Litecoin is a household crypto name boasting persistent development throughout its decade-long existence, the latest being MWEB.

It was first created in 2011 by Charlie Lee as an upgrade to Bitcoin and since then has been a major beneficiary of the industry’s global success. The project gained credibility, a highly liquid market and ongoing research & development interest, all the while maintaining a top 20 position on crypto ranking sites.

Robust Tech & Activity

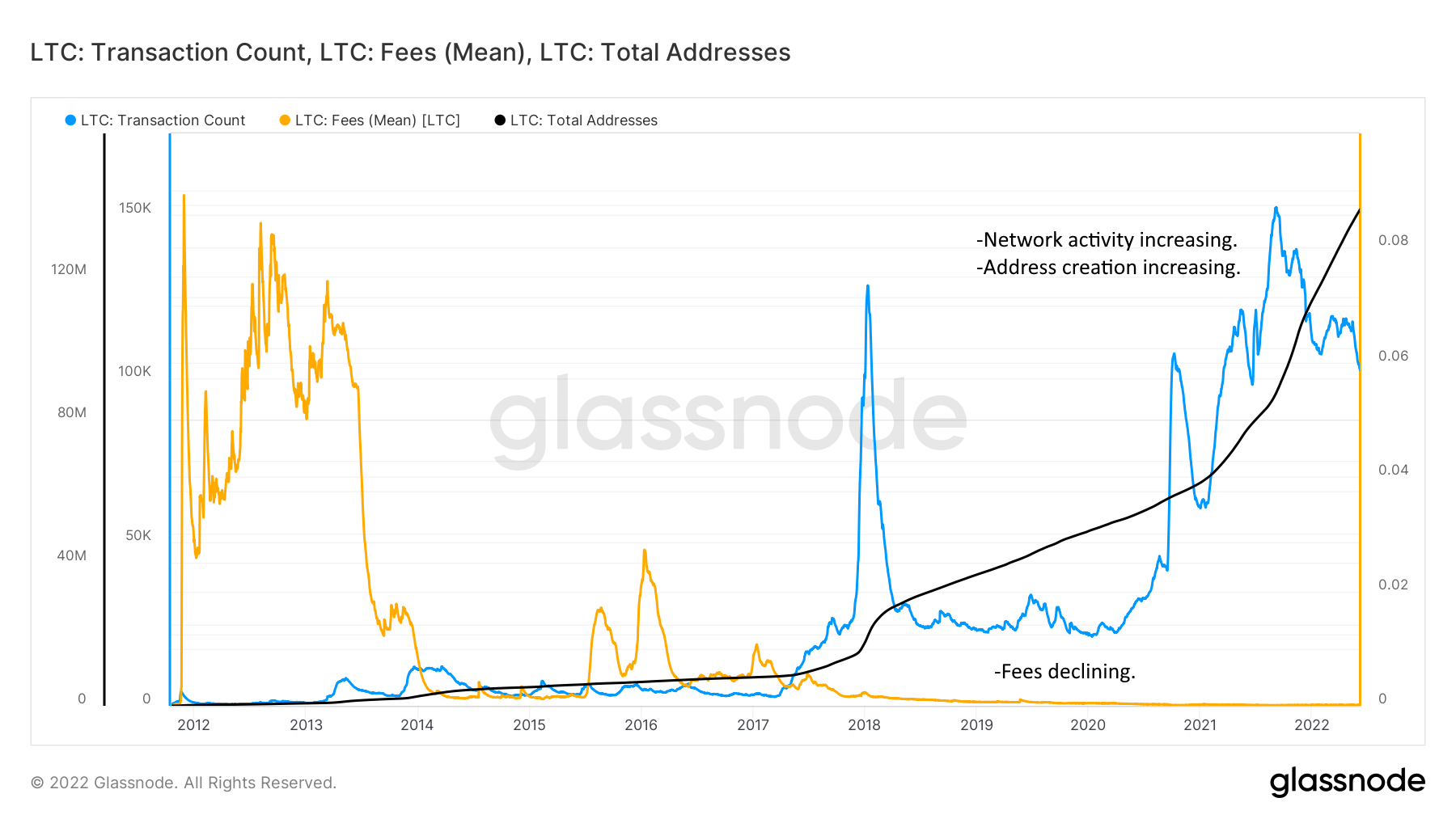

Its main selling points are instant, near feeless transactions with a developer emphasis on increasing fungibility and privacy attributes with the launch of MWEB. A common talking point is that Litecoin is the Silver to Bitcoin’s Gold. While this comparison has held its own for over a decade, Litecoin’s diverse applications have thrust the project into a new paradigm of economic activity. This is reflected in various key metrics.

Clearly, over the course of its 10 year existence Litecoin has not only stood the test of time, but thrived. This is reflected in its adoption alongside Bitcoin, a growing user base and transaction count, declining fees, and most importantly – ongoing core development partly supported by the Litecoin Foundation.

Litecoin’s reputation as the ‘silver to Bitcoin’s gold’ still rings true in its development cycle too. In fact, Litecoin is routinely developed as a test-bed for new technologies which tend to be integrated into bitcoin at a later date. One such instance was the SegWit implementation. Due to infighting within the Bitcoin community over SegWit, Litecoin went ahead and implemented the upgrade first as a testing-bed for bitcoin. A few years later, Charlie Lee revealed that he was the anonymous figure who had created the 1 million dollar SegWit bounty (proving that SegWit transactions were safe).

The same might be true of MimbleWimble Extension Blocks, and perhaps even the new NFT and smart-contract implementation on top of the Litecoin network. Liteverse is one such project that is up and running on the Litecoin network, which boasts zero network outages (100% uptime) compared to centralised blockchains that can be turned off by developers.

All in all, Litecoin’s reputation and strong ties to bitcoin from both a coding and fundamental use-case offers a superior alternative to trending one-hit-wonder projects like Solana. Most importantly, these updates and upgrades are implemented while remaining faithful to the Scrypt proof-of-work mining algorithm and core tenets of sound money and scarcity as a base-layer for economic activity.

The inseparable similarities between Bitcoin and Litecoin are even an incentive for merchants to integrate it on their payment rails, which has accelerated Litecoin’s adoption as a commonly used payment mechanism. And despite misguided and perhaps mal-intentioned calls against Litecoin, the project remains in active development.

The Mimblewimble Upgrade

Admittedly, Litecoin lost some of its shine to newer, often half-baked proof-of-concept projects that came (and went) over the years. But development took a dramatic turn Northwards in the last 12 months. After years of ongoing development, the Litecoin Foundation, which has only been around for half of the coin’s existence, announced that the Mimbile Wimble Extension Block (MWEB) code was completed on March 16.

Privacy

MWEB improves key features that Litecoin lacked – namely fungibility and privacy (via confidential transactions). Launched in October 2020, the MimbleWimble testnet was battle-tested for 5 consecutive months before developers were comfortable announcing its completion. MWEB allows senders to encrypt the number of coins to be sent using ‘blinding factors’, obfuscating the sending and receiving addresses. This vastly improves privacy features (found in centralised legacy financial systems) while at the same time enhances network scalability.

The Litecoin founder, Charlie Lee, personally helped fund the project and has focused efforts on fungibility, scalability and privacy for years, viewing this update as a key transitory evolution of the Litecoin blockchain.

Fungibility

Briefly, fungibility introduces the concept that coins are mutually interchangeable. For example, one dollar can be traded with another dollar irrespective of its transaction history. Since cryptocurrency transactions are all recorded on the blockchain, funds that were used for nefarious activities can be tarnished in some way, making them a target for overzealous regulators. Since the principles of physical cash are true for any type of money, this is not fair on users who value relative privacy.

MimbleWimble seeks to replicate this physical cash fungibility online by using extension blocks. These are essentially interconnected adjacent chains running next to Litecoin’s main chain. It’s an optional feature for users those who want more privacy and fungibility for their LTC transactions.

Ultimately, the end goal is for Litecoin to forge the Nakamoto standard; becoming a store-of-value, replacing cash, and forming the bedrock for layered economic activity on a free and open web3.0.

Smart Money Supports the Network

Grayscale is the leading money manager for cryptocurrency assets worldwide, holding over $48 billion in cryptocurrency assets. It provides insight into the movement of large capital inflows and has become the go-to proxy from which to broadly generalise high net-worth capital flows over the years.

For years, LTC has maintained strong inflows and remains a top pick in a crypto investment portfolio. Currently, the Grayscale Litecoin Trust (LTCN) enjoys a top 5 position in ranking, comprising over $100.7 million in total holdings with the asset manager.

Litecoin’s name-recognition also lends itself to the blockchain’s health more broadly, in both liquidity and as a widely accepted means of payment. Apart from being tradeable on practically every crypto exchange, the coin is available on traditional financial applications such as Paypal, Revolut and many others. For what it’s worth, LTC is also ahead in ATM offerings, with over 6,461 ATMs offering LTC in 2020, according to cryptonews.net.

When seen in aggregate, it’s clear that there is strong infrastructural support for Litecoin, both in the legacy financial system and the crypto ecosystem.

Acquire Litecoin here.

Good Projects Persist

While some have continually proclaimed the imminent death of Litecoin (often with a similar tone as those who proclaim the death of bitcoin), the opposite has proven to be true. After nearly 11 years, Litecoin persists as a top ranking coin, complementing bitcoin’s existence with sound money principles and an emphasis on improving fungibility, privacy and layered economic activity.

But the market can remain irrational for a long time, thereby creating a disparity between fundamental value and realised market value. But for those paying attention, the resolution of this price-to-fundamental divergence is crystal clear.

In all its history, LTC has remained faithful to the Austrian economic model, tangibly improving Bitcoin development in the process. The two cryptocurrencies have much in common – a strong brand and straight-forward vision. Moreover, Mimblewimble now makes Litecoin technically superior to Bitcoin, counterbalancing worrying privacy-infringing trends in Europe and around the world. Since technology always wins, Litecoin’s fundamental position among a basket of cryptocurrencies with a future is not only secured, but eminently desirable.

Litecoin is a secure, private, fast, fungible and near-feeless blockchain with demonstrable persistence and a clear roadmap. As the world continues to be plagued by inadequate economic policies and worse legislation, the future is bright for immutable, decentralised proof-of-work coins that cannot be tampered with.

Litecoin is one such coin.

This is not financial advice

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!