Money is so fundamental to human organisation that its origins trace back to pre-history. Indeed, the historical landscape is awash with different monies used throughout the ages for commerce and trade. And in a time of radical monetary upgrades, understanding money in its historical context (all be it brief) could not be more topical than today.

From humble beginnings preceding Graeco-Roman times, money fulfilled the role of being a medium of exchange, storing and measuring wealth. In essence, an agreed-upon ledger of sorts. Due to its fundamental nature, money existed before recorded history, and much of what’s known about the somewhat unknowable early days is mostly built on logical inference and conjecture.

In this brief history, we’ll delve into key stages of money up until the present day.

1. Barter and Commodity Money (Pre-Roman Times – 6th Century BC)

In the earliest stages of human civilisation, people engaged in barter, exchanging goods and services directly. However, this system was severely restricted due to economic phenomenon known as the ‘coincidence of wants’, i.e. bartering.

Under a bartering economic system, a person with a surplus of value such as excess grain or livestock, would swap it for something of similar or greater or equal value or utility, such as a clay pot or a tool. But problems quickly arise due to the improbability of wants and needs aligning, which would hinder a transaction.

Due to this friction, in-kind transactions were likely limited as they could only work when one party actually has the item, or is willing to make said item, that the other party is seeking.

In the absence of a medium of exchange, early people were continually faced with the ‘coincidence of wants’ problem.

2. Metal Coins (6th Century BC – Middle Ages)

In c. 350 BC, the Greek philosopher Aristotle contemplated the nature of money. He posited that every object has two use-cases: it’s intended purpose, and as an item to sell or barter.

Assigning monetary value to an object such as a gold/silver coin or promissory note (IOU) arises as people acquire the psychological capacity to place trust in each other, and an external authority in a barter exchange. Over time, convenience would dictate the terms of monetary transitions.

Commodity money preceded metallic coins, and involved objects that had intrinsic value. Ancient China, Africa and India used cowry shells. The Mesopotamian civilisation developed an economy using copper, and later silver coins (the Shekel). In the 7th century BC, coinage started to appear in the Aegean Sea (Greece-West Turkey), China and India; all of which were separate occurrences since these civilisations had no contact with one another. Coins were made of electrum, a natural alloy of gold and silver.

The concept quickly spread throughout the Aegean, Greece and the vast Persian Empire. In addition to facilitating commerce, troops were paid in silver coinage, which contributed to the Athenian Empire’s dominance in the 5th century BC. The concept of standardised coinage spread rapidly throughout the Mediterranean – through Greece and Rome, with various metals such as gold, silver and copper being used.

In the 4th century, a Roman temple dedicated to the Goddess Moneta (adopted from the Greeks), eventually came to contain the mint of Rome, which stood for centuries. Over time, the Goddess’ name became a primary source for several words in Latin, English and other languages, including the words “money” and “mint”.

3. Medieval Coins: Gold and Silver Standards (Medieval to Modern Times)

In 800 AD, emperor Charlemagne enacted a series of reforms which ushered in the issuance of a standard silver penny. By 1200 AD, monetary debasement in Western Europe due to rivalrous feudal lords and fiefdoms was becoming apparent to the public at large. By 1160 AD, coins from Venice only contained 0.05g of silver, while those coins minted in England had 1.3g. Larger coins came into production in the 13th century, with the England introducing the concept of ‘shillings’ and ‘pounds’.

Setting aside the great monetary debasement under King Henry the seventh in the 16th century, England’s coins were consistently minted from sterling silver (silver content of 92.5%). This was in contrast to coinage found in Barcelona, which had a 60% copper and 40% silver alloy mix, called the ‘Billion’. The rise of England, and the United Kingdom as an emerging and dominant global power could be linked to its superior monetary technology.

All in all, gold and silver became widely accepted as valuable metals, and their use as money persisted for centuries. Many civilisations, including the Byzantine Empire and the British Empire, adopted gold or silver standards, linking their currency to a fixed amount of these precious metals.

4. Paper Money and Banking (Middle Ages – 17th Century)

While paper money can be traced back to 11th Century China, and arguably ancient Egypt, it would be Marco Polo’s 13th century account of it that would bring ‘promissory notes’ to greater prominence and usage. With bills of exchange taking over large swathes of wholesale trade, European trade towards the end of the middle ages included a vast network of traded goods such as cloth, wool clothing, win, tin and a number of other commodities.

Goods were supplied to a buyer against a bill of exchange, which constituted a promise of payment for a specified date in the future. Provided that the buyer was reputable or endorsed by credible sources, the seller would present the bill to a merchant banker, who would then redeem the money in gold or silver coins at a discounted value before the due date. The idea was to circumvent a potentially perilous journey from town to town, with a bill of exchange being redeemable at the town’s bank.

As trade expanded to include the known world, lugging around vast quantities of metal coins on large ships became cumbersome. Safety precautions against banditry were also in demand, at which point the birth of modern banking and fiat money (money by decree) came into its own.

5. The Gold Standard (19th Century – Early 20th Century)

The Gold Standard came into effect in the United States at the turn of the century, where the value of the Dollar was directly tied to a fixed quantity of gold. Under the Gold Standard, the United States Treasury would be obliged to redeem Dollars in gold coins on demand. Before that, silver certificates and the ‘silver dollar’ had circulated as fiat currency, which was not redeemable for gold.

The law fixed one dollar at 25.8 grains of 90% pure gold, and coins contained a 10% copper alloy for durability. While a source for stability in international trade, monetary policy flexibility was limited, and the US would soon face the same dilemma that others before it had to contend with: debase the currency and put off an economic slump until a future date, or let the free-market work?

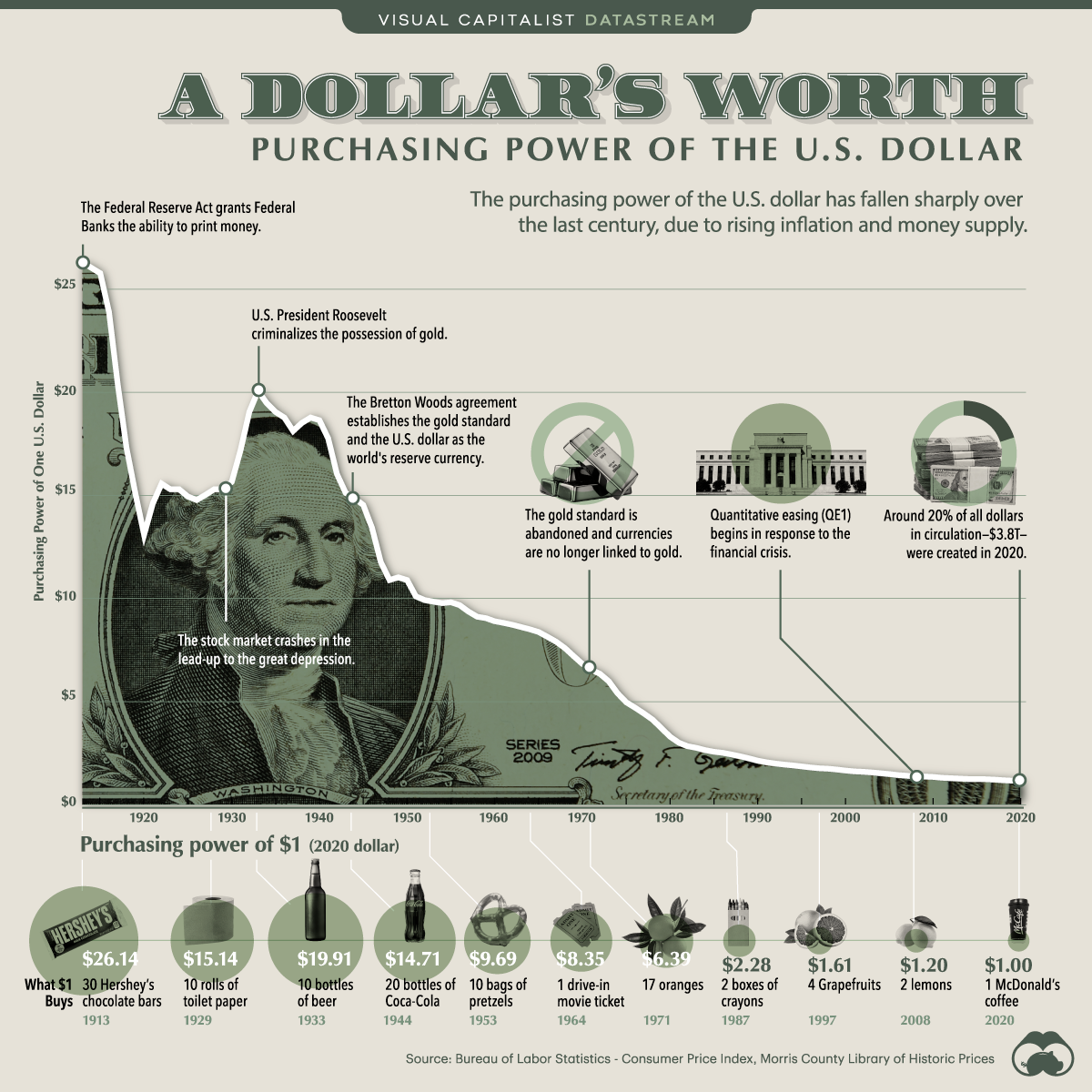

Following the great depression of 1933, the gold standard was replaced by the post-world-war two Bretton Woods system, which restored the ability of central banks to exchange United States dollars for gold at a fixed price.

This change and vast international cooperation set into motion radical monetary debasement of the US-Dollar, along with all fiat currencies since. Monetary debasement can only go on for so long without going unnoticed, however. Inflation accelerated to double-digits in many Western nations following trillions of Dollars in money printing, with 22% of the entire USD supply being printed that year alone.

6. The Rise of Cryptocurrencies (2009 – Present)

Following the great financial crisis in 2009, the anonymous figure known as Satoshi Nakamoto introduced the world to Bitcoin, the first viable decentralised digital currency built with a SHA-256 algorithm. Unlike fiat currencies, Bitcoin introduced a public ledger that required no central bank, treasury or intermediaries to facilitate transactions, instantly surpassing all monetary technological innovations before it from a technological standpoint.

Early adopters posited that Bitcoin’s scarcity of 21 million coins made it especially valuable since no other currency provided that level of provable and quasi-unalterable finality. However, one downside was Bitcoin’s slow transaction speed of 10 minutes. In 2011, former-Google engineer, Charlie Lee, launched Litecoin which aimed to be a Lite version of Bitcoin used for everyday transactions. Set with an 84 million-coin hard cap and faster transaction times (2.5 minutes), Litecoin mimicked the contemporary Gold-Silver exchange rate.

As Bitcoin acquired the status of digital gold over the years, so too did Litecoin acquire the status of digital silver, which you can read about here.

Following those early days, thousands of cryptocurrencies have attempted to iterate and improve on the Bitcoin whitepaper. This has resulted in a proliferation of monetary experiments, financial innovation and scams which are part and parcel with every innovation. In large part, the Bitcoin whitepaper was akin to lighting the fuse on a stick of dynamite neatly placed under a century-old fiat currency regime that’s probably reached its natural conclusion (the same as those before it).

However, a concurrent theme running throughout fiat monetary history isn’t so much the asset itself, but the ebbs and flows of trust, coupled with a high-stakes confidence game. By contrast, traditional hard assets such as gold, silver and other alloys and metals used throughout the ages required substantial energy expenditure in order to mine, refine and distribute them. In other words, it’s trust on one hand, and proof-of-work in the other.

With that brief history in mind, it’s worth contemplating where an interconnected planet will gravitate given these choices in light of their monetary historical contexts: does the next leap forward lie in fiat money, or in programmatically unalterable money?

Either way, it’s clear that from the early days of barter to the modern mishmash of currencies in existence today, monetary technology has rarely been static, if ever. On the contrary, this is a story of nuance, iterative processes and adaptations which change depending on the needs of society. Gold and silver – considered primary forms of money for millennia – are arguably inadequate for a digital age due to substantial technological pitfalls and payment limitations. Regardless, they are now joined by Bitcoin and Litecoin, and other contenders, which have ushered in a new era of financial possibilities, commerce, banking and peer-to-peer trade.

Did you like the article? Share it!