Legendary investor and co-founder of PayPal and Palantir Technologies, Peter Thiel told thousands of attendees at the Miami Bitcoin conference that central bankers are bankrupt.

The tech visionary and staunch libertarian described bitcoiners as a “revolutionary youth movement” who need to “go out of this conference and take over the world”.

Bitcoin Versus Equities

In his speech, Thiel described Bitcoin as the only honest market left that is not an apparatus of the state.

He said:

Even being in a stock you’re effectively in a Government-linked entity. Companies, woke companies are quasi-controlled by the Government in a way that Bitcoin never will be.

Thiel went on to say that the benchmark for Bitcoin is not gold’s $12 trillion market cap, but global equities. Bitcoin’s current market capitalisation is $831 billion, while global equities are $115 trillion in aggregate.

The question is why can’t there be parity between Bitcoin and equities? Why shouldn’t we be talking about something more like a hundred to one?

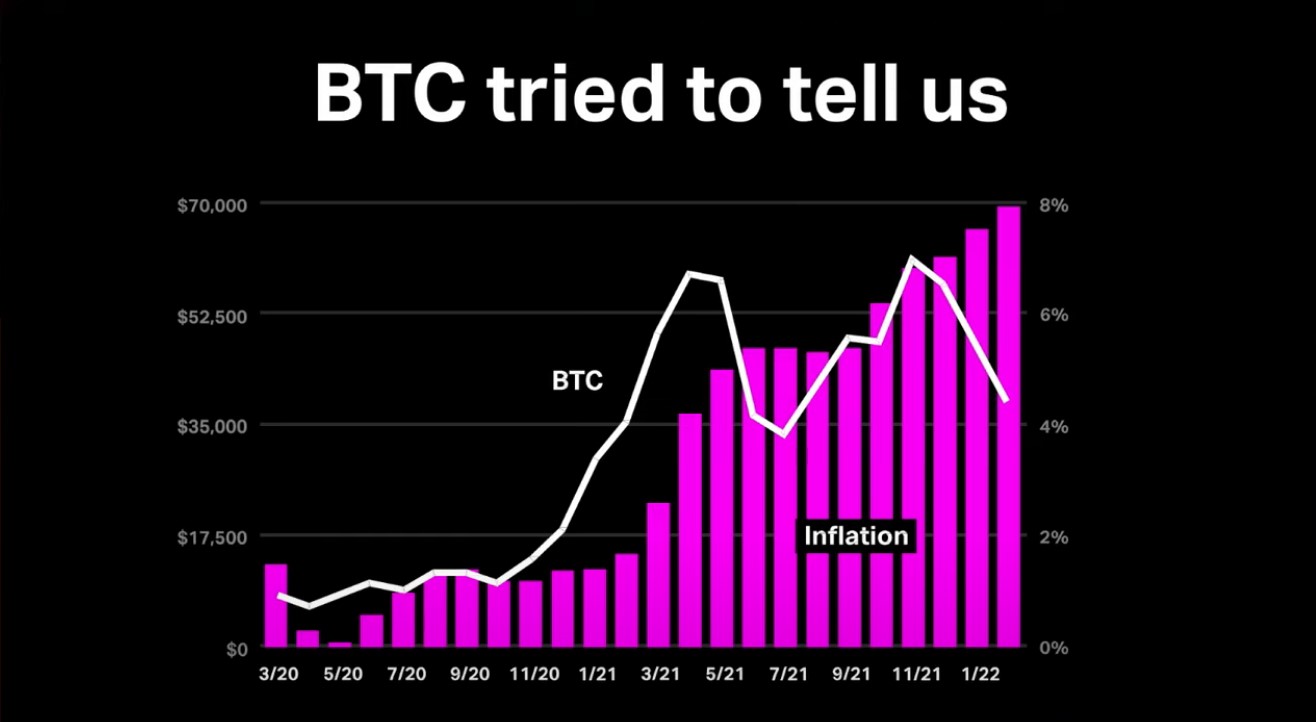

He then suggested that the Bitcoin thesis on inflation was playing out in real time, and that the asset provided warning signals.

Bitcoin is always the most honest market in the world, it’s the most efficient market, and it’s the canary in the coal mine. It was telling us that the inflation was coming. In the last two years, it went from $5-6,000 up by a factor of 10x.

Thiel continued:

It is telling us that the central banks are bankrupt. That we are at the end of the fiat money regime. And that’s sort of what it has priced in. I think the central bankers, Mr Powell, people like that, should be extremely grateful to bitcoin because it’s the last warning they’re going to get. They’ve chosen to ignore it. They will have to pay the consequences for that in the years ahead.

Inflation Takes Off Globally

Inflation has only increased globally. In Lebanon, it has reached 219%, with the state’s Deputy Prime Minister Saade Chami declaring bankruptcy this week.

In Turkey inflation has surpassed 61%. In the USA inflation rose to 7.9% in February, and is expected to rise further in March. The European Central Bank increased its inflation forecast from 3.2% to 5.1% in March. Since then, official Eurozone inflation rose to 7.5%.

Argentina and Brazil are seeing a 10% rise in inflation after a period of relative calm, all the while their neighbour Venezuela collapses into hyperinflation.

Speaking to the worthlessness of fiat money in November 2020, Lagarde said that the European Central Bank can print money forever if need be.

As the sole issuer of euro-denominated central bank money, the Euro system will always be able to generate additional liquidity as needed So, by the definition, [the central bank] will neither go bankrupt nor run out of money. In addition to that, any financial losses, should they occur, would not impair our ability to seek and maintain price stability.

Euro zone inflation rose to 7.5% in March, up from 5.9% in February.

In order to curb central-bank-caused inflation, Fed chairman Jerome Powel increased interest rates by 25 basis points in March, which is the same as bringing a knife to a gun fight. The US central bank is now tightening monetary policy, and may increase rates by 50 basis points in May as pressure mounts.

The move could cause a recession, but higher interest rates means increasing profitability for commercial banks. However, this move cannot undo the damage done by the record-breaking amounts of money printed in the last two years.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!