The premium rate for Grayscale’s Litecoin Trust (LTCN) has climbed to 150% following a sustained positive market shift first confirmed in November 2023; a harbinger of things to come.

Litecoin’s secondary market price rose to $17 per share on Wednesday, Feb. 14, just 9% shy of the local high hit on Jan. 2nd, according to Coinglass data.

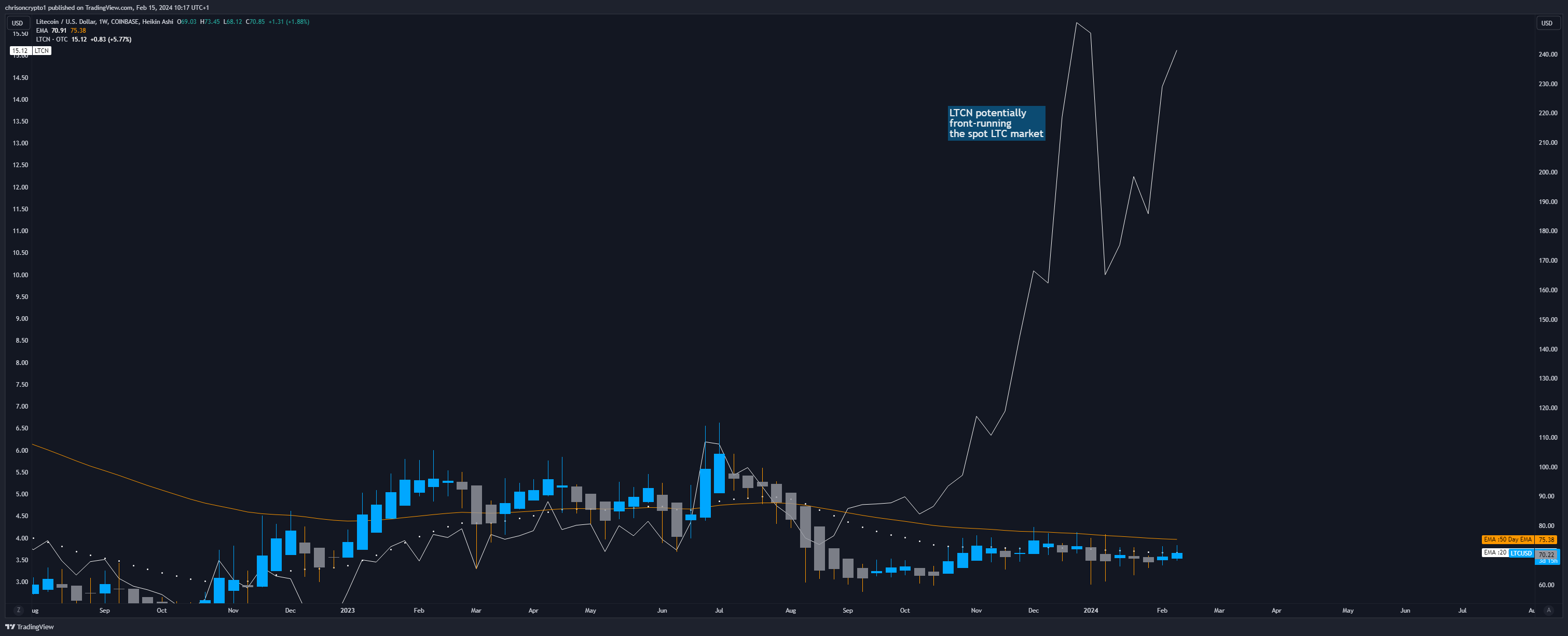

Following the LTCN market turnaround in early November 2023, a secondary bullish signal fired in mid January, with highly-watched moving averages painting a golden-cross on the weekly timeframe. A golden cross suggests a long-term bull market moving forward, while a death cross suggests a long-term bear market. In Litecoin’s case, institutional markets appear to be front-running the spot-market price, which has yet to experience said golden-cross.

In other words, Litecoin’s spot market price is lagging institutional investment flows. Today, LTC trades at $70.2, while LTCN trades at $15 (around $171). Last month, LTCN exchanged hands at $18, equating to around $205 per coin. In November 2020, LTCN exchanged hands at $510; that’s about $5,814 per coin, potentially.

Bearing in mind the above positive weekly market shift, as well incoming institutional products for more cryptocurrencies besides Bitcoin (ETFs), which are practically guaranteed for LTC, it would be prudent for market participants to adjust their expectations for this blue chip asset.

Beyond that, traders, chartists and Litecoin enthusiasts point towards the cryptocurrency’s fundamental value proposition to buttress a positive price-trajectory not dissimilar to exponential pre-ETF Bitcoin bull market cycles.

One such data point is the LTC hash rate, wherein new miners join the network and add to its security and immutability against potential bad actors. Litecoin’s hash rate hit a new record of one PetaHash at the time of writing, with more participants joining the network as users, miners or custodians offering financial services to clients.

Notably, there has never been a successful 51% attack against the Litecoin network, unlike other chains such as Ethereum Classic, or newer blockchains that routinely experience mysterious outages such as Solana.

Another significant data point which remains highly touted to this day is Litecoin’s original value proposition – Bitcoin scalability that does not come at the expense of decentralisation, like the centralised Lightning Network.

Contrary to various noises made by LTC detractors, the Silver-to-Bitcoin’s gold narrative is actually based on first principles by design. Since centralisation is the harbinger of eventual financial censorship, Litecoin enthusiasts tend to encourage a plurality of worthy layer 1 cryptocurrencies, (Monero included) rather than submit to unacceptable trade-offs to the detriment of sound monies.

Did you like the article? Share it!