US inflation figures officially reported a 7.9% increase on Thursday, the highest ever in the United States in over 40 years. Europe’s outlook doesn’t look any better.

Increases in indexes for oil and gas prices, shelter and food were among the largest contributors to all items surge. The Consumer Price Index (CPI), which tracks prices for certain consumer goods and services – including clothes, groceries, restaurant meals, recreational activities and vehicles — increased 0.8% in February on a seasonally adjusted basis after rising 0.6% in January.

Cryptocurrencies aren’t going away. Buy Bitcoin & Litecoin here.

According to the US government, it now costs 8.6% more to eat food than it did one year ago in the United States.

Price increases over last year (CPI report)

Used Cars: +41.2%

Gasoline: +38.0%

Gas Utilities: +23.8%

Meats/Fish/Eggs: +13.0%

New Cars: +12.4%

Electricity: +9.0%

Food at home: +8.6%

Overall CPI: +7.9%

Food away from home: +6.8%

Apparel: +6.6%

Transportation: +6.6%

Shelter: +4.7%— Charlie Bilello (@charliebilello) March 10, 2022

High inflation is not contained in the United States, as the ECB’s La Garde increased its inflation forecast from 3.2% to 5.1% today. That’s over a 50% increase in official inflation expectations.

A Rock and a Hard place

Notably, both figures come from respective regional Governmental bodies, which have an incentive to report the lowest numbers possible. In fact, there is wide-spread belief that real inflation numbers are well within double-digit territory and steadily rising in both the United States and Europe.

These figures come at a time when the US Federal Reserve is unable to aggressively raise rates without forcing global financial Armageddon. Suffice it to say that printing millions of Euro-Dollars, manipulating rates to zero percent, and then expecting to have no negative consequences is the same as denying the existence of gravity.

The recipe for disaster due to unhinged easy monetary policy was set in stone with the West’s response to the Ukraine-Russia conflict. There are no more options now and the Fed is stuck between a rock and a hard place.

More specifically, the Fed cannot raise rates aggressively without risking a major recession, nor can it mitigate exponential inflation due to easing policies.

Pick your poison.

Cash is Trash

While economists, central bankers and politicians play power games, the average citizen picks up the tab. Inflation punishes those with no investable assets, not the wealthy whose money is stored in yield-bearing assets and financial products which tend to outpace bad monetary policy decisions.

Regardless of what politicians, economists and those who oversee monetary and fiscal policy do, they will be wrong.

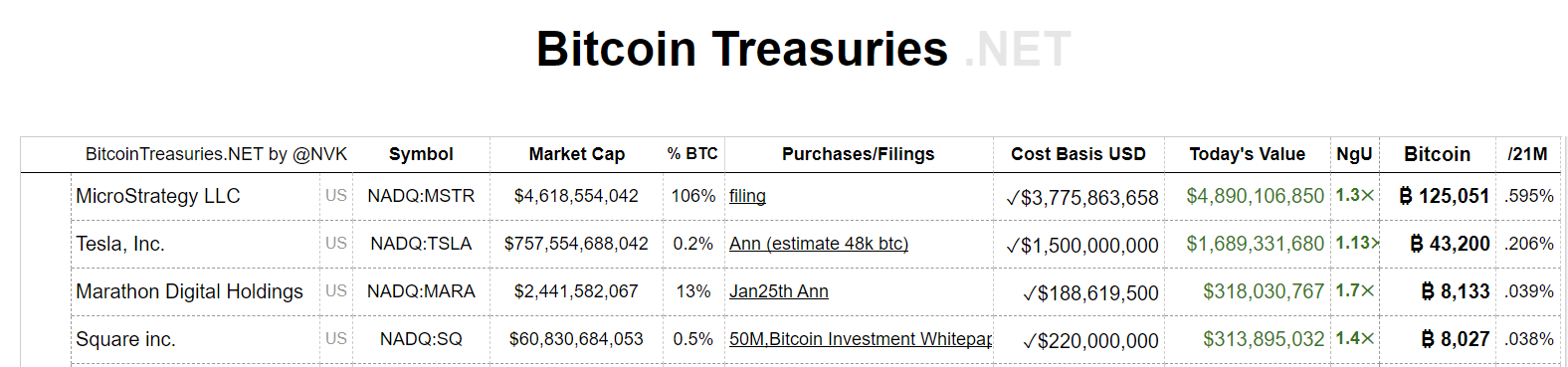

Veteran investors like Ray Dalio and Paul Tudor Jones have been increasing their allocation in Bitcoin and crypto for years, partly due to inflation concerns. They are joined by visionaries and tech entrepreneurs like MicroStrategy’s Michael Saylor, whose company owns 125,000 BTC; and former Twitter CEO Jack Dorsey.

In October last year, Dorsey warned that hyperinflation will change ‘everything’ and that it will be experienced in the United States soon, and ultimately across the entire world.

Bitcoin exchanges hands at $39,160 at the time of writing. The crypto briefly spoofed $40,280 (Bitfinex) when US CPI data figures were released on Thursday.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!