In brief

- Pantera Capital CEO Dan Morehead said rate hike increases wouldn’t be “that bad” for bitcoin.

- According to Pantera Capital, the market has “priced in about five rate hikes”.

- The US Federal Reserve will raise interest rates to curb inflation, which hit 7.5% in January.

Cryptocurrencies aren’t going away. Buy Bitcoin & Litecoin here.

The US Federal Reserve is expected to raise interest rates as early as March in an attempt to curb inflation, which hit 7.5% in January. Investors have kept a close eye on the Fed’s next steps, concerned that any policy change might cause a major decline in cryptocurrency prices.

In a Feb. 16 letter to investors, the CEO of Pantera Capital agreed with an assessment from the company’s co-chief investment officer Joey Krug, stating that the market has “priced in about five rate hikes” already. Krug said that while “crypto definitely got hit” by the news of planned rate hikes, this was “being overplayed”.

According to Krug, crypto markets will wholly decouple from traditional markets “over the next number of weeks”. To bolster his arguments, Krug said that conventional macro markets and crypto tend to corelate on downturns for about 70 days, after which crypto breaks away and trades on its own. He explained:

“Crypto is still a relatively small market and so things like the federal funds rate being at 1.25% versus 0% doesn’t make a huge, huge difference for something that’s growing four to five times year over year, especially if you look at stuff like DeFi, where it’s already trading at fairly cheap multiples.”

BTC & ETH have bottomed out

Krug asserted that a $2,200 Ethereum was “likely the bottom”. This could apply to the broader market, which on Jan. 21 wiped out more than $230 billion off the total market capitalisation. Bitcoin over 7% under $39,000 on the day, only to tank further around $33,000 some days later amid increasing fears of interest rate hikes.

Chief executive Dan Morehead said bitcoin as an asset will perform well during period of rising interest rates. He outlined scenarios involving different assets and how increasing rates could impact them. Bond and stock prices would fall, he said, as would real estate and other types of assets.

“Whereas blockchain isn’t a cashflow-oriented thing. It’s like gold. It can behave in a very different way from interest-rate-oriented products. I think when all’s said and done, investors will be given a choice: they have to invest in something, and if rates are rising, blockchain is going to be the most relatively attractive.”

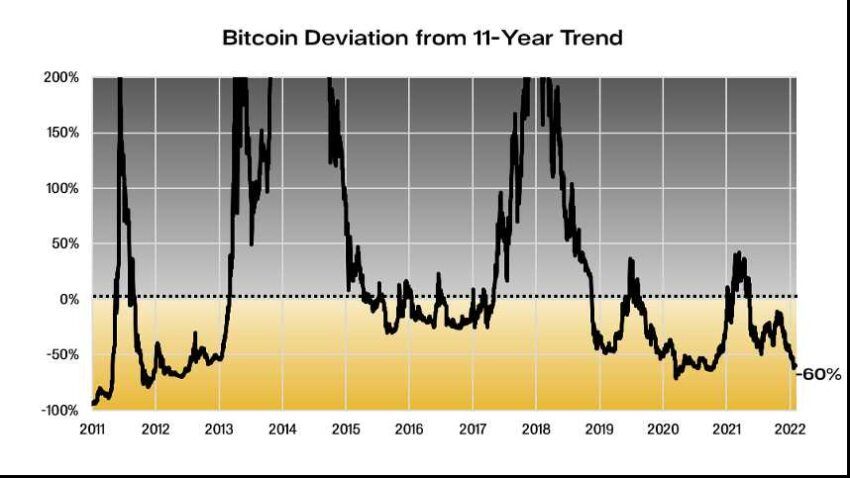

Morehead pointed to Bitcoin’s current price which is trading at 60% below its 11-year trend, meaning “the odds are really high that the markets are at an extreme and will bounce back relatively quickly.”

The chief executive predicted that when the US “bond bubble” pops in the short term, this will drive people into crypto. He said some declines in asset prices could have resulted from investors selling in order to pay tax in the United Stated due by April 15.

US inflation increased 7.5% year-on-year in January, its highest level in 40 years. The Fed says it is planning to raise its benchmark rates to contain inflation, but so far the Fed has missed all its targets.

Rates have remained near zero since March 2020.

Dan Morehead’s view is similar to Ray Dalio’s, who told investors to minimize cash and bond ownership last year.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!