The unfolding financial crisis in the United States is accelerating, with fresh research indicating that nearly half of America’s 4,800 banks are “burning through their capital buffers’ to stay afloat.

Time is running out

US banking stocks are tumbling this week, picking up on a thread which began in March with the collapse of Silicon Valley Bank. The ongoing declines come in the wake of a regulatory seizure of the First Republic Bank by federal regulators on May 1.

Astonishingly, America’s largest bank, JP Morgan Chase, has taken on the bank’s assets and liabilities, and will service redemptions. But does JP Morgan have enough to fill the $229 billion hole if depositors request their funds?

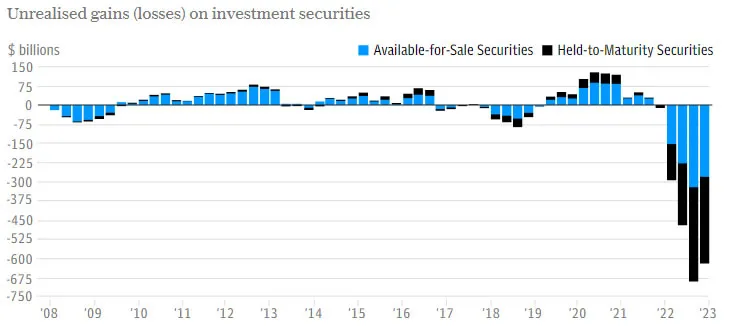

Crashes in US commercial real estate and the bond market “collided with $9 trillion uninsured deposits in the American banking system,” the report noted.

US financial crisis

University banking expert, Professor Amit Seru, told the UK’s Telegraph that thousands of banks are underwater, adding:

Let’s not pretend that this is just about Silicon Valley Bank and First Republic. A lot of the US banking system is potentially insolvent.

Published in April by Professor Seru, the report estimated that over 2,315 banks are sitting on assets that are worth less than their liabilities.

The US banking system’s market value of assets is $2.2 trillion lower than suggested by their book value of assets accounting for loan portfolios held to maturity.

A number of these lenders include America’s largest banks, and one was described as a “globally systemic entity with assets of over $1 trillion.”

On top of that, the Federal Reserve’s attempt at quantitative tightening hasn’t yet hit the economy, with many pundits predicting a recession is around the corner. The US’ massive wall of debt has been growing, with estimates placing total US debt at an eye-watering $31.7 trillion.

Rising debt-to-GDP

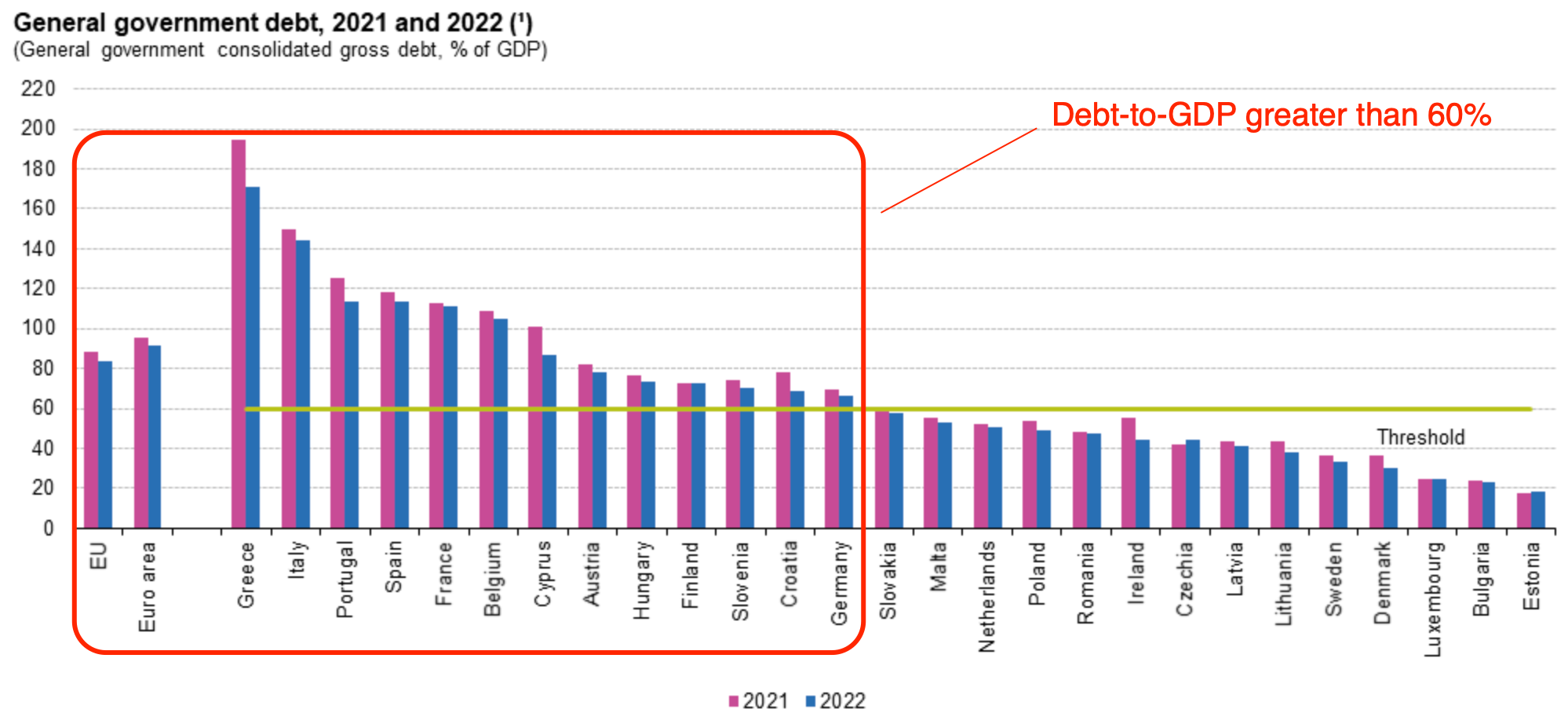

Fiat-standard countries have high debt-to-GDP ratios generally, with Japan and the US registering 250%, 107%, respectively. China, the US’ main competitor, has closed capital accounts so the regime’s figures (50.5%) must be taken with a grain of salt.

As noted by Swan Bitcoin’s lead analyst Sam Callahan, the EU’s debt-to-GDP levels have exceeded 60%. The Stability and Growth Pact of 1999 required that countries in the EU must keep debt-to-GDP levels below 60%. Slovakia and Malta (45%) are at relative par with the Netherlands, below the threshold as of 2022 data. But 48% of countries in the EU are well above the level.

Concurrently, the EU’s ‘common fiscal rules‘ proposal is an attempt to combat the rise in debt levels. However, these rules would centralise the EU economy under the European Central Bank. This would socialise risky financing practices and the ensuing losses through a centrally planned economy.

At the end of the day, global monetary conditions are downstream from US policy. Bitcoin emerged in response to the US banking meltdown of 2008, which caused a global financial crisis. Evidently, the irony that Bitcoin could be the financial parachute in this crisis is certainly not lost on traditional banks.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!