In stark contrast to the endless swaths of ‘flash in the pan’ meme coins, empty promises and blockchains that do not work, Litecoin transaction volumes have been on a steady incline according to new data.

In a post on X, the director at non-profit Litecoin Foundation, Jay Mila, discussed on-chain activity growth witnessed on the network, per data from intotheblockdata.

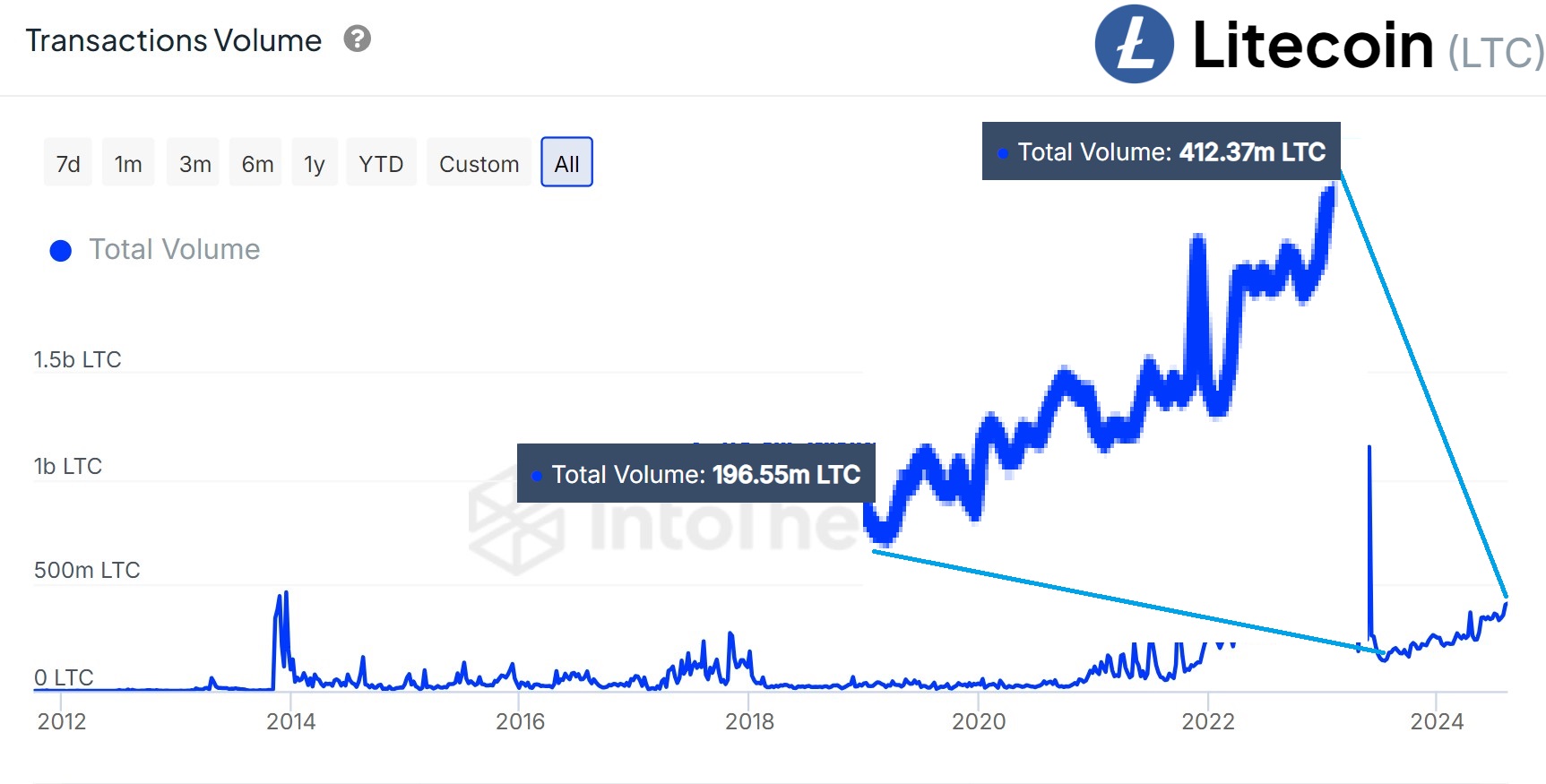

Specifically, transaction volumes, which keep track of the total amount of LTC involved in transfers, has trended up and to the right since late 2020, accelerating higher after 2023 into 2024.

Per the above data, Litecoin transactions rested at around 196.55 million 12 months ago. That figure has increased to 412.37 million LTC in August 2024.

The jump in network finds confluence with a number of fundamental indicators, namely the YoY percentage base-chain address growth relative to ETH and BTC, and Litecoin’s YoY MWEB-address growth, among other data points.

Good is bad; bad is good?

Despite the surge in activity and usage, however, Litecoin/Dollar has so far been unable to benefit from the positive price momentum one might expect, as was the case with Bitcoin.

The strange state of affairs has led onlookers and data analysts to suggest that well-capitalised whales might have an axe to grind against the OG cryptocurrency, and by extension, normal everyday users.

One X user listed a number of anomalies that may have precipitated Litecoin’s dollar weakness after the 2021 collapse, suggesting that Mike Novogratz’ Galaxy Digital is likely behind a large short position against the asset.

I put together a list of anomalies around LTC which lead me to believe there is the possibility some large and relatively powerful institution(s) in crypto are short ltc. Comment if I missed something bc this is off the top of my head and if you have any insight into these…

— Why Litecoin (@WLitecoin) August 13, 2024

Infamous for tattooing the now-defunct Terra Luna logo on his arm before its blowout and the subsequent daisy chain of fraud, culminating in the FTX-saga, Novogratz is no stranger to crypto drama.

In late 2021, the American businessman received no small amount of criticism when he told CNBC to replace the LTC ticker with SOL, a network with a rich history of pseudo-functionality.

As detailed in a viral reddit post on r/Cryptocurrency, besides having an off switch, the Solana blockchain is plagued with issues that simply shouldn’t exist in an industry that markets itself as the future of finance.

The damning list was compiled by an AI terminal using publicly available information and knowledge on Solana, detailing significant flaws that would leave even an exceedingly dim-witted orangutang scratching its head in disbelief.

Regardless, SOL/USD has increased 641% YoY. Conversely, LTC/USD is up 17% in that same time-frame.

Given the black on white information at hand, however, one can’t help but question how a blockchain that does not work, can’t keep the lights on, and is riddled with connections to the FTX-Fraud could truly be valued at $66.7 billion.

Moreover, the idea that any self-respecting investor, veteran or otherwise, ought to invest in what would have easily been described as vapourware pre-2020 is as absurd as asking a baboon to ponder all Shakespearean works, then recite them to you in Latin.

Incidentally, financial absurdity was a recurring theme and contributing factor to Bitcoin’s success. Perhaps the same state of affairs is necessary for Litecoin’s incoming success.

Buy, trade and exchange Litecoin on reviewed exchanges here.

Disclaimer: the content on this site should not be considered as investment advice. Investing is speculative. Your capital is your responsibility.