Global debt increased by $10 trillion in the first six months of 2023 to $307 trillion, despite rising interest rates which have damped credit markets.

As reported by the Institute of International Finance (IIF), a financial consortium representing many global banks, over the last decade global debt increased by a “staggering” $100 trillion.

Notably, over 22% of all Dollars in circulation came into existence in 2020, following the global false alarm often referred to as the corona-virus pandemic. Debt has continued its upward trajectory as a fraction of global gross domestic product (GDP), increasing from 336% at the end of 2022 to an anticipated 337% by the year’s end, after climbing from 334%.

The uptick has been attributed to budget deficits, sluggish economic growth, and somewhat decelerating inflation due to excessive money creation. IIF Director Emre Tiftik wrote in a report:

The sudden rise in inflation was the main factor behind the sharp decline in debt ratio over the past two years, allowing many sovereigns and corporates to inflate away their local currency.

In the first half of 2023, advanced economies attained the lowest level of household debt as a share of GDP in two decades, said the IIF, a positive data point in the report. It adds that if inflationary pressures continue in these markets the “health of household balance sheets, particularly in the US, would provide a cushion against further rate hikes.”

Reportedly, these economies account for 80% of the increase in global debt, with the US seeing its debt surge beyond the $33 trillion mark. Many large economies have registered debt increases, including BRICS nations such as China, India and Brazil, for instance. Global debt has been growing even as central banks raise interest rates to ameliorate the accelerating monetary debasement they drove in 2020.

The Federal Reserve has raised rates by more than 5% over the last 18 months, yet the term ‘higher for longer’ has been used extensively as economic stressors continue to mount.

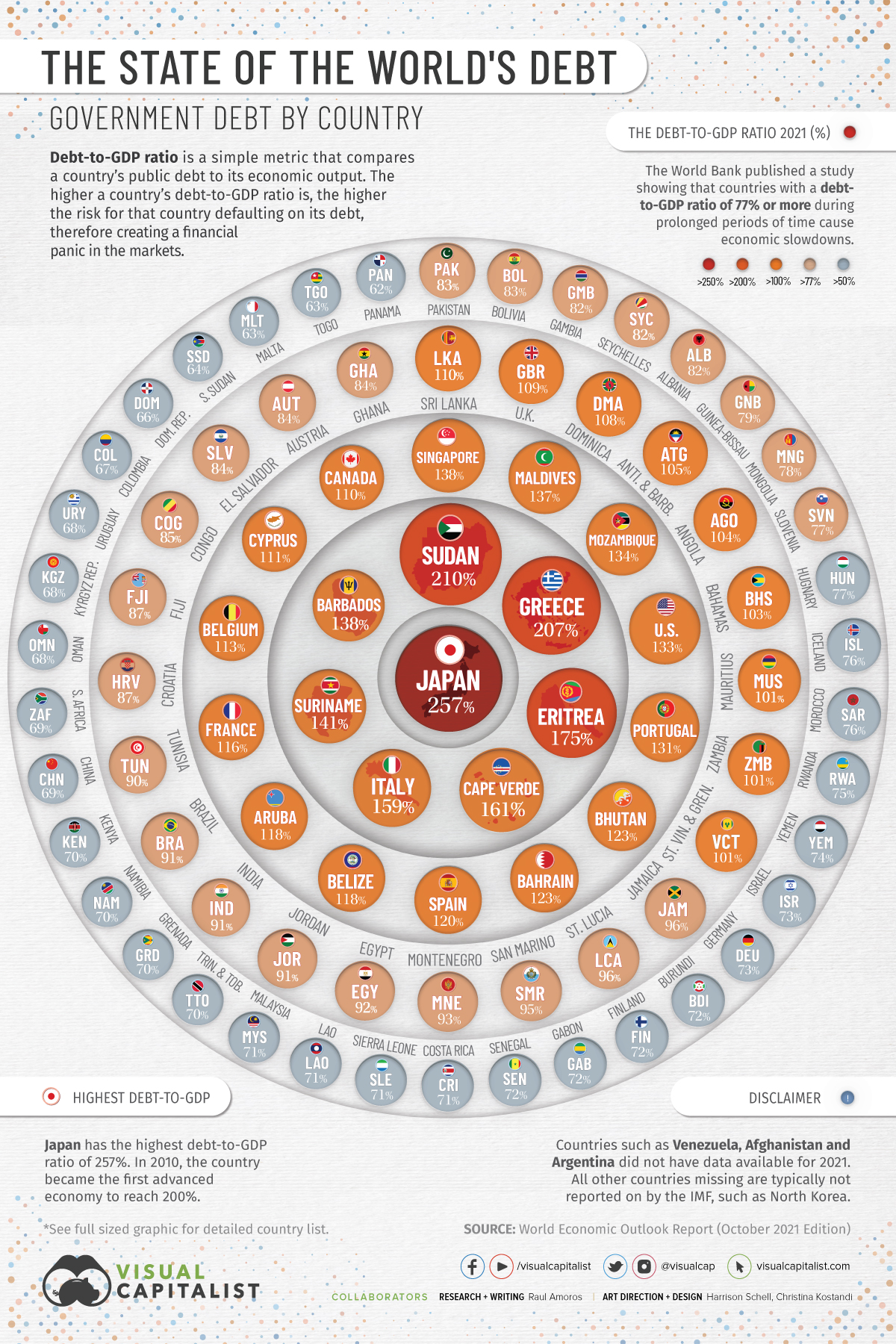

According to the report, government debt levels are “at alarming rates in many countries,” as the “global financial architecture is not adequately prepared to manage risks associated with strains in domestic debt markets.”

Did you like the article? Share it!