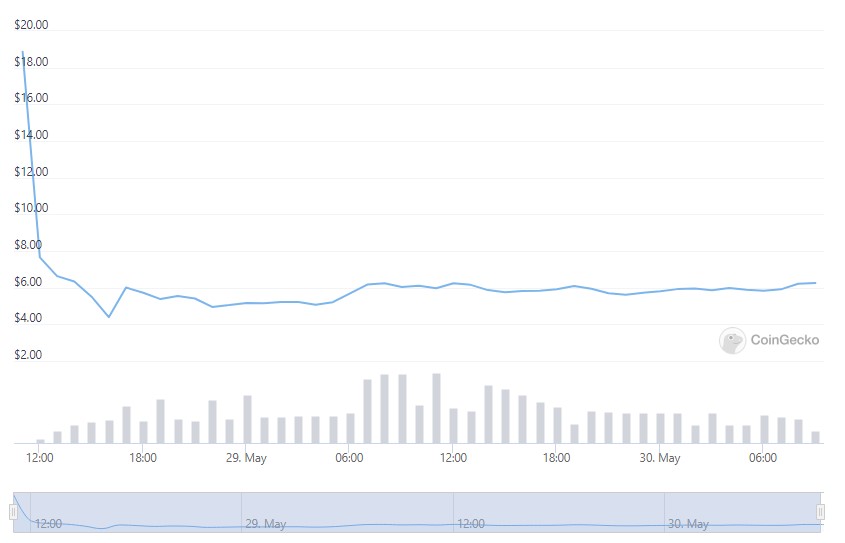

LUNA traded under $6 on Monday morning, after peaking at $18.9 following the launch of Terra 2.0 on Saturday. The rebranded coin lost over 70% of its value after the relaunch, suggesting an understandable lack of faith in Do Kwon‘s attempted revamp.

Bait and switch?

LUNA Classic (LUNC) and Terra Classic USD (USTC, formerly UST) holders were issued 70% of LUNA 2.0, with varying vesting options depending on the quantity and duration of holdings. Burned Luna investors on Twitter seemingly made light of the small portion of capital recovery, with “bait and switch” memes about the move going viral on crypto Twitter.

A brief introduction to $LUNA 2.0 pic.twitter.com/YmnbgL59n3

— Devchart 👨🏻💻 (@devchart) May 29, 2022

Following the devastating UST implosion, it remains to to be seen how Terra 2.0 will support itself without a native stablecoin (USTC), which may soon enter the extensive graveyard of “classic” blockchains.

Cryptocurrencies aren’t going away. Buy Bitcoin & Litecoin here.

Terraform Labs CEO Do Kwon’s proposal to create the new Terra 2.0 chain gained a 65.5% approval in a governance vote on Wednesday. In doing so, Do Kwon might hope to regain credibility by attempting to recover some of the lost investor funds following the ponzi-like destruction of up to $60 billion worth of tokens. The dragged out story has drawn comparisons between Do Kwon and Bernie Madoff’s ponzi implosion in 2009 on crypto Twitter.

In 2009, Bernie Madoff lost investors $60 billion. He was sentenced to 150 years in prison.

In 2022, Do Kwon lost investors $60 billion after Luna collapsed to $0. He then created Luna 2.0. pic.twitter.com/CkCC8AKPVR

— Fintwit (@fintwit_news) May 29, 2022

LUNA 2.0 is currently traded on exchanges such as Kraken, Huobi, and Bybit, while the world’s largest exchange Binance has listed LUNA on a separate trading zone for new tokens with higher risks and volatility.

Look before you leap?

The TerraLuna saga draws attention to the fragility of trust in an emerging space rife with innovation, scams, technology and bugs. The mixed bag and outsized potential profits and losses compared to traditional markets come part and parcel with the chaotic nature of innovation. Regardless, the industry’s failure to properly self-regulate has provided a decade’s worth of ammunition for regulators to clamp down on the space.

The silver lining is that investors may start to look towards projects with a robust value proposition and fundamentals. Such events tend to mark a turning point within the ebbs and flows of market psychology and participation, highlighting the timeless adage to look before you leap, and to research before you ape.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!