Grayscale Investments said the US Securities Exchange Commission has gone against its investor protection mandate, creating an uneven regulatory playing field for investors by approving futures-based ETFs while continuously denying spot Bitcoin ETFs.

The reiterated argument comes after the SEC announced its first legal brief in an ongoing lawsuit filed over questionable rejections of GBTC’s spot exchange-traded fund conversion.

In brief

- Grayscale Investments said the SEC has filed its first legal brief in the lawsuit the crypto asset manager filed over the rejection of its application for a spot bitcoin exchange-traded fund.

- In the 73-page response brief, the SEC argued its rejection was “reasonable, reasonably explained, supported by substantial evidence.”

- Per Grayscale, the SEC has put investors at unnecessary risk by disallowing the largest Bitcoin fund to upgrade its product offering based on an “extra-textual requirement that is not required for futures-based ETFs”.

In a company statement on Friday, Grayscale said:

This is the next milestone in our ongoing litigation following the filing of our opening brief on October 11 and the supporting amicus briefs shortly after.

In an October opening brief, Grayscale’s legal argument focused on an uneven application of the law, whereby regulators approved riskier Bitcoin futures products which are tied to spot market pricing, while denying Grayscale’s lower-risk conversion product. The SEC rejected Grayscale’s request to convert its flagship GBTC fund into an ETF in June, with the decision potentially harming 850,000 investors who own shares in the trust, per Grayscale.

In the 73-page response, the SEC argued its fact-free rejection was “reasonable, reasonably explained, supported by substantial evidence,” with “no inconsistency in the Commission’s disapproval of Grayscale’s spot ETP despite having approved two CME bitcoin futures ETPs.“

The SEC said futures and spot-based bitcoin funds are “fundamentally different products”. Futures ETFs include an array of intermediaries such as an ETF provider, clearing house, futures broker, administrator, auditor, law firms, the CME and hedge funds, all of whom would take advantage of the arbitrage opportunities. This brings the SEC’s motives into question.

Regulators directly responsible for destroying investor capital?

By doing so, the SEC funnelled investors into technically riskier financial products while encouraging growth of fraudulent institutions epitomised by the recent FTX exchange blowout, which defrauded billions of Dollars worth investor funds.

The SEC said its disapproval of Grayscale’s ETF proposal did not reflect an “impermissible, merits-based scepticism of bitcoin as an investment.”

The Commission previously approved ETPs that hold only futures contracts that trade on the CME, which is registered with the CFTC; those ETPs’ underlying assets are thus subject to robust surveillance. The bitcoin spot market, by contrast, is fragmented and unregulated, and petitioner presented no supportable basis to conclude that the CME’s surveillance of futures trading would sufficiently detect and deter fraud and manipulation targeting the bitcoin spot market and thereby protect against fraud and manipulation in Grayscale’s product.

In response to the SEC filing, Grayscale accused the SEC of “creating an uneven playing field for investors by approving Bitcoin futures-based ETFs, while continuously denying spot Bitcoin ETFs.“

The SEC unlawfully disapproved Grayscale’s proposal for a spot Bitcoin ETF based solely on an inability to satisfy an extra-textual requirement that is not required for futures-based ETFs. It’s fundamentally unfair and harmful to investors for the SEC to distinguish between these similar funds without articulating a sound basis for this decision.

The SEC’s mission is to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation. In denying Grayscale’s GBTC conversion proposal, the SEC is failing to fulfil its mission, particularly as it relates to the protection of investors.

“We look forward to reviewing the SEC’s reply brief,” the firm said, noting that its next brief is due Jan. 13 before the final briefs on Feb. 3.

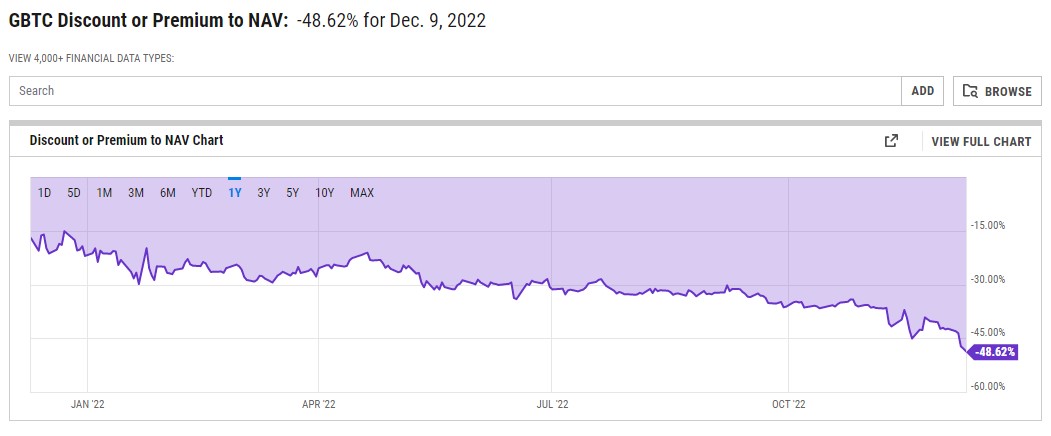

GBTC versus Bitcoin price hit an all-time low on Friday, with the discount ratio reaching 48.6%, per the latest data. The fund trades at a discount to the net asset value, as shares don’t grant the holder access to the underlying assets.

Recently, Coinbase affirmed that Grayscale assets are secure amid calls for the firm to reveal that its wallet holdings are backed 1:1. Questions as to which firms are ‘swimming naked’ in a high-interest-rate macro environment continue to circulate, with uncertainty gripping markets following a continuous stream of insolvencies and uncovered fraud of once-revered crypto firms.

Still, if the largest US regulated Bitcoin fund blows up, Gary Gensler and SEC regulators could be directly responsible for capital destruction, after having already gone out of their way to encourage capital flight into riskier products and untrustworthy exchanges like FTX. Alternatively, the SEC’s actions could be favourably described as negligence of their ‘investor protection’ mandate. Neither interpretation is desirable, and the consequences of such actions are unfolding in real time.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!