Litecoin bounced above $63 on Wednesday, August 14, marking a 28.5% increase over the past 9 days despite significant downward pressure.

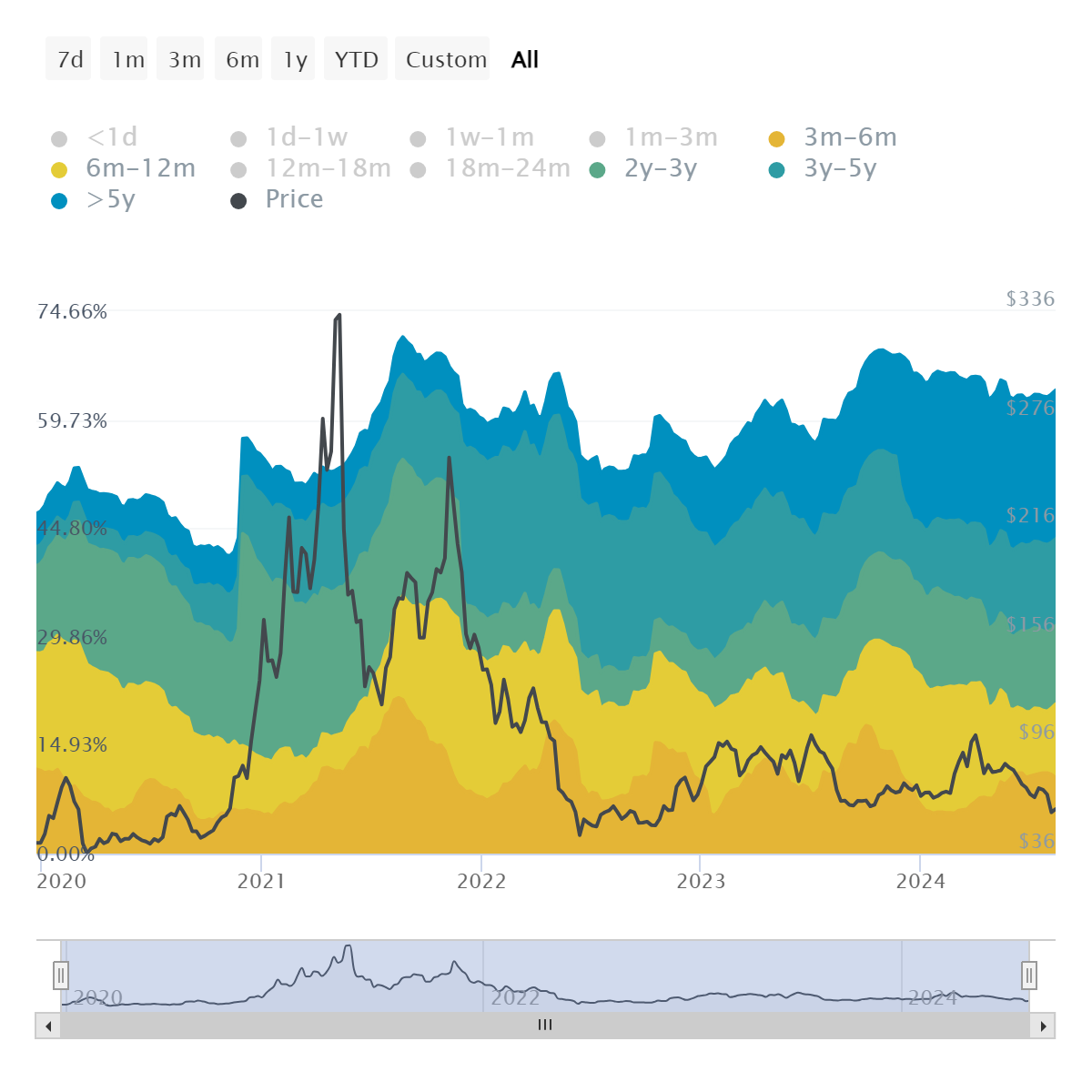

Despite the price-plunge to $49 on August 5, on-chain data shows that long-term holder activity hasn’t abated, with 3-5 year UTXOs accounting for upwards of 32% of all addresses.

The reasoning behind this UTXO movement is that as LTC is acquired by long-term band brackets, the influence that this cohort exerts on price increases due to growing supply constrains in the network. In plain English, there is less Litecoin to go around over time. Sellers, especially those that borrow against the open cryptocurrency, cannot do so indefinitely against such a backdrop.

As noted, long term holders have continued to increase their accumulation commensurate with previous market cycles. Per IntoTheBlock data, holders tend to increase their coins as a percentage of the total supply during accumulation periods, and distribute a portion of said coins as the Litecoin/Dollar value surges.

Since 2018, the troughs for long-term holder balance sheets have been on the rise, indicating a growing cohort of users with positive long-term views on the asset. In Dec. 2018, holder balances accounted for around 12.5% of supply, which grew to 39.2% in Dec. 2021. This figure stands at 60.3% as of August 14.

Coupled with this movement of coins from short-term users and speculators to long-term holders is the steadily growing appreciation that Litecoin exists as a digital commodity or speculative digital bearer asset. Notably, the peaks and troughs in long-term UTXOs and holder balances coincide with a staple accumulation structure used by technical traders; the only difference being that instead of an hourly chart, Litecoin/Dollar has printed the pattern on a monthly or quarterly chart.

That said, this seemingly positive picture remains tenuous due to the increasing frequency of support trendline tests since June 2022, lending credence to calls for a potential sell-off and break in the coin’s macro market structure.

Litecoin has long been a major player in the cyrpto space, at times surpassing both Bitcoin and Ethereum with transaction volumes. As noted in a previous post, Litecoin’s organic address growth has surged significantly more than both BTC and ETH over a 12-month period too.

To one degree or another, arguments for Bitcoin and Ethereum have historically hinged on fundamental network activity such as those quoted above. So if history is any indicator, Litecoin may yet pleasantly surprise markets over a long-enough time-horizon.

Buy, trade and exchange Litecoin on reviewed exchanges here.

Disclaimer: the content on this site should not be considered as investment advice. Investing is speculative. Your capital is your responsibility.