends on the buy-in time and investor capital. This is a form of ‘stakeholder capitalism’.

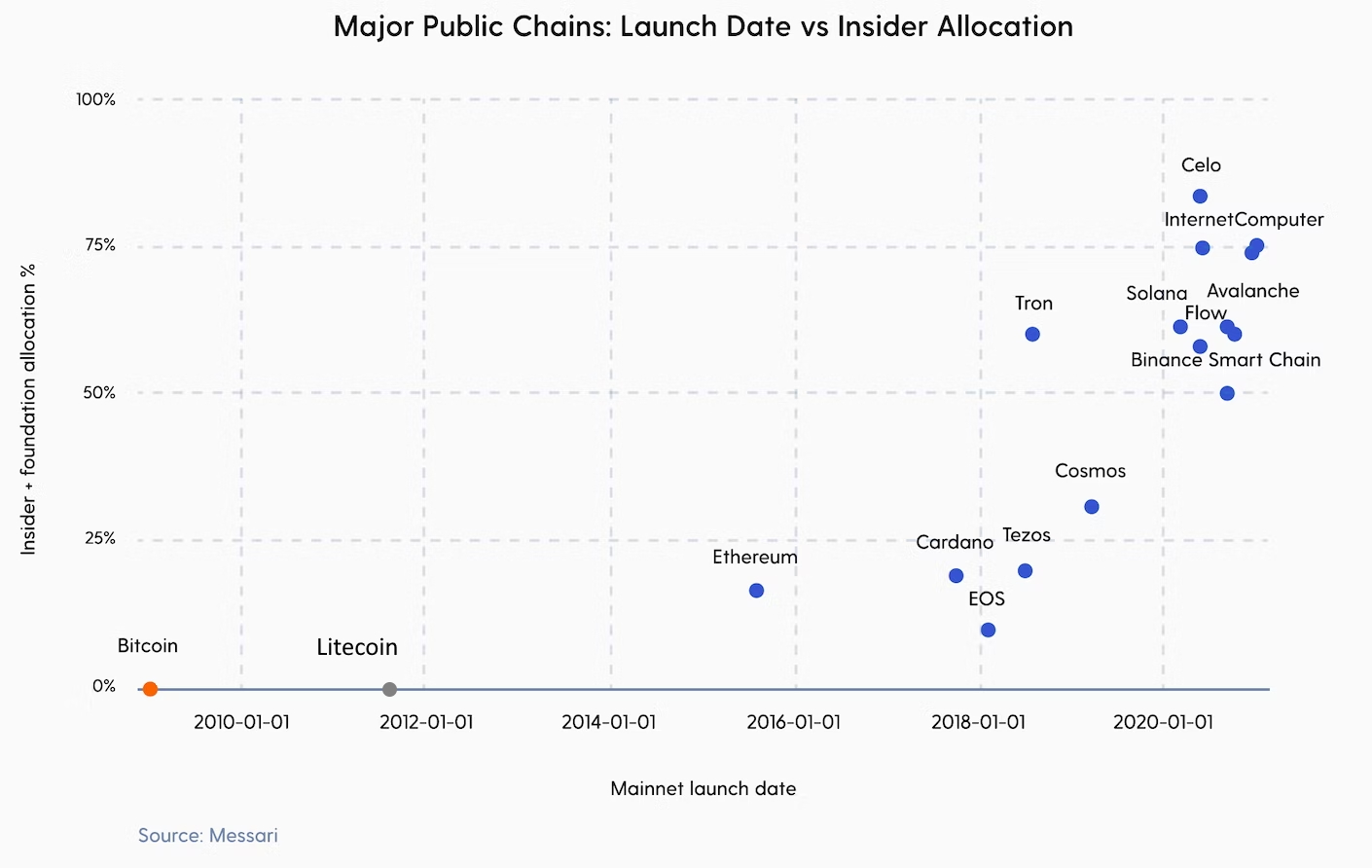

Proof-of-stake projects have development teams, marketing departments, executives, venture capitalists and various insiders who are involved before coins become publicly available. Typically, a substantial portion of tokens are allocated to these various parties with a ‘vesting period’ before the project is open for public acquisition or staking. This is called ‘pre-mine’.

A study by Sam Callahan released in May 2022 found that Ethereum had a 20% pre-mine – a relatively small amount compared to more recent projects. This is important because founders only needed to acquire an additional 31% over time in order to gain pivotal influence over improvement proposals (BIPs, LIPs, EIPs).

Both Bitcoin and Litecoin had no pre-mine. Litecoin’s launch on October 9th, 2011 was provably as fair as Bitcoin’s. Zero pre-mine means one individual or group cannot change the protocol in any way, unlike most PoS altcoins. The only way to change the Bitcoin protocol is through true consensus of 51% of work done for the network, which is not easy to achieve. This is incredibly valuable because it maintains protocol integrity as only changes that are beneficial for everyone will be voted into the protocol. The “Blocksize War” covers this in detail.

In some sense, the Proof of stake consensus mechanisms is the polar opposite of PoW. Besides dramatically increasing efficiency of improvement proposals, PoS attributes include:

- No real-world cost of production (i.e. something for nothing).

- A pre-mine (to varying degrees) whereby a majority stake by insiders, well-capitalised individuals, countries and organisations can dramatically change the rules of the protocol for their benefit.

- A reliance on trust, such that stakeholders with enough capital trust each other to not change the protocol.

When push comes to shove, there is a very real trade-off between the two mechanisms. Proof-of-work requires energy in order to secure a global monetary network in such a way that no organisation can inflate the total number of coins. This makes it a hard asset which can be held for a long period of time. On the other hand, proof-of-stake relies on all-too-human decision makers, not dissimilar in essence to the current global central bank regime. At any moment, malicious self-serving parties could intervene. In other words, proof-of-stake is not a replacement to proof-of-work as the network’s integrity is always at risk (by design).

Where’s the innovation?

That being said, the idea of a ledger has been around for sometime. Today’s payment rails transmit ledger data to each other all over the world, distributing balances from centralised systems among themselves and maintaining data integrity under the law. The innovation of a blockchain is true decentralisation without trusted intermediaries. This is accomplished with proof-of-work. PoS chains cannot do this with any comparable level of integrity. PoS altcoins essentially introduce trust with centralised parties which could have malicious intentions. In this case, the entire point of a decentralised blockchain is negated at the protocol level. This is an overlooked distinction which is rarely highlighted in the crypto space, yet it could not be a more important building block when learning about blockchains.

This profound fact means that PoS coins are more or less competing with centralised systems like Revolut, Cash App or other centralised payments platforms. On such platforms, money can be stopped, censored or confiscated at a moment’s notice. It could also be revealed that a platform is fraudulent or insolvent – FTX being the current example of both scenarios at once. More importantly, PoS encourages new founders to create an ever-expanding pre-mine, and focus on marketing instead of development. This is how ponzi schemes are made, and the further away from first principles a protocol gets, the more likely it’s vapourware.

On the other hand, proof-of-work coins with a proven track-record are playing a different game entirely. There is no comparison that can be made which would be considered fair as the fundamental innovation rests in open, decentralised technology, not speed and efficiency at the expense of this innovation.

Still, a technically superior innovation is not a license to rest on laurels. Improvements such as Litecoin’s flagship Privacy-enhancing MWEB or Bitcoin’s Lightning network are ongoing and aimed at scaling decentralisation worldwide.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!