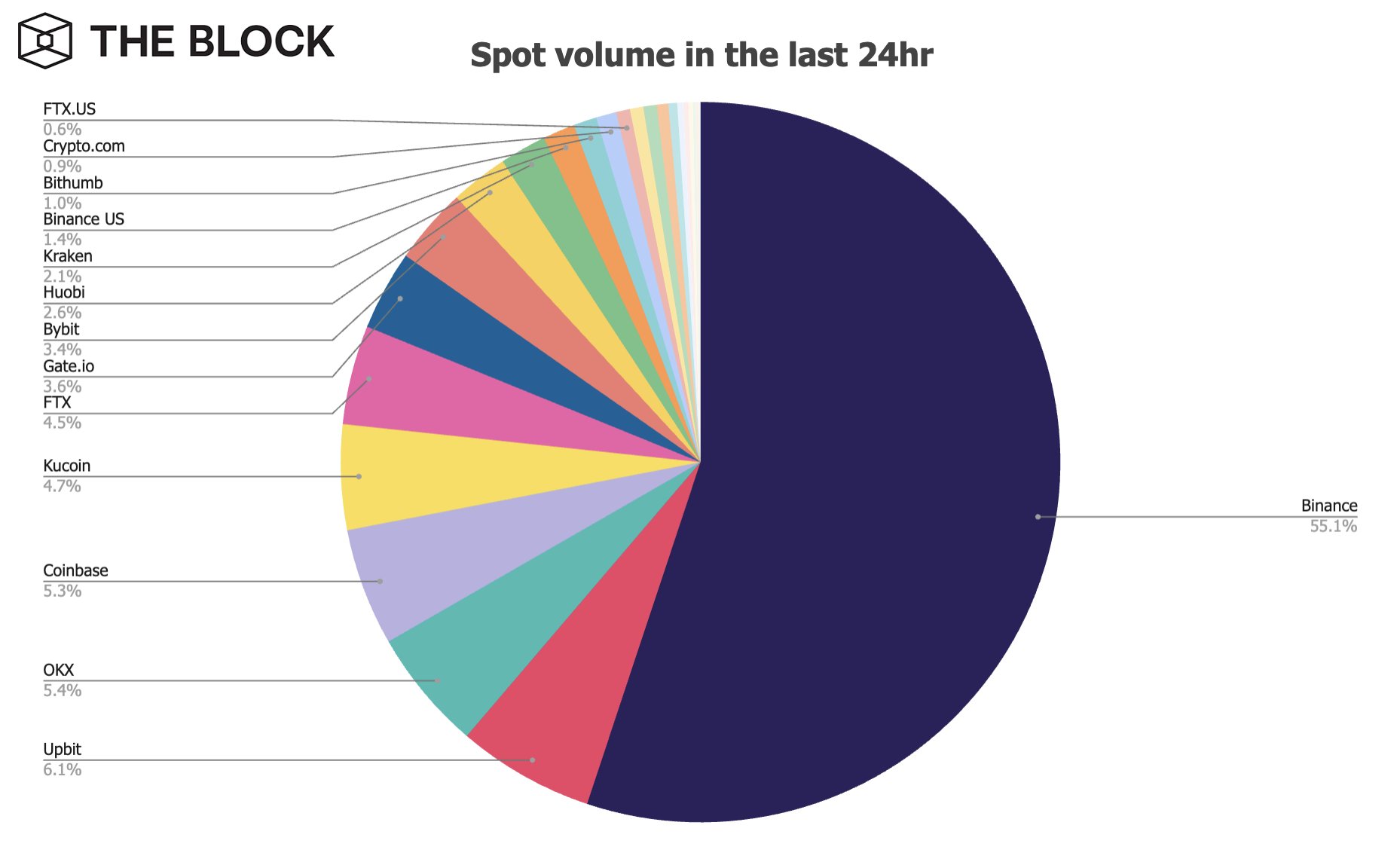

Fresh data from The Block shows that centralised crypto exchange Binance has tentatively secured the lion’s share of volumes in the crypto exchange sector, dominating both spot and derivative trading volumes.

In brief

- Binance accounted for more than 55% of the spot crypto market over the last 24 hours.

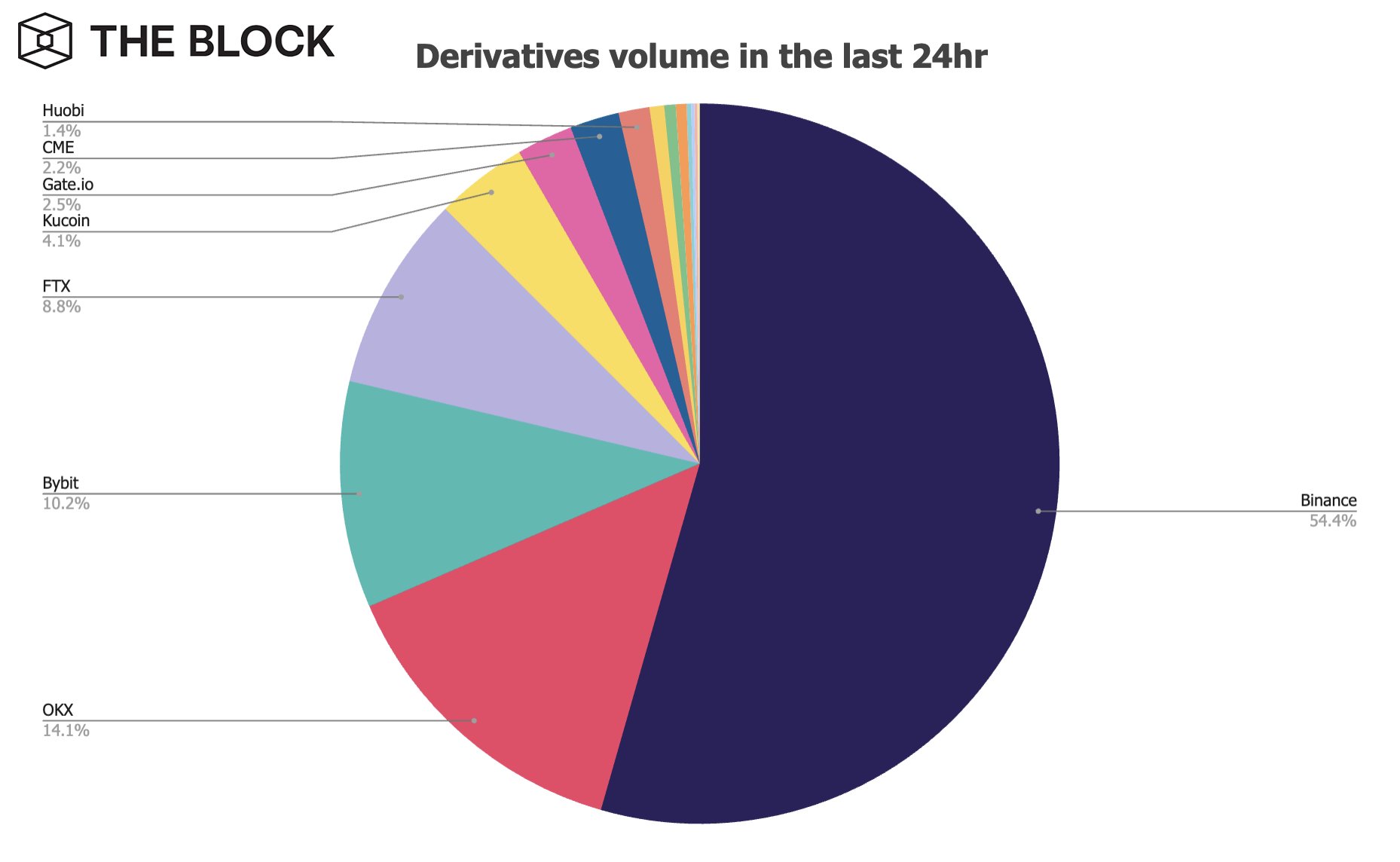

- The exchange also claimed a high percentage of the derivatives crypto market.

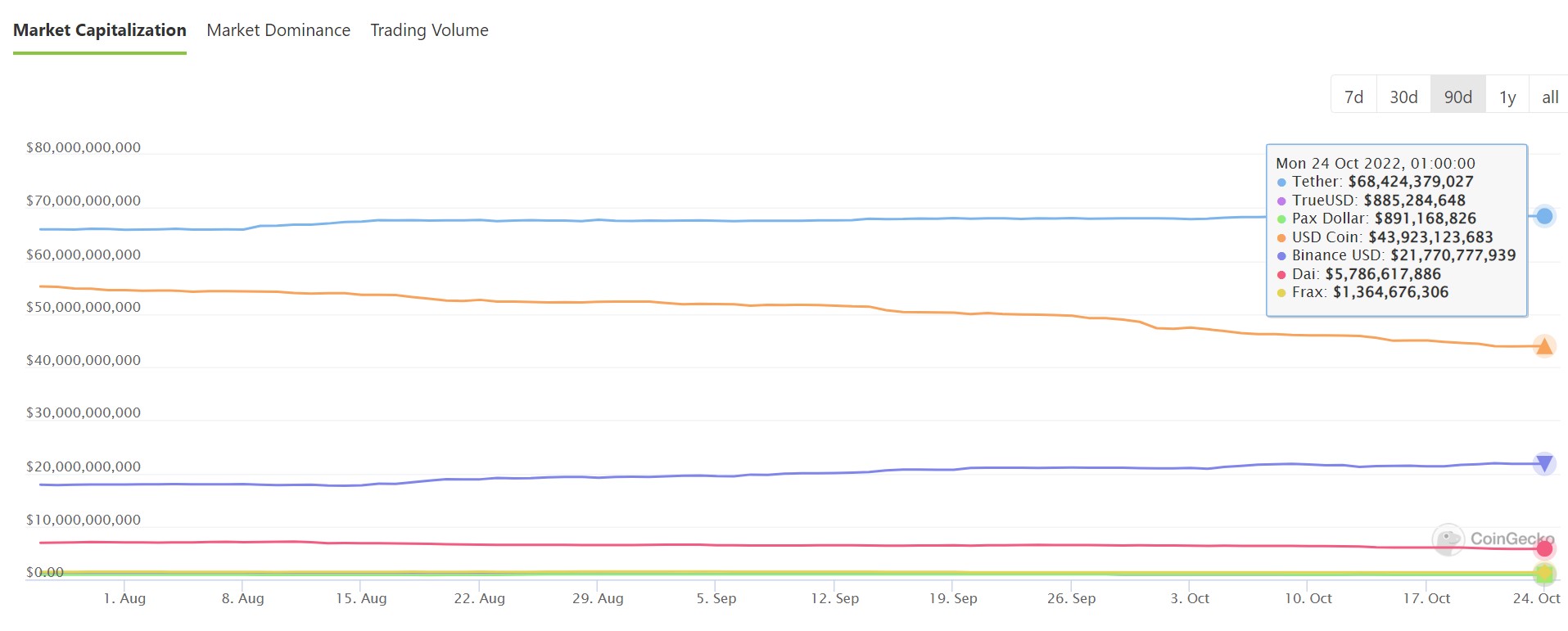

- BUSD stablecoin is gaining traction as USDC loses market share. USDT is the most widely adopted stablecoin.

- Binance has solidified regulatory inroads into Europe recently.

Cryptocurrencies aren’t going away. Buy Bitcoin & Litecoin here.

Per research from The Block, a period of 24 hours, Binance achieved over 55% of spot volume for exchanges. Three exchanged accounted for over 5% – Upbit (6.1%), OKX (5.4%) and Coinbase (5.3%) — while Kucoin and FTX accounted for 4.7% and 4.5%, respectively.

Binance US overtook FTX.US, garnering 1.4% of the total volume as opposed to FTX’s 0.6%.

Notably, the trend remains consistent across crypto derivatives trading, with the exchange attaining a similarly high 54.4% of volumes in 24 hours.

The difference on the derivatives front comes down to fee structure over other exchanges. OKX holds claim to the second highest derivatives volume at just over 14%, while Bybit stands at 10.2%. FTX has 8.8% market share.

Binance current market dominance in terms of buying and selling coincides with its relative growing strength in the stablecoin sector. The supply share of Binance USD (BUSD) in the stablecoin market

Stablecoin gyrations

Binance’s apparent dominance on the volume front coincides with increasing market share in the stablecoin sector. The supply share of Binance USD (BUSD) in the overall stablecoin market has increased, especially over Circle’s USDC which is losing market share following its axing via conversion on Binance last month.

USD Tether remains the most widely adopted and used stablecoin, however, with no signs of slowing down.

In September, JPMorgan underlined that USD Tether will remain structurally important in all cryptocurrency trading.

Tether’s importance is not only confined to its market cap share in the stablecoin universe but also depends on its usage, in particular in trading.

Still, Binance has continued to carve out regulatory inroads into Europe. Last Thursday, the exchange revealed it acquired regulatory approval in Cyprus as a Crypto Asset Services Provider. Previously, it gained regulatory approval in three other European countries — France, Italy and Spain. Binance also gained regulatory approval in New Zealand, opening an office earlier in October.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!