Bitcoin advocate and investment strategist Lyn Alden argues that contrary to baseless bureaucratic claims, Bitcoin’s energy consumption is not an ‘exponential problem’.

Investment strategist Lyn Alden took to Twitter to explain how the Bitcoin network will increase efficiency as adoption ramps up.

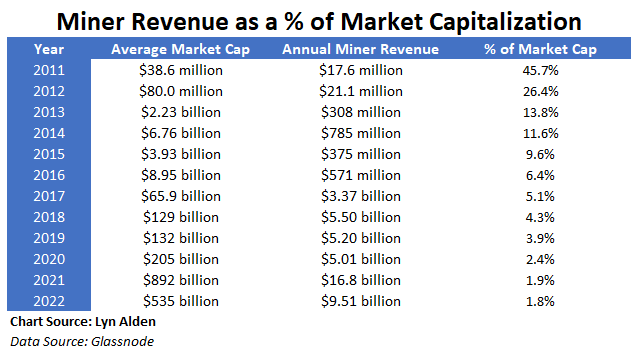

Alden highlighted Glassnode analytics data to demonstrate that BTC mining revenue grows more slowly than its market capitalisation and transaction volumes.

In 2022, Bitcoin’s yearly mining revenue stood at $9.51 billion, about 1.8% of the coin’s average $545 billion market cap. With mining revenue hitting $16.8 bllion in 2021, this accounted for just 1.9% of the $892 billion market cap. Since 2021, mining revenue has been on a steady decline relative to Bitcoin’s market cap, per the chart. In other words, Bitcoin mining as a percentage of its market cap is consistently a single-digit fraction. When seen in the context of global energy usage, bitcoin’s current energy consumption is effectively a rounding error.

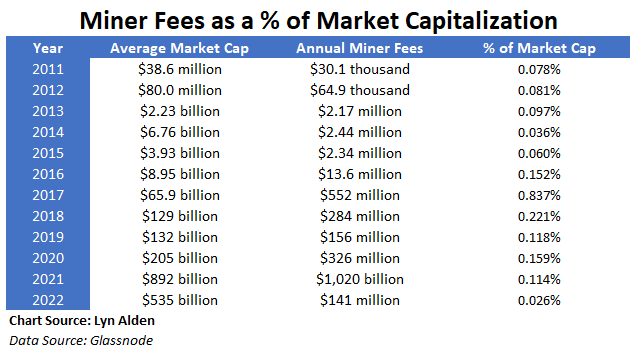

Mining revenue and fees accounted for 0.064% and 0.0010% of the network’s $14.86 trillion transaction volumes in 2022. Still, the coin’s monetary velocity (pace of circulating coins, discounting large exchange spikes) stood at 7.7 in 2022, compared to 5.2 in 2021.

When seen in context, Bitcoin’s volumes and market cap have outpaced miner fees. This result is within expectations, in part due to Bitcoin’s inbuilt difficulty adjustment mechanism.

No leg to stand on

Critics, in particular European bureaucrats who have demonstrated a consistently aggressive approach towards Bitcoin adoption, argue that Bitcoin uses too much energy. The cherry on the cake came from a blog post from ECB executives, who claimed that BTC is experiencing an “artificially induced last gasp before the road to irrelevance.”

Bitcoin has rallied 20% since the comments. Unsurprisingly, these fine gentlemen are working on a Central Bank Digital Currency rollout which will effectively reduce money to coupons.

Beyond the deliberate mud-slinging from plentiful charlatans at the ECB and EU, other critics argue that the network will not use enough energy to remain secure, as BTC’s block subsidy moves towards only fees.

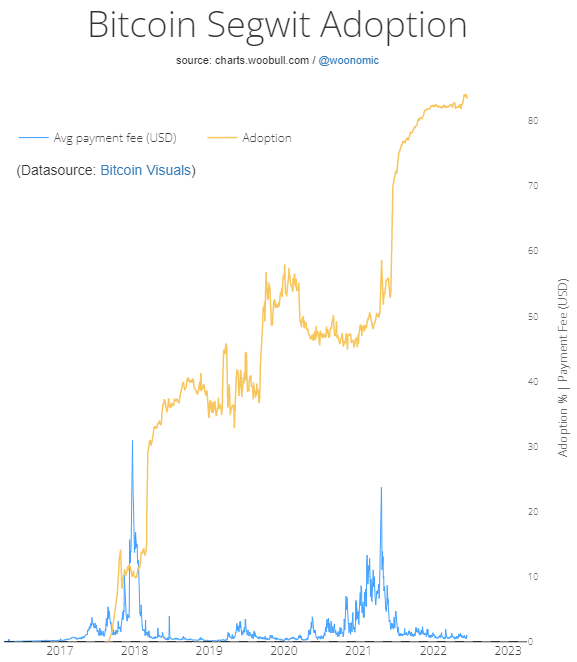

But according to Alden, such critics fail to take SegWit adoption into account, because they believe volume is stagnant.

Ever since the Segwit soft fork was introduced, whenever bitcoin fees get high, it results in a new spike of Segwit adoption — the network gets more efficient over time.

If transaction volumes continue increasing, upward fee pressure will ensue. When that takes places, it will incentive new development across the Bitcoin stack, like the Lightning Network, driving their adoption.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!