The US Securities & Exchange Commission’s (SEC) extensive regulatory crackdown has wiped over $100 billion from the total crypto market cap, but this hasn’t bitcoin whales from scooping up coins on sale. Alternative cryptocurrencies bared the brunt of the sell-off due to a legal tussle between regulators and exchanges. In the meantime, Bitcoin whales are adding coins to their growing balance sheet.

Bitcoin whales scoop up $26 million in BTC per day

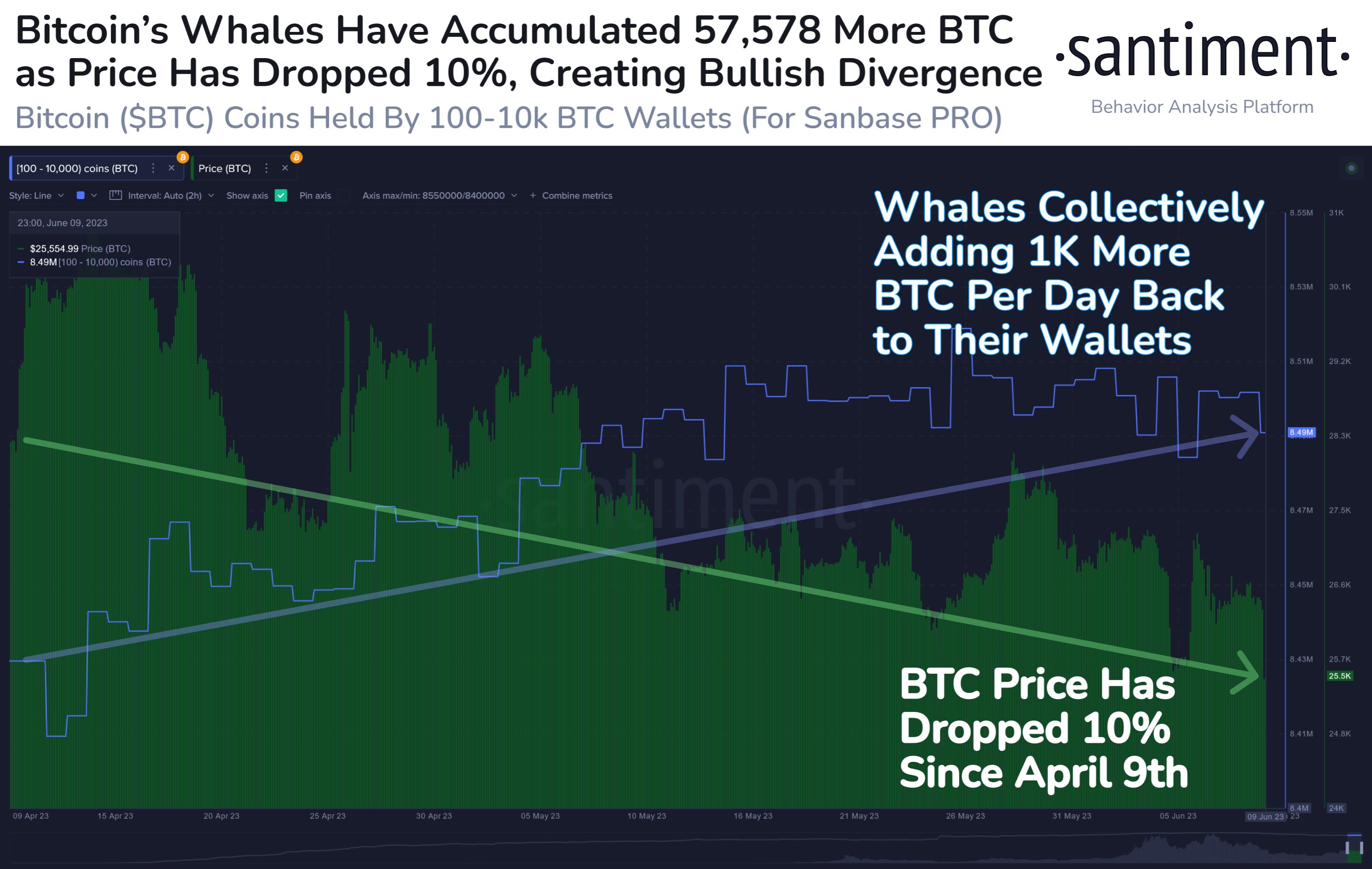

As data from crypto intelligence firm Santiment indicates, whales are picking up 1,000 BTC each day, worth $26 million. Large wallets are quietly buying the asset in big quantities.

Per data in the chart above, large wallets have bought 57,578 more BTC as the asset’s USD-price fell 10% between April 9th and June 9th. In the same timeframe, whales consistently added over 1,000 BTC a day.

The significant downturn in the market capitalisation of certain alternative cryptocurrencies is likely to have been aided by the SEC’s regulatory clampdown. Curiously, both Litecoin and Monero – both decentralised cryptocurrencies in the ‘sound money’ bearer-asset basket – did not make the list.

Interesting. https://t.co/XWkOWZnfoB

— Chris on Crypto⏫Ł₿Ⓜ️🕸 (@ChrisOnCrypto1) June 10, 2023

According to data from CoinGecko, Bitcoin’s dominance rocketed from 44.21% to 45.69%. Both increasing BTC dominance and whale accumulation are tailwinds for the asset’s fiat price.

Together, the two metrics could catalyse a significant Bitcoin rebound. At the time of writing, Bitcoin exchanges hands at $26,000, with the asset declining 6% over the week. BTC/USD is 62% below all-time-highs.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!