In Brief

- Thiel made the remarks at a conservative conference.

- While not overly supportive of the industry, Thiel said he wished he bought more earlier.

- He called out the US Federal Reserve for not acknowledging inflation fears, while crypto market prices show those concerns are strong.

Cryptocurrencies aren’t going away. Buy Bitcoin here.

Speaking at a conservative conference on Oct. 31, the PayPal co-founder who now runs Palantir Technologies has said that cryptocurrency price movements are a testament to worries about inflation.

Thiel was not too enthusiastic about bitcoin and other cryptocurrencies at the current price-point, saying that he’s “not sure that one should aggressively buy”. However, he didn’t hold back in stating that the price itself is an indication of a “crisis moment” and that he regretted not buying more bitcoin earlier.

Most of Thiel’s remarks had to do with criticising the Federal Reserve for its handling of the economy. He said that the central banking system didn’t acknowledge the significance of the situation and that its decision to crank up the money printers wouldn’t have an inflationary impact.

The Federal Reserve has printed trillions of dollars in the last few years, unleashing over 22% of the entire US money supply in the first half of 2020 in response to a deliberate halt in global economic activity. During this time, inflation fears have slowly transitioned from a distant threat to a daily experience for millions of people with no end in sight.

In addition to that, the Fed’s balance sheet has grown enormously, and is expected to continue expanding well into the foreseeable future as more assets are acquired in this great recession.

Following the broken ECB system, the FED might also have to take decisions about negative interest rates soon. When this happens, borrowers are credited interest, rather than paying interest on the borrowed money. The illogical system is the de-facto state of affairs in many EU countries. FED Chairman Jerome Powell dismissed the idea of negative interest rates last year, but this discussion is likely to come up again soon.

Crypto: a bulwark against inflation

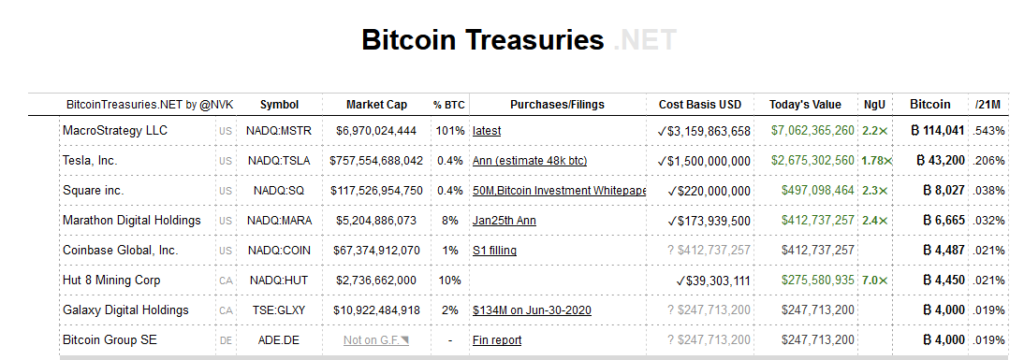

Bitcoin has proven to be a strong asset and hedge against inflation. Many companies have started adding the crypto to their holdings for this exact reason.

Among the most well-known of these is MicroStrategy, which has been at the vanguard of major companies investing in the cryptocurrency. The CEO Michael Saylor has often likened Bitcoin to digital gold and digital property, saying that it’s a better option than the precious metal.

Meanwhile, Thiel’s Palantir technologies is considering to add assets to its balance sheet. The company accepts bitcoin as payment from clients, which follows in the footsteps of his other firms like PayPal and Venmo.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!