American Business-Intelligence company MicroStrategy acquired an additional 1.900 Bitcoin in December at an average price of $49,200, totaling at $94 million.

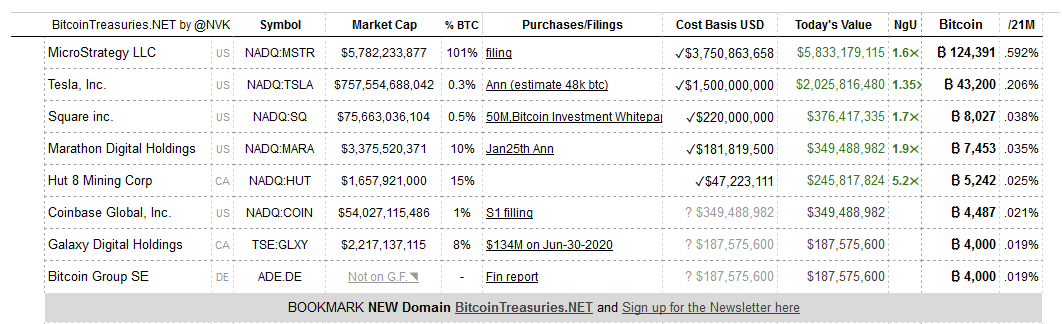

This brings the total number of bitcoin owned by the entrepreneurial company up to 124,391, acquired at an average price of $30,160.

The company has been highly vocal about bitcoin adoption, particularly as a corporate treasury reserve asset as a hedge against runaway inflation.

Cryptocurrencies aren’t going away. Buy Bitcoin here.

With this latest purchase, the company has spent $3.8 billion acquiring bitcoin since its initial purchases in August 2020.

The new purchases come shortly after the firm acquired another 7,000 bitcoin in November.

CEO Michael Saylor recently reiterated MicroStrategy’s intention to continue its strategy of buying and holding bitcoin.

We don’t wish to express a general opinion or take investment risk with regard to which platform, which application, and which use case of bitcoin will be most successful. We think that the least risky, most diversified investment strategy is to simply hold bitcoin.

Over the years, Bitcoin has increasingly become a crucial part of investment plans, having ended 2021 60% higher in Dollar terms. MSTR’s share price has unsurprisingly been correlated with bitcoin’s movements, rounding off the year with a 35% increase.

A Bitcoin-Litecoin future

Throughout 2021, Bitcoin and Litecoin fundamentals have seen continued strength and growth, with 90% of the total supply being mined as investment interest soared among both retail and traditional financial institutions.

The supply and demand dynamics may help push the coin towards the much anticipated $100,000 BTC price, which the El Salvadorian President has predicted will take place in the next 12 months. If reached, the total market capitalisation of bitcoin would be approximately $2 trillion – a mere drop in the ocean when compared to traditional indexes and markets.

As noted in the first newsletter analysis for 2022, Bitcoin is currently exchanging hands at pivotal on-chain levels.

If the crypto maintains its price trajectory, this would further cement its acceptance as a valid alternative to gold, and who knows what else come what May.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!