Crypto analytics firm Santiment has noted that the peer-to-peer payments network known as Litecoin is flashing positive readings that might lead to a price surge.

As posted on X, Santiment noted that Litecoin is witnessing a rapid rise in address activity alongside other networks such as Maker and LidoDao.

📊 #Litecoin, #Maker, and #LidoDao are all seeing rapidly rising address activity. Typically, this gradually rising utility is accompanied by market cap growth. While $MKR and $LDO have seen this come to fruition, $LTC has yet to see a similar rise. https://t.co/hOwwknnP98 pic.twitter.com/rbmswUrx82

— Santiment (@santimentfeed) January 4, 2024

According to the analytics firm, the on-chain signal is normally “accompanied by market cap growth.” Santiment also highlighted that Litecoin has flashed a bullish divergence, a technical signal which suggests upwards price pressure is in the works.

Litecoin exchange hands at $65.30 at the time of writing, down around 11% since the start of the year when LTC opened at $73.88. Crypto analysts, as well as this website, have often drawn attention to a number of positive signals which point to a looming radical repricing for Litecoin.

One such signal is the divergence between Grayscale’s LTCN trust, and Litecoin’s spot price, such that LTCN is pricing in a potential sea-change in USD-denominated prices for the thirteen-year old payments network. At press time, LTCN stands at 15.50, which is around $178 per LTC.

Litecoin is going to moon so hard. LTCN is the indicator and the lnvm’s are the targets $LTC pic.twitter.com/NF3fppMsYG

— master Ⓜ️🕸 (@MASTERBTCLTC) January 2, 2024

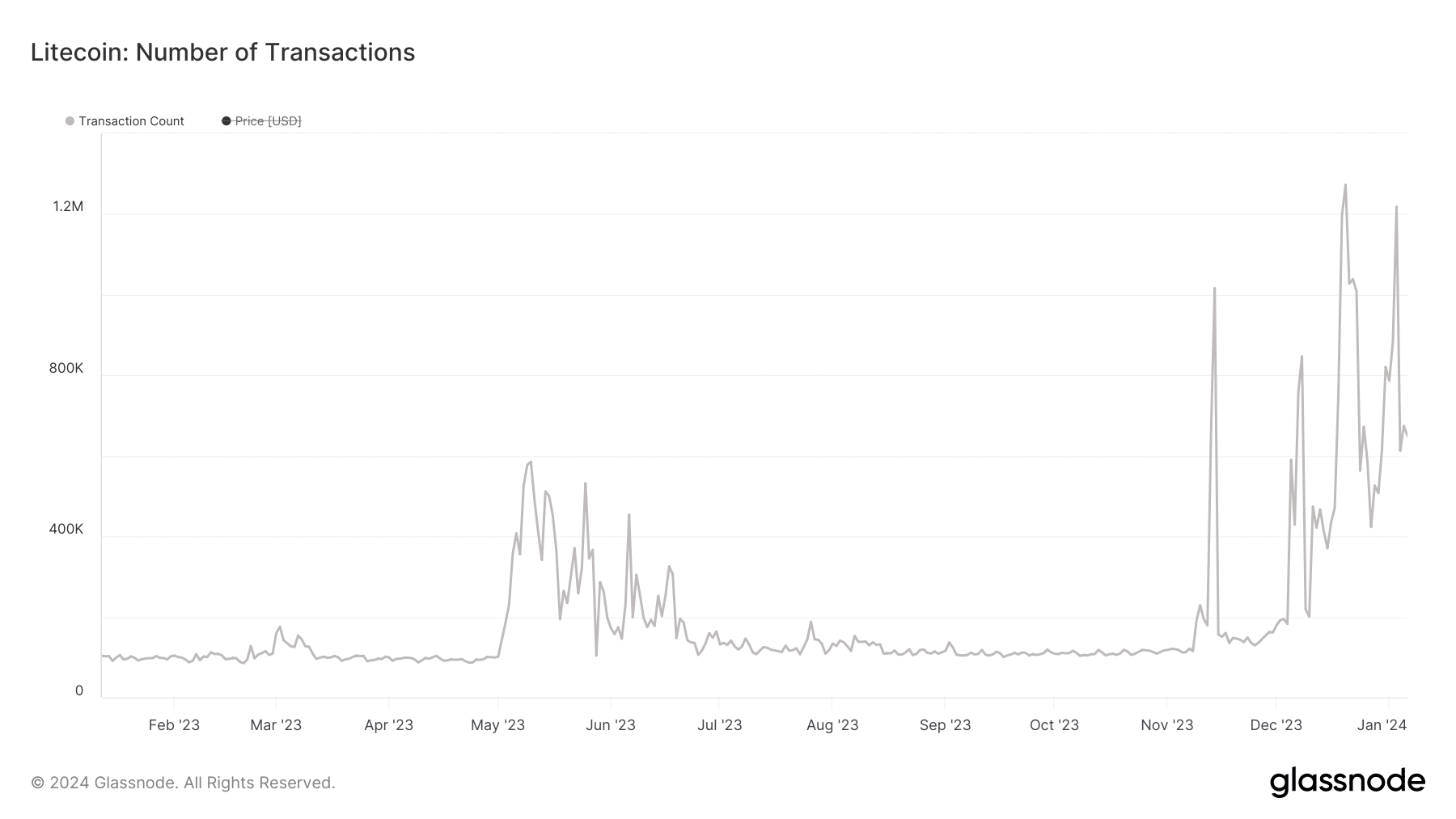

So far, Litecoin’s impressive on-chain data has not manifested in upward price pressure, however; an awkward situation when considering that not so long ago, Bitcoin’s price-movements were attributed to similar network effects and usage expansion.

Litecoin has traded significantly below its 2023 peak in recent months, with the halving event failing to provide meaningful price impetus to propel the coin forward, despite numerous tailwinds.

Regardless, Litecoin’s implied network value is bound to catch up to its widespread utilisation, which has continued to significantly outpace market cap growth since the halving in 2023.

Did you like the article? Share it!