A damning, court-ordered 476-page examiner’s report on Celsius’ bankruptcy proceedings revealed that the firm’s operations were similar to a ponzi scheme.

Here are some key takeaways that all but confirm the worst fears and allegations.

1. Celsius’ issues began in 2020

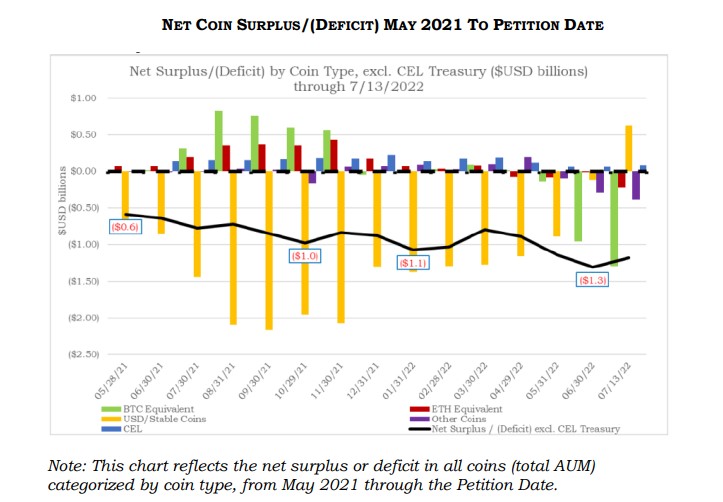

The examiner found that Celsius’ problems date back to at least 2020, when the company mismanaged client funds, using the money for operational costs and rate rewards. During the bull run of 2021, Celsius even recorded a pre-tax loss of $811 million. The firm appears to never have had any profit margins throughout its lifetime. In mid-2021, Celsius appeared to be insolvent, with stablecoin liabilities adding up to $2 billion in August that year. Celsius also had a significant Bitcoin and Ether deficit by mid-2022.

2. Alex Mashinsky cashed out $68 million

Despite repeated assertions that he did not sell the platform’s native CEL token, Celsius CEO Alex Mashinsky did in fact sell 25.1 million CEL tokens for $68.7 million.

3. Celsius insiders knew the business was illegal

Throughout 2020 and 2021, Celsius borrowed using deposited Bitcoin and Ether as collateral. When the Luna foundation imploded and the market collapsed, Celsius used that BTC and ETH to pay outstanding loans and unwind its DeFi positions. This was done to acquire assets for customers who wanted to withdraw assets.

Dean Tappen, the company’s Coin Deployment Specialist described Celsius’ use of customer stablecoins as “very ponzi like.”

Celsius’ former chief Financial officer Harumi Urata-Thompson is quoted as confirming this illegal activity.

[w]e are talking about becoming a regulated entity and we are doing something possibly illegal and definitely not compliant. If anyone ever found out our position and how much our founders took in USD could be a very very bad look . . . We are using users USDC to pay for employees worthless CEL . . . All because the company is the one inflating the price to get the valuations to be able to sell back to the company,” said another Celsius employee on Slack.

4. Client funds were used to pump the $CEL token

The insolvent company spent at least $558 million in token buy-backs. Most of the funds used were borrowed from customer deposits, and the firm was actively involved in artificially inflating the CEL token price by placing ‘resting’ orders to buy the token. These orders would be triggered if prices fell below a certain price point.

Celsius also sold its token in over-the-counter (OTC) transactions. They used a strategy called an “OTC Flywheel”, whereby the selling activity is offset with public market buy orders.

5. Celsius employees withdrew funds as the company collapsed

While Alex Mashinsky was the largest holder of CEL tokens, a number of managers also sold or swapped their tokens. Specifically, Celsius CTO Nuke Goldstein sold $2.8 million and CSO Daniel Leon sold $9.74 million.

More internal documents show that after LUNA’s collapse in May 2022, Alex Mashinsky withdrew assets from the platform.

6. The rewards rate policy was made up

Instead of having a formalised rewards rate policy, decisions were made on an ad-hoc basis. These rates were driven in large part by Mashinsky’s concern that customers would leave if rates dropped below their competitors.

While an investment committee was in place to determine these rates, committee executives told the examiner that Mashinsky made the final call, and his receptiveness to alternative viewpoints “waivered depending on his mood and who was in the room.”

Celsius did not generate enough yield to meet the reward rates on assets either.

7. Mashinsky wanted to double down on FTX

Mashinsky flew to the Bahamas in January 2022, where he visited FTX’s Sam Bankman-Fried and Alameda Research’s Caroline Ellison.

In his interview with the examiner, Mashinsky told the Examiner that he came away distrustful of FTX and sought to unwind any exposure to the FTX platform. This contradicts Celsius’ Chief Credit Officer Brian Strauss, who said Mashinsky wanted to double down on the crypto exchange and the Risk Team had to persuade him otherwise.

In early 2022, Celsius increased exposure to FTX by keeping assets on the exchange and borrowing stablecoins from them. By April 2022, Celsius had borrowed $1.5 billion in stablecoins and had over $2.5 billion in crypto on FTX.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!