A day after announcing its lawsuit against Binance and its CEO CZ, the SEC filed an emergency motion to freeze digital assets held by the exchange’s US arm.

The Commission is seeking to freeze holdings of multiple BAM entities that operate Binance.US

SEC Requests to Freeze BAM assets “on an expedited basis”

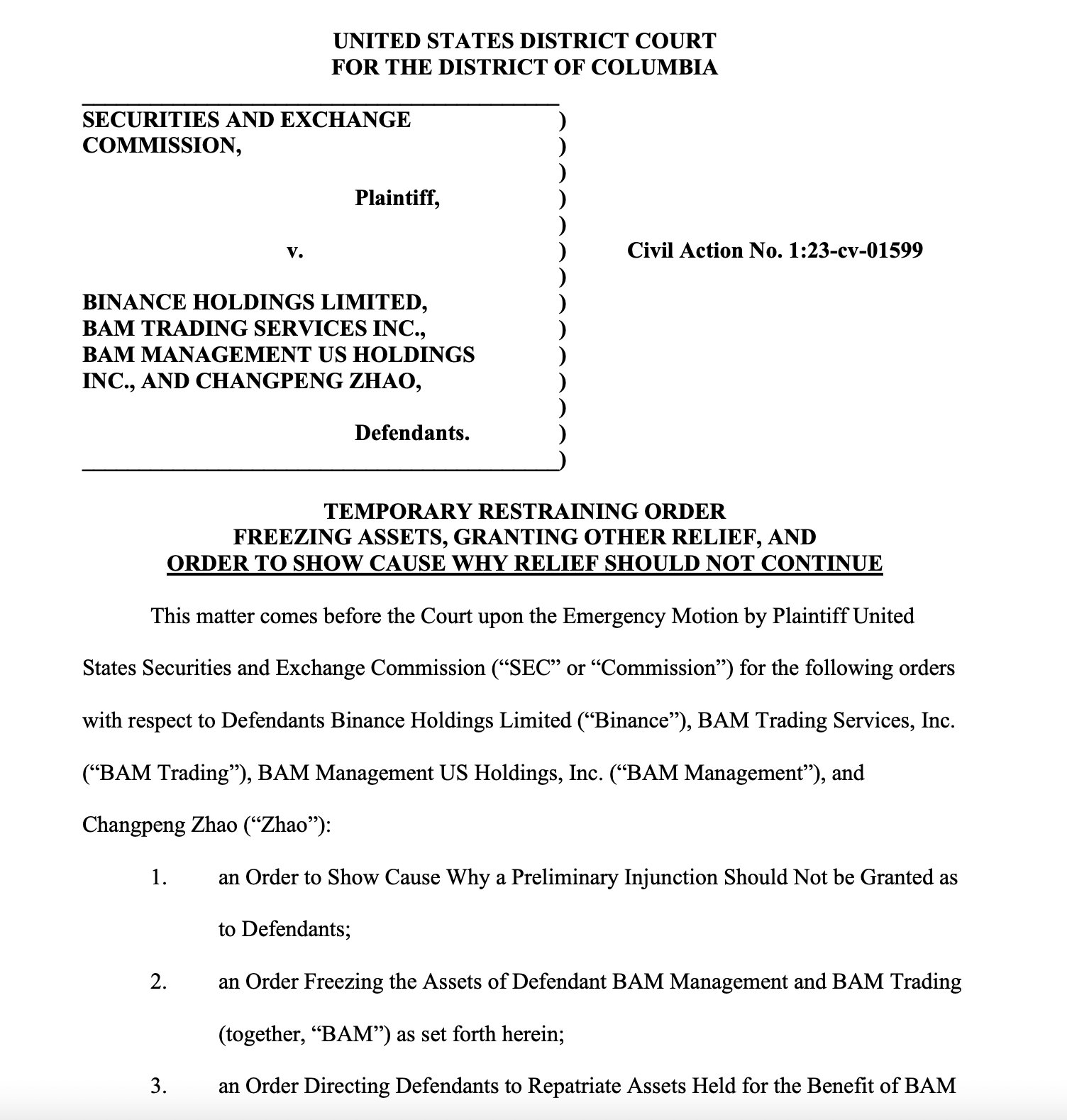

On June 6th, the Securities and Exchange Commission filed a motion to freeze the assets of BAM Management US Holdings Inc. and BAM Trading Services Inc. The two entities were sued a day prior along the exchange, as well as its CEO, Changpeng Zhao.

The complaint also revealed the intention to freeze assets held by Binance.US. According to the commission, freezing assets is necessary to achieve several goals:

(iv) prohibiting Defendants from destroying, altering, or concealing relevant records;

(v) requiring sworn accountings from Defendants;

(vi) ordering expedited discovery;

(vii) authorizing alternative means of service; and

(viii) ordering any other equitable relief necessary to protect investors and effectuate

the requested relief.

On top of that, the regulator states that the request was filed on an “expedited basis” to guarantee user asset security. The SEC justifies its request by describing Binance’s behaviour as volatile, evasive and without regard to US laws.

SEC files lawsuit against Binance and CZ

The expedited motion to freeze assets follows the SEC’s decision to take legal action against Binance and its founder CZ 24-hours prior. The lawsuit accuses the exchange of 13 accounts of wrongdoing, such as commingling users’ assets, wash trading, and offering unregistered securities.

Coinbase has also been caught in the crossfire, and faces another motion for the sale of so-called unregistered securities as well.

Prior to the SEC lawsuit, Binance has faced pressure from US regulators. In early 2023, the CFTC lodged its own complaint against the cryptocurrency exchange. Furthermore, in February, the company disclosed it anticipated financial penalties to resolve issues with US authorities.

Immediately after the lawsuit revelation, Binance wrote in a blog post that it intended to defend itself against the regulator’s claims.

Crypto community weighs in

The crypto community has been split on the matter. Bitcoin-focused influencer Gabor Gurbacs said the crackdown was predictable, since the industry failed to self-regulate.

I personally don’t agree with the SEC’s regulatory approach on digital assets, but I also think that the scams, scammers and BS need to go. The “industry” failed to cleanse itself from the inside out (self-regulation), now regulators are stepping in. It was predictable.

— Gabor Gurbacs (@gaborgurbacs) June 6, 2023

OG Bitcoiner Samson Mow, known for his work on nation-state adoption of Bitcoin, called on the crypto community to ‘cease decentralisation theatre’.

The Crypto people are right. Now is the time for us to stand together.

First they need to sell their shitcoins, cease the decentralization theatre, and stop enabling outright scams.#Bitcoin only.

— Samson Mow (@Excellion) June 6, 2023

Prominent figures on the other side of the pond, including Justin Sun and Charles Hoskinson were critical of the regulators’ lawsuits. Hoskinson assessed the move as “the next in a series of steps to implement chokepoint 2.0”.

According to Messari founder Ryan Selkis, Gary Gensler is not fit for purpose. He says that under Gary Gensler, the SEC has:

FAILED to catch FTX ($8bn fraud & bankruptcy)

FAILED to protect Grayscale investors ($8bn impairment)

FAILED to protect Voyager, Genesis, BlockFi borrowers ($4bn+ bankruptcies)

It’s not that he’s mean, it’s that Gensler is an incompetent, crooked cop.

Regulators in the US and in the European Union have been on a crusade against the cryptocurrency space amidst a deepening financial crisis, and the looming launch of CBDCs. The frictions can be vaguely outlined as both internal and external factions bearing down on the emerging crypto-financial system.

All in all, mountains of scams, most of which blew up in 2022, have left many wondering about the reason why most digital assets exist in the first place, if not to raise capital. One possible free-market workaround that does not involve regulatory overreach or promoting up and coming scammers could be a market-wide return to grass-roots cryptocurrencies, which include time-tested assets such as Bitcoin and Litecoin.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!