Digital silver continues to attract users despite often being overshadowed by shiny scams and Ponzi schemes on blockchains like Solana, colloquially dubbed “analos.”

While these hyped-up networks grab headlines, their frequent outages and instability reveal their deep flaws. Meanwhile, Litecoin maintains a pristine record of one hundred percent uptime with no network hiccups since its inception.

In fact, there is no need to argue against fragile networks like Solana, as their own weaknesses will eventually be their undoing.

Instead, here are ten nuggets of information worth considering if you value decentralised networks, value-asymmetry, and sane bets in an industry that’s gone off the deep end:

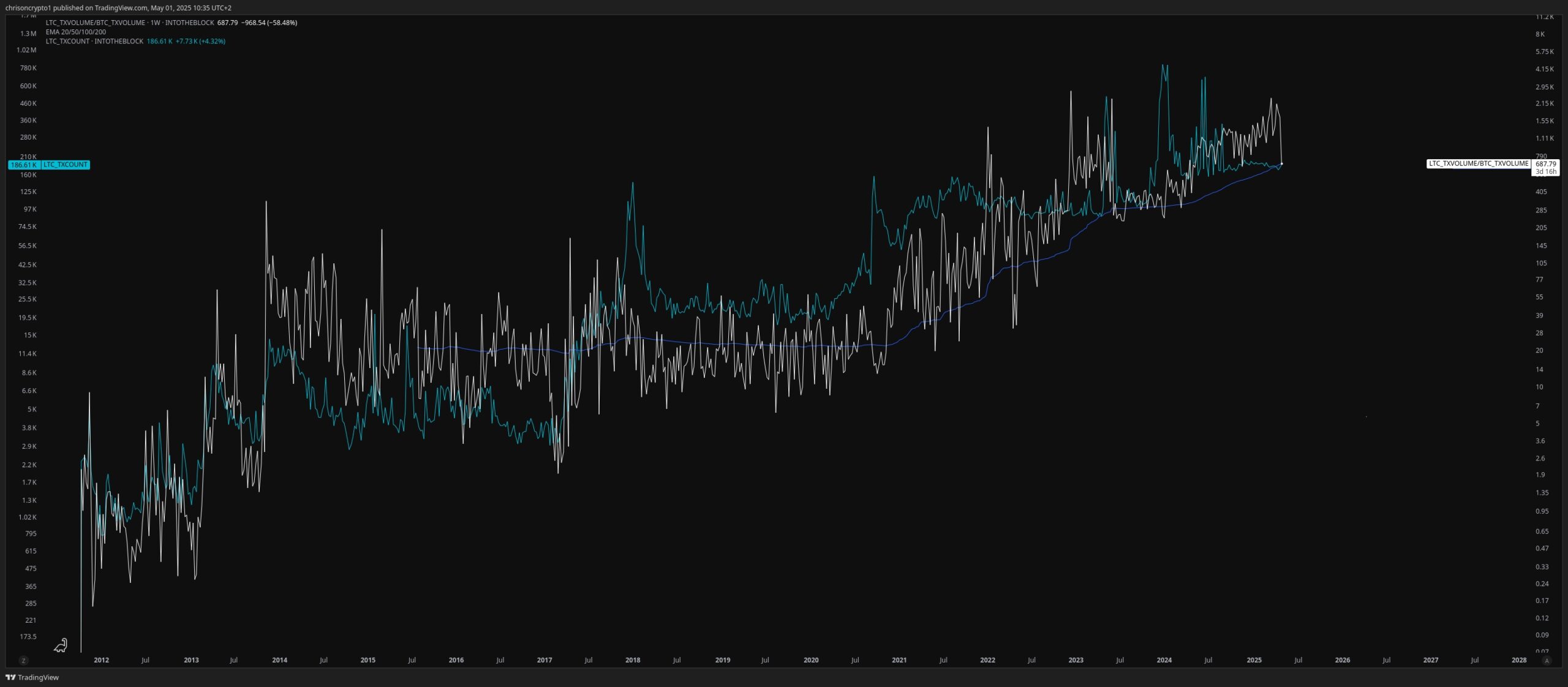

1. Litecoin transaction volumes on the rise versus Bitcoin

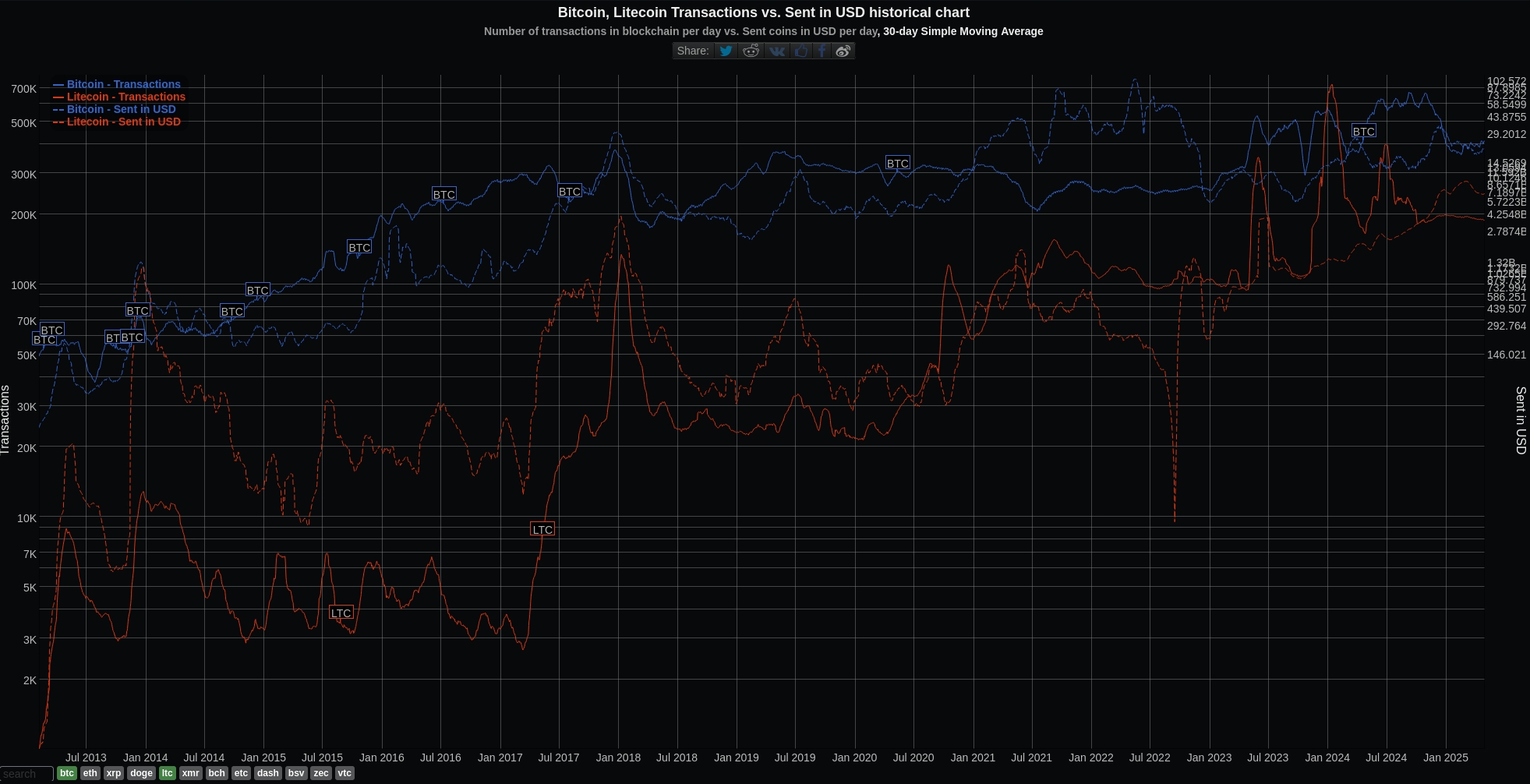

Litecoin has recently celebrated its 300 millionth transaction, a milestone that underscores its adoption as a payment solution after having been monetized for lower dollar values. This increase in transaction volume relative to Bitcoin shows that Litecoin is becoming more widely used, potentially due to its faster confirmation times, but mainly due to its relatively low network fees compared to Bitcoin.

Thanks to Litecoin’s higher relative transaction capacity, the coin is on track to surpass Bitcoin’s on-chain transactions and could double or treble those of Bitcoin soon. In other words, Litecoin’s focus on practicality and payments has been paying off and will continue to do so well into the future.

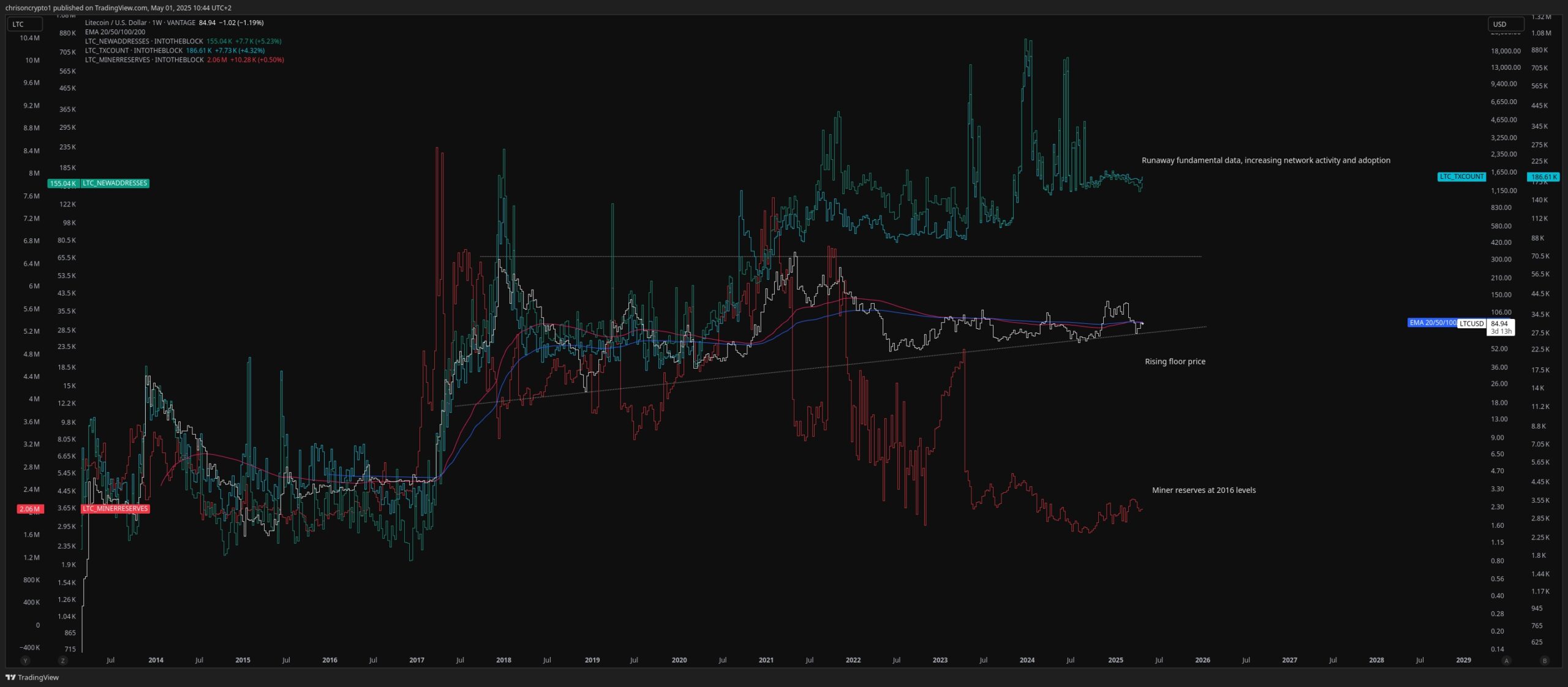

2. Miners Have No Reserves Left to Sell

The exhaustion of miners’ reserves is a significant factor for Litecoin’s price dynamics. You can read about the details here. The TL;DR is that Litecoin miners no longer have millions of coins to distribute into the market, which means there is less downward pressure from newly minted supply.

This scenario creates growing supply-side restrictions, which can result in radical repricing overnight as any increase in demand would have to be met from existing long-term holders or new investors, not by miners’ sell-offs.

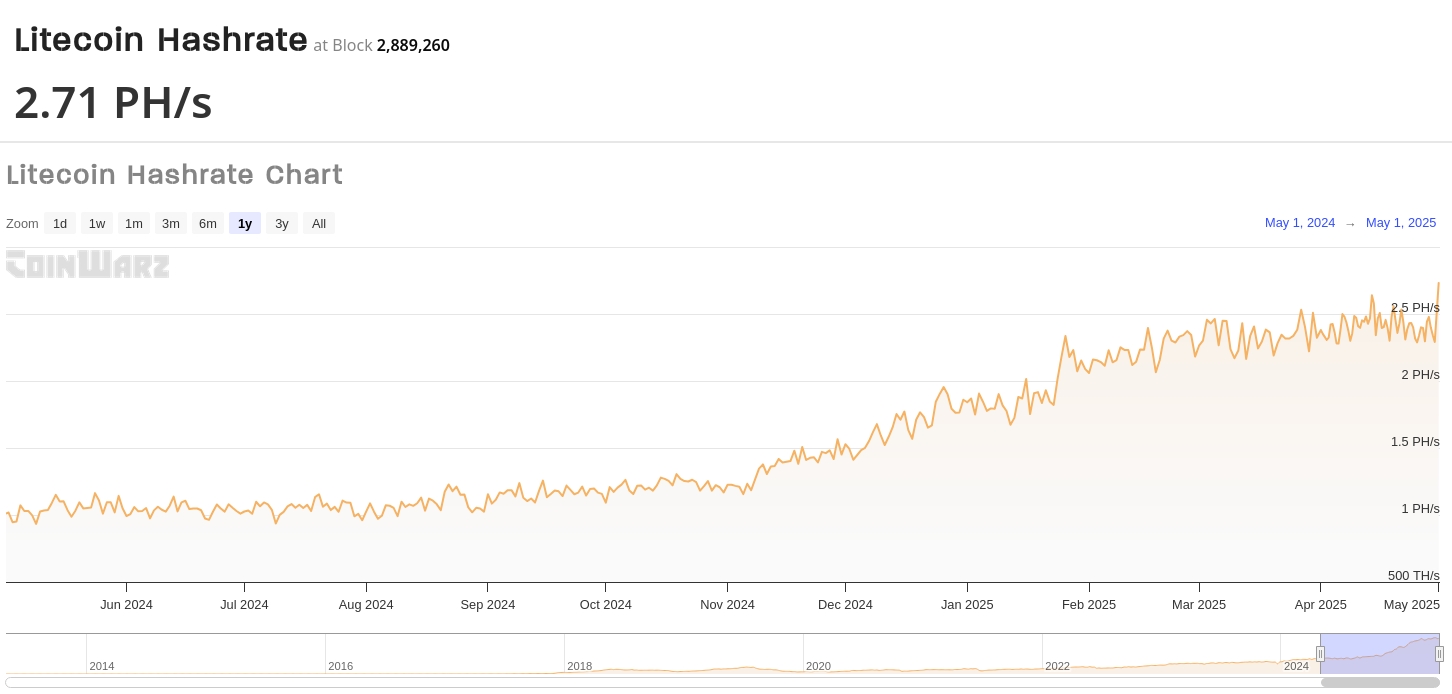

3. NGU Hashrate

Litecoin’s hashrate has been setting new all-time highs, the latest being 2.71 PetaHashes achieved on May 1st, 2025. This is a testament to the network’s security and confidence in the network. A higher hashrate means it’s harder for any single entity to gain control over the network, making Litecoin transactions more secure. The hashrate increase also reflects optimism in the coin’s future value, as miners invest in hardware and electricity to mine Litecoin.

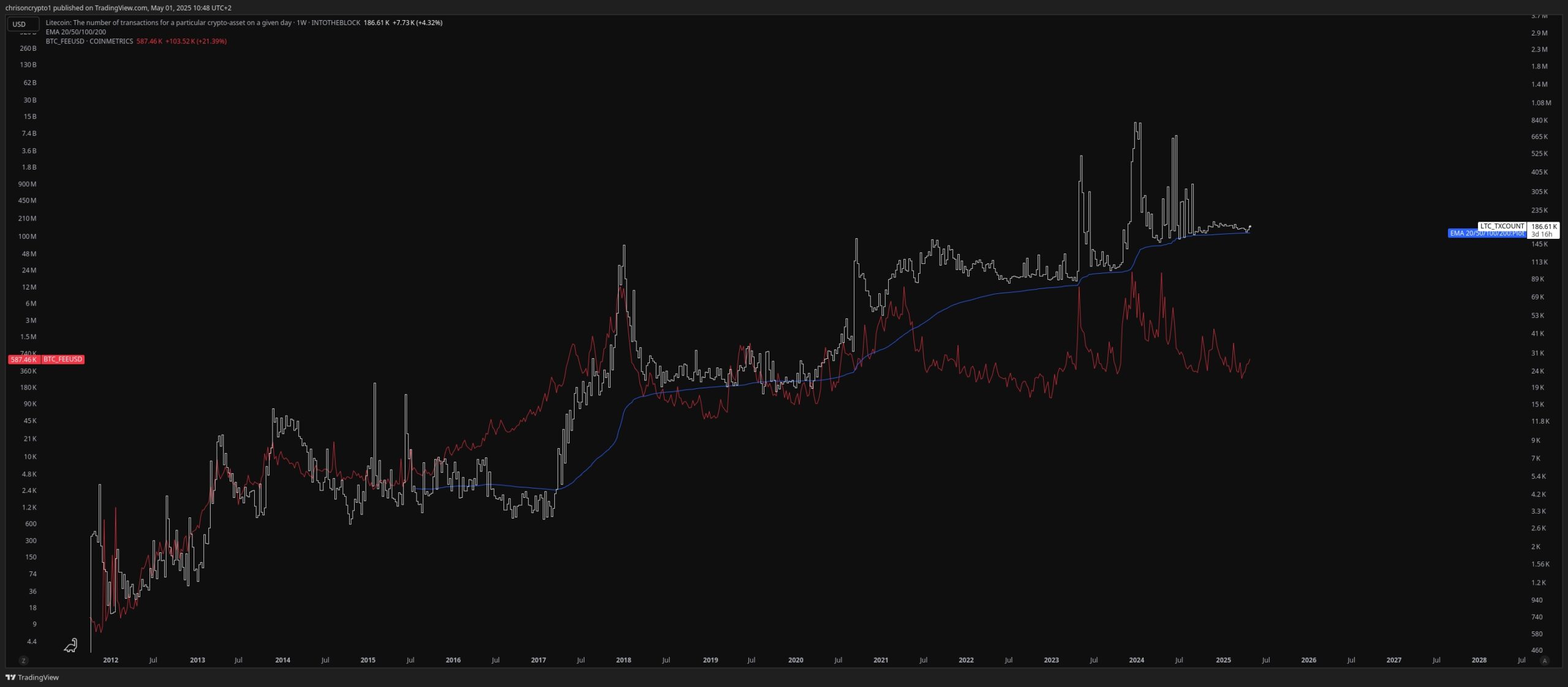

4. Historical Relationship to Bitcoin During Network Congestion

Litecoin has often acted as Bitcoin’s “silver” when Bitcoin’s “gold” is under stress. During times when Bitcoin transactions slow down due to network congestion, Litecoin sees an influx of users looking for quicker, cheaper transactions. This has historically led to price surges in Litecoin, mirroring Bitcoin’s movements but often with higher volatility.

Notably, the surge in Litecoin transactions does not diminish once Bitcoin’s network congestion clears, resulting in a permanent increase in Litecoin usage. This suggests that Litecoin’s network activity will soon eclipse that of Bitcoin out of sheer practicality, if nothing else.

5. Positive HTF Technical Pattern (8-Year Flag Pole Structure)

its time to max bid litecoin $LTC

moonshot time pic.twitter.com/8RQXANFMaa— Parody Litecoin (@litecoinparody) May 1, 2025

Chartists and analysts on X have pointed out an 8-year flag pole structure in Litecoin’s price chart, a pattern that typically precedes significant price expansion. This structure suggests that following a prolonged period of consolidation, Litecoin is poised for a breakout, potentially replicating or even exceeding past bull runs.

While price expectations vary widely, there’s an emerging consensus that Litecoin is on the verge of unlocking major capital inflows, which would result in fairly radical asset repricing. A five-digit price tag on each coin has been floated and is often debated.

6. Canary Capital Litecoin ETF

The potential introduction of a Litecoin ETF by Canary Capital is a game-changer for institutional investment, as it simplifies the process for investors to gain exposure to Litecoin without directly managing the cryptocurrency.

Litecoin would be the third crypto exchange-traded fund to be launched in the United States, following those of Bitcoin and Ethereum. Since it’s an actual commodity, unlike Ethereum, capital flows are likely to echo those of Bitcoin, which would lead to increased liquidity and investor interest as more investors enter the market.

7. Supply Shock; Not Enough LTC to Go Around

With Litecoin’s total supply capped at 84 million coins, there’s an inherent scarcity, which would become more pronounced as increasing demand faces a cohort of holders who are unlikely to part with their hard-earned coins any time soon. The situation is exacerbated by miners’ supply exhaustion, leading to a supply shock where the market does not have enough Litecoin to meet rising demand, pushing prices upward.

8. Value Asymmetry; 4:1 Litecoin-Bitcoin Ratio

Litecoin’s supply is four times that of Bitcoin, leading to discussions about a potential 4:1 price ratio. It must be noted that such a comparison cannot be made arbitrarily, but since Litecoin meets all the preconditions necessary for good money and was designed as digital silver, the market can easily justify and argue the digital silver case with ease.

Bitcoin’s value currently stands at $2 trillion. If the 4:1 ratio is realised, then Litecoin’s $8 billion to around $500 billion, placing the price per coin at $5,952, potentially.

9. Made in the USA

Litecoin was created by Charlie Lee, an American citizen who openly supports the coin through the Litecoin Foundation. While this is a fairly superficial point since the founder has no direct control over the network, US President Trump’s policy leans towards supporting so-called American technology and innovation. This may result in more favorable rulings for Litecoin-related products, amplifying the coin’s appeal to a wider audience in a friendly regulatory environment.

10. Chosen Bitcoin Scaling Solution

Litecoin has played a crucial role in Bitcoin’s scaling solutions, notably with the implementation of Segregated Witness (SegWit). It acts as a testing ground for features before they’re adopted by Bitcoin, showcasing both its historical and contemporary importance in the digital economy.

The privacy layer launched in 2022 has continued to gain traction among users, and is a prelude to things to come for the Bitcoin network if history is an indicator. At the same time, Litecoin (L1) usage statistics have only gone up and to the right, making it the de facto user choice over secondary solutions such as the Lightning Network.

Unlike other networks, these fundamental data points show real underlying growth. The only thing Solana and Litecoin have in common is that their fundamentals and price are both divorced from reality; while Solana is a speculative piece of vaporware that can barely process transactions, Litecoin is a useful complement to Bitcoin with the added benefit of having unique technological innovation.

This value asymmetry will not last forever, and it fuels the rallying cry of truly decentralised networks, which represents the shared interests of users, investors, companies, countries, and everyone in between.

If you enjoyed reading this article, share it!