Billionaire investor Bill Miller, who holds an outstanding investment track record, continues to exalt Bitcoin as one of his top personal assets.

A solid track record

Miller rose to prominence when he headed the Legg Mason Value Trust, which beat the S&P 500 for 15 full years from 1991 to 2005. At a point, he oversaw a $70 billion worth of client assets.

But the great financial crisis hurt Miller’s returns, and he left the firm in 2016. Still, Miller remained an active investor at his own firm until he decided to retire at the end of last year after a successful 40-year long career in the investment sector.

Recently, Miller hasn’t held back regarding his support of Bitcoin, which has produced a return of 17,000% since April 2013 (per data from CoinMarketCap). Miller’s exceptional track record is a testament to his prowess in navigating financial markets. As such, his perspective is valuable.

Miller’s Bitcoin thesis

Miller’s thesis rests on Bitcoin being a legitimate store of value comparable to ‘digital gold’. This view is shared by many investors who have held Bitcoin for stretches of time throughout its 14-year history.

Physical gold has been used for thousands of years, and is still used today. According to WCG analysts, central banks have been stockpiling gold at the fastest pace in 55-years as macro-economic conditions heat up, and Russia-NATO and China-West tensions rise.

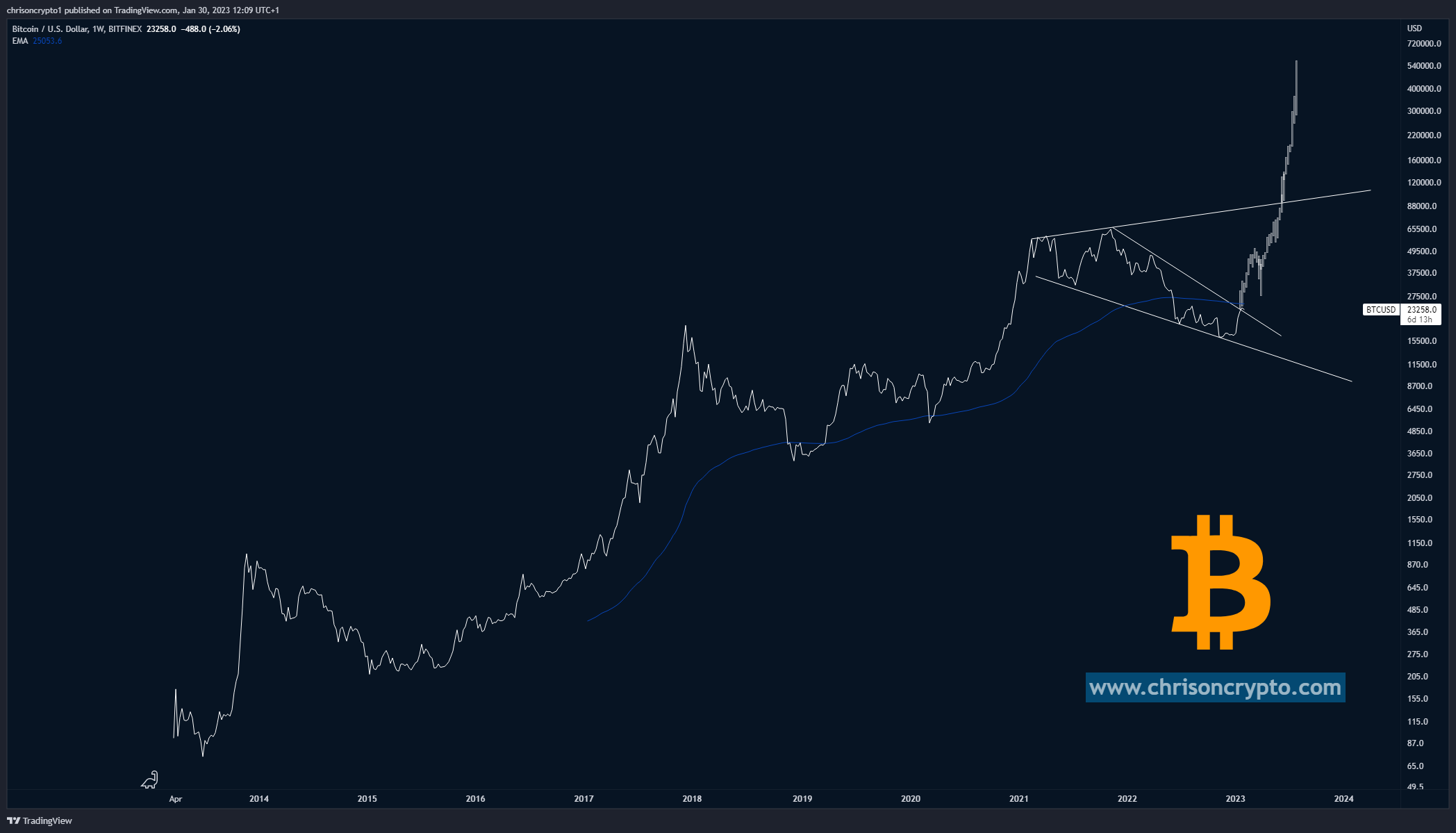

But does Bitcoin come anywhere near gold in terms of purchasing power? Over the last 10 years, an ounce of gold has climbed 16%, whereas Bitcoin has gained astronomically higher figures in percentage terms. It’s meteoric rise has been a bumpy ride throughout volatile months, but the overall yearly trend remains ‘up and to the right’.

On top of that, Bitcoin’s most important trait is that there will only ever be 21 million coins. This is hard-coded in the protocol, and it’s unlikely to ever change in the future. When it comes to gold, if prices soar dramatically then it would become economically viable for businesses to find new ways to extract it from the ground; and this doesn’t count the $771 trillion worth of gold that lies hidden in the ocean.

Increasing the gold supply places downward pressure on gold prices when it comes to market.

In January last year, Miller revealed that half of his personal net worth is invested in Bitcoin. In a January 2022 interview with WealthRack’s Consuelo Mack, Miller said:

I think the average investor should ask himself or herself what do you have in your portfolio that has that kind of track record — number one; is very, very underpenetrated; can provide a service of insurance against financial catastrophe that no one else can provide; and can go up ten times or fifty times. The answer is: nothing.

Miller made no mention of Litecoin, which – like bitcoin – has a capped supply of 84 million coins and is regarded as being the “silver-to-bitcoin’s” gold for ten plus years now.

A possible catalyst

The US Federal Reserve has raised interest rates at the highest rate-hike in history. By doing so, the cost of capital (borrowing) increases, placing pressure on the economy. Rates went from near-zero to 4.5% in December. The central bank is expected to reach its terminal funds this year as the cycle of rate hikes comes to an end. The rapid rise in rates has hurt risk assets such as growth tech stocks and cryptocurrencies. Miller believes that when the Fed pivots in 2023 or 2024, Bitcoin will march higher.

According to the investor, everyone should have at least 1% of their own net worth in Bitcoin. The upside potential is exponentially higher if individuals, companies, corporations and governments begin storing their wealth in it.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!