According to data from IntoTheBlock, Litecoin adoption has been taking significant strides when it comes to year-on-year total address growth.

The cryptocurrency boasts a remarkable 44.6% growth in total addresses compared to the same period last year, outpacing both Bitcoin and Ethereum which saw 15.3% and 13.8% growth, respectively. This impressive surge comes amidst a strong demand for LTC among users, as well as increasing adoption by merchants and businesses.

This notable uptick in users highlights Litecoin’s appeal as an accessible and reliable cryptocurrency with comparatively miniscule transaction fees. Indeed, with its faster processing times and low fees, Litecoin has managed to capture the attention of both retail and institutional investors alike.

As more users join the LTC ecosystem, this growth is likely to continue, bolstering Litecoin’s value proposition within the cryptocurrency market.

The digital commodity’s growth in user wallet adoption is particularly noteworthy, as it demonstrates demand for the cryptocurrency among retail investors. As more users buy, store and use LTC, the resulting demand and supply shock due to latent halving effects could lead to significant price appreciation for the asset, as was the case with Bitcoin in its formative years.

Furthermore, Litecoin’s ability to attract new users highlights its appeal as a decentralised, accessible and reliable digital commodity and means of payment.

Institutional Litecoin Adoption Gains Momentum with Fidelity product

In a recent development, Fidelity Investments announced the addition of Litecoin (LTC) to its crypto offerings. This significant move highlights the growing institutional interest in Litecoin and its increasing adoption within the mainstream financial sector. As a leading asset management firm with over $3 trillion in client assets, Fidelity’s decision to include LTC is a testament to the cryptocurrency’s time-tested legitimacy.

JUST IN: Financial powerhouse @Fidelity, publish a new dedicated report from their @DigitalAssets division.. “An overview of #Litecoin and its use cases” pic.twitter.com/TlfW4hZk8W

— Litecoin (@litecoin) July 17, 2024

The inclusion of Litecoin in Fidelity’s portfolio is expected to attract more institutional investors to the cryptocurrency market, further driving up demand and potentially leading to increased price appreciation.

This development comes as part of a broader trend toward greater institutional adoption of cryptocurrencies, with more financial institutions recognizing the potential benefits of diversifying their portfolios with digital assets.

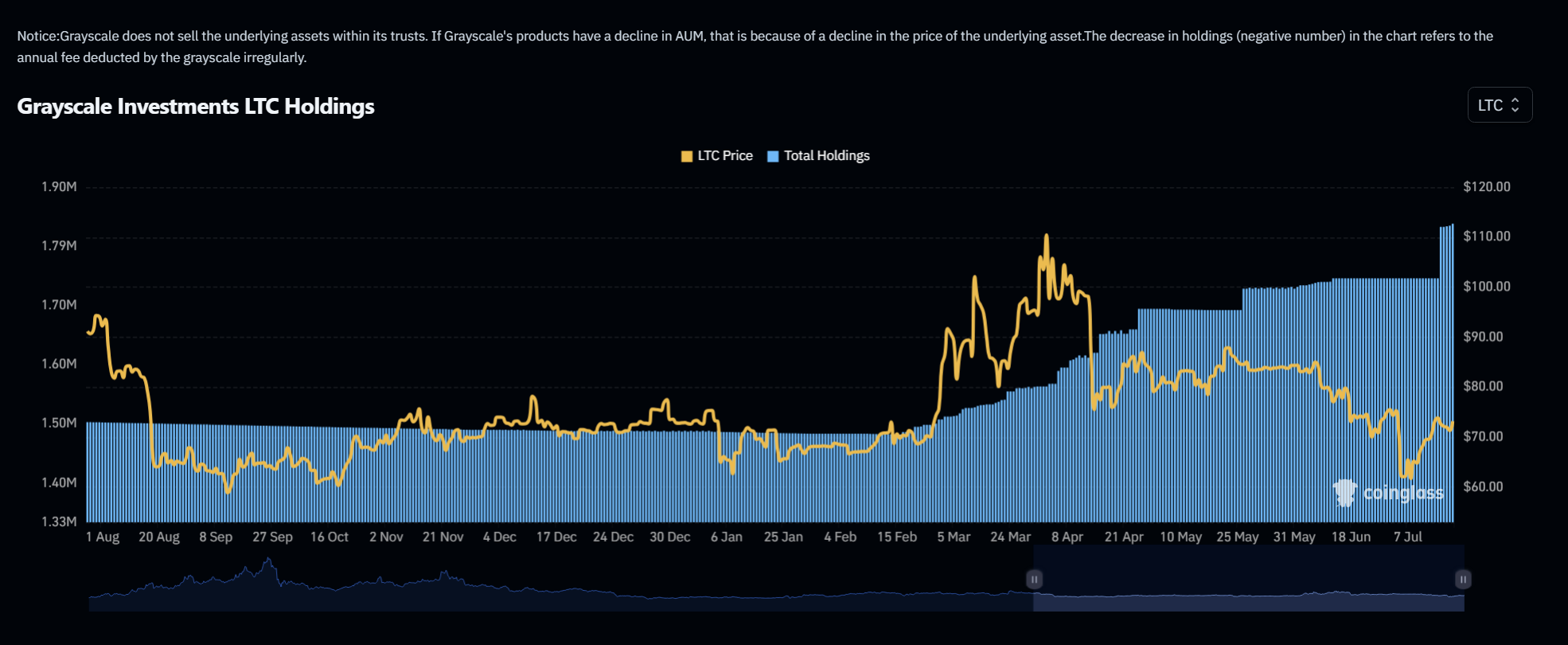

Beyond that, data from Coinglass also shows Grayscale investment product holdings (LTCN) rising over a 12-month period, and accelerating higher into July.

Accumulation ticked higher on July 17th, when investors added another 80,000 coins. Since Nov. 2020, Grayscale investors have increased their holdings from about 600,000 LTC to nearly 1.9 million coins, or about 2.3% of the total LTC supply.

As Litecoin continues to gain traction on both a retail front and within the financial sector, it is likely that more institutions will follow Fidelity’s lead and add LTC to their portfolios, further driving up Litecoin adoption.

Disclaimer: the content on this site should not be considered as investment advice. Investing is speculative. Your capital is your responsibility.