The European Commission estimates the total level of unused savings in the EU stands at €10 Trillion, and plans to use this money to militarise Europe on the back of citizens without public consultation.

Savings: The Latest Piggy Bank

The statement was issued by the EC’s press service Maria Luis Albuquerque, European Commissioner for Financial Services and Investments.

“A significant part of Europeans’ savings lies in the form of deposits at very low interest rates (from 0.3 to 0.8% per annum) and even in the form of cash reserves. The mobilisation of even a small part of these resources will make it possible to change the investment landscape in the EU,” the European Commissioner said.

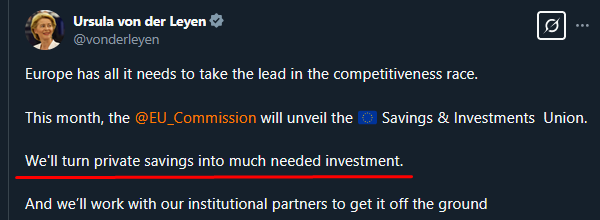

Per the Euro Commission President Ursula Von der Leyen, who is currently under investigation for the Pfizergate scandal for her opaque role in the covid-19 gene therapy contracts, intends to ‘turn private savings into much needed investments’, as she stated.

In other words, the EU will finance its deficits and enormous military investments partly through the €800-plus billion ‘REARM Europe’ defence spending plan, and also by tapping into people’s savings accounts. This is taxation without representation.

The plan, ostensibly aimed at funding the bloc’s federal military ambitions over and above nation-state security, aims to finance Europe’s military industrial complex via €10 trillion of EU citizens’ savings.

There is no such thing as ‘unused savings’, since savings and investments are distinct use-cases in and of themselves.

Savings and investments have distinct purposes and are not interchangeable. Indeed, low interest rates do not render savings ‘unused’; but reflect a broken monetary system where central banks have left citizens no option but to park funds conservatively – funds that are now open to further wealth extraction by the EC.

By labelling these funds as surplus cash ripe for redirection is to ignore the very real fact that these balance sheets belong to people, and that this plan essentially boils down to theft.

Coercion and Undermined Liberties

The Commission’s plan to ‘mobilise’ these savings is unlikely to include direct confiscation, as this would be too politically explosive. Instead, subtle mechanisms such as tax incentives, regulatory pressure on banks to redirect deposits, or negative rates to oblige savers into riskier investments like defence bonds are on the table.

Meanwhile, the EU’s ambition to launch a central bank digital currency, another brilliant plan which could trap citizens into a regime of financial surveillance and capital controls, is set to be ready for launch by late 2025.

All this is happening without a public mandate, and highlights the stark contrast between outward rhetoric about rights, liberties and transparency, and the reality of carefully crafted finance-speak and obscure nature.

The idea that conservative low-interest bank deposits are reduced to the personal piggy bank of the whims of an unelected commission whose President is under investigation not only reeks of overreach, but also suggests criminal behaviour.

Concerned citizens who are wary of this apparent heist might want to look to alternative means of securing their savings given that the EC’s solution to self-inflicted economic ruin is to betray the very freedoms it supposedly seeks to protect.

If you found this article useful, consider sharing it.