Litecoin, now recognised as a digital commodity by the US Commodities Futures Trading Commission (CFTC), set a hashrate all-time high on March 27th, 2023 at block height 2,446,369.

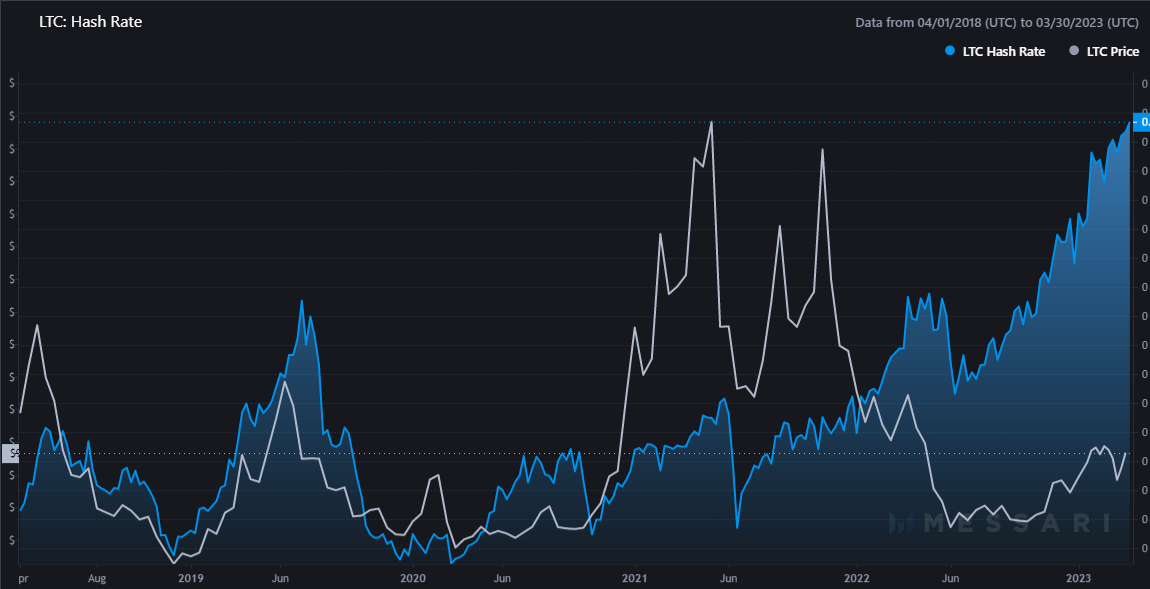

The cryptocurrency’s hashrate has witnessed a steep, near-linear growth trajectory since June 13th, 2022, when LTC/USD bottomed out at $40.

In the months leading up to May 2022, the Litecoin network went through a rocky period of consolidation as the crypto sector reeled from the Luna-foundation implosion, which battered markets to the brink of extinction. The US SEC and other regulators have since levied charges of fraud against Luna’s Do Kwon, who was recently arrested in Montenegro on March 23rd.

Despite bad actors and bouts of financial fraud in 2022, Litecoin’s hashrate has technically been on a relentless uptrend since June 2021, per Messari data.

Litecoin’s hashrate is measured in hashes per second (H/s). The calculation uses current mining difficulty and the average LTC block time between mined blocks versus the the defined block time as variables to determine the global network hashrate. The hashrate is an important metric for assessing network security and strength. The more machines dedicated to discovering the next block, the higher the hashrate rises and the harder it becomes for malicious agents to disrupt the network.

Historically, price tends to follow hashing power when it comes to proof-of-work blockchains. As of March 27th, the discrepancy between prices and Litecoin’s hashrate continues to widen, presenting a potential opportunity for crypto-savvy investors to pick low-hanging-fruit before others notice.

The CFTC’s decision to classify Litecoin as a digital commodity in a recent lawsuit certainly provides greater clarity for investors looking to participate in the crypto market. Admittedly, ETH’s classification is less clear given its pre-sale distributions.

The Litecoin halving

One reason for soaring hashing power could be due to the network’s halving event, which is expected to take place in August. In 2023, Litecoin will be experiencing its third halving event, undergoing a 50% reduction in the amount of newly minted Litecoin. Presently, 12.5 LTC are issued every 2.5 minutes, on average. After the halving, the 12.5 will be reduced to 6.25 Litecoin.

The historic event takes place every four years until there is no more LTC left to mine. This feature is engrained into Litecoin’s code, or put in traditional finance-speak, the coin’s monetary policy. Unlike proof-of-stake networks such as Ethereum and Cardano, which can easily change their monetary policy like the US Federal Reserve or the ECB, the Litecoin network (PoW) is highly resistant to changes. This is a feature not a bug.

The four-year halving cycles for Bitcoin and Litecoin demonstrate that there is a way to have automated, consistent, and transparent monetary policy at a protocol level. Fudging the numbers is neither necessary nor beneficial.

During uncertain global economic times such as the current economic climate, one thing is definite – Litecoin’s halving schedule is set in stone, and it will instantly become harder to obtain more Litecoin by late August this year. Presently, about 71.5 million Litecoin out of the total 84 million have been mined (85% of the maximum supply), with the remaining 15% being distributed at a slower pace over the coming decades.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!