New data from on-chain analytics platform Glassnode indicates that investors are increasingly confident in their Bitcoin investment, with a key metric reaching a historically significant high value area.

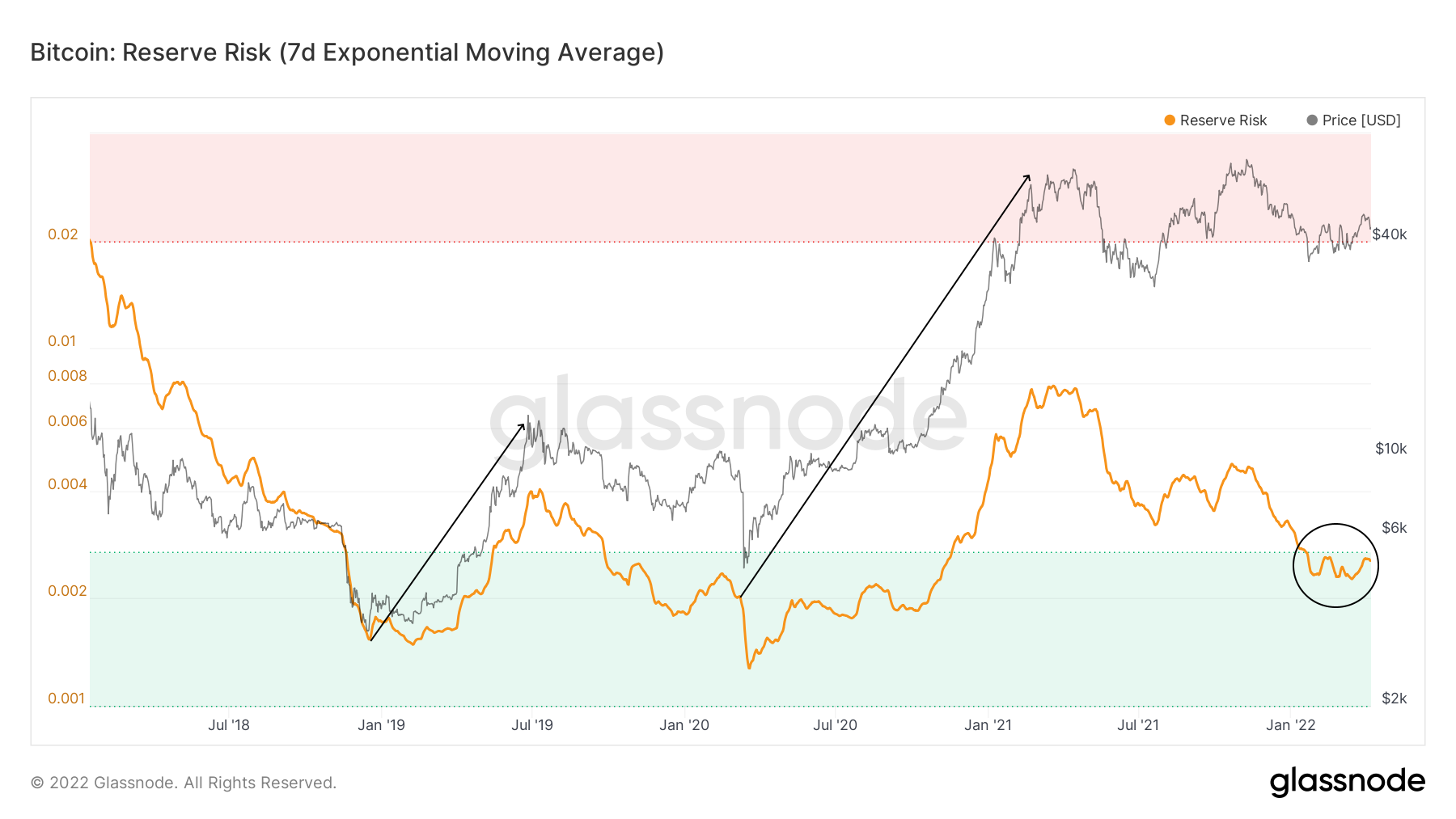

Reserve Risk is defined as the price / HODL Bank. It is used to assess the confidence of long-term holders relative to the price of the native coin at a given point in time. A Reserve Risk ratio below 0.007 indicates high investor confidence and low relative prices. Conversely, a high ratio above 0.02 suggests low investor confidence and high relative prices.

Since the first $64,000 peak in April 2021, Bitcoin’s Reserve Risk (7-day EMA) started to trend lower as confidence in the asset waned relative to the price.

The trend continued for the remainder of the year until January 2022, when the metric entered a high value area.

Historically, the lower the Reserve Risk, the higher the likelihood that Bitcoin has bottomed and is in a process of accumulation.

In other words, the indicator shows that Bitcoin is an attractive investment on balance at current prices ($43,500).

Cryptocurrencies aren’t going away. Buy Bitcoin & Litecoin here.

Realised P/Ls Reset

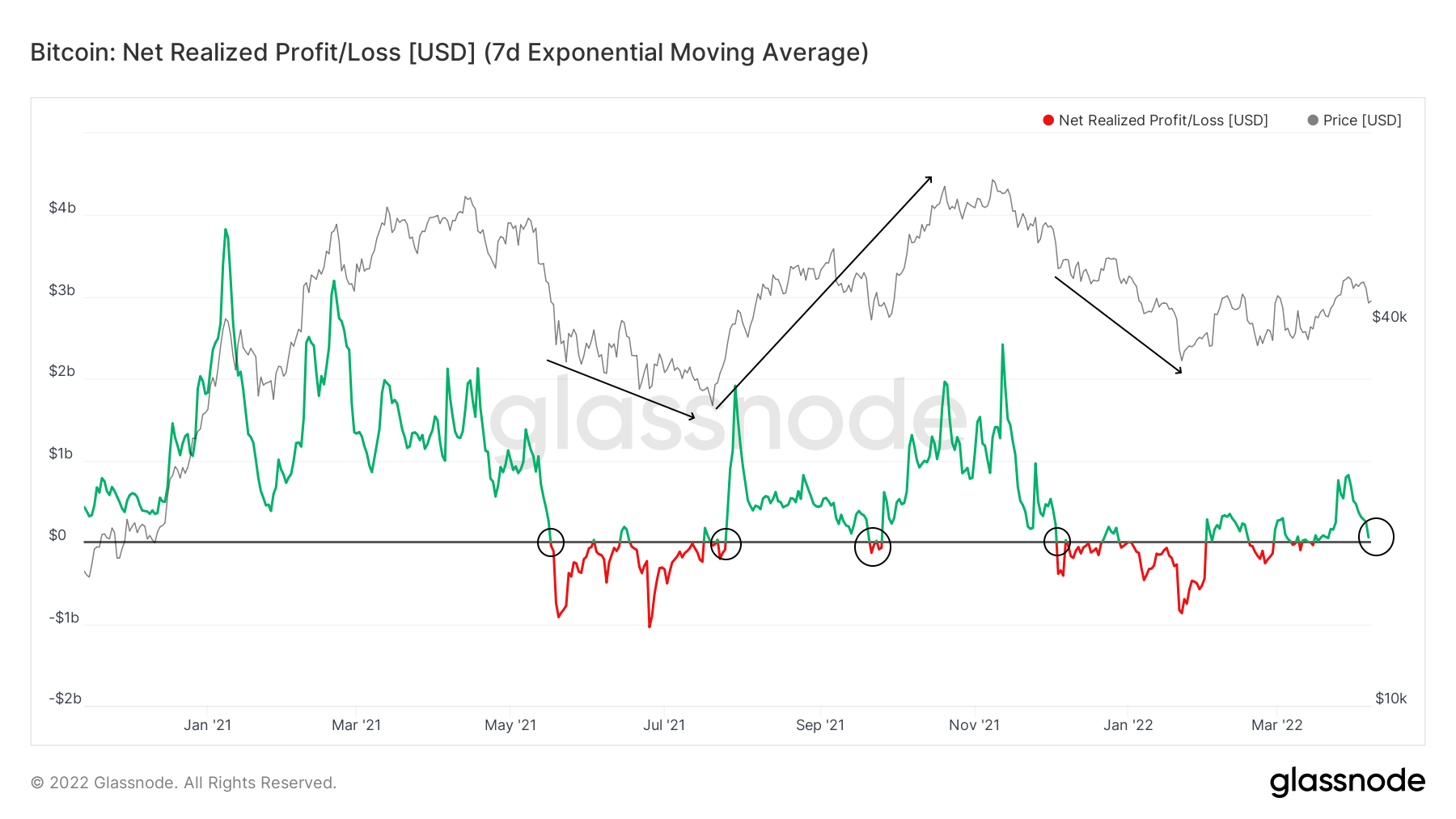

On Wednesday, the crypto market witnessed its third largest derivatives-led liquidation event this year, registering over $400 million in long-liquidations.

The slide in prices caused the ratio of realised profits and losses to reset as coins were forcibly moved.

In trending markets, Bitcoin’s net realised profit/loss (7-day EMA) tends to periodically reset to $0 before resuming direction. Should prices continue to slide, the ratio would enter negative territory, showing that investors are at a net loss in a seller’s market. But with high investor confidence in the asset, market conditions are more favourable for buyers than sellers.

The fresh data comes in conjunction with various confluent data points which suggest robust investor confidence in Bitcoin.

Bitcoin exchanges hands at $43,500 at the time of writing.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!