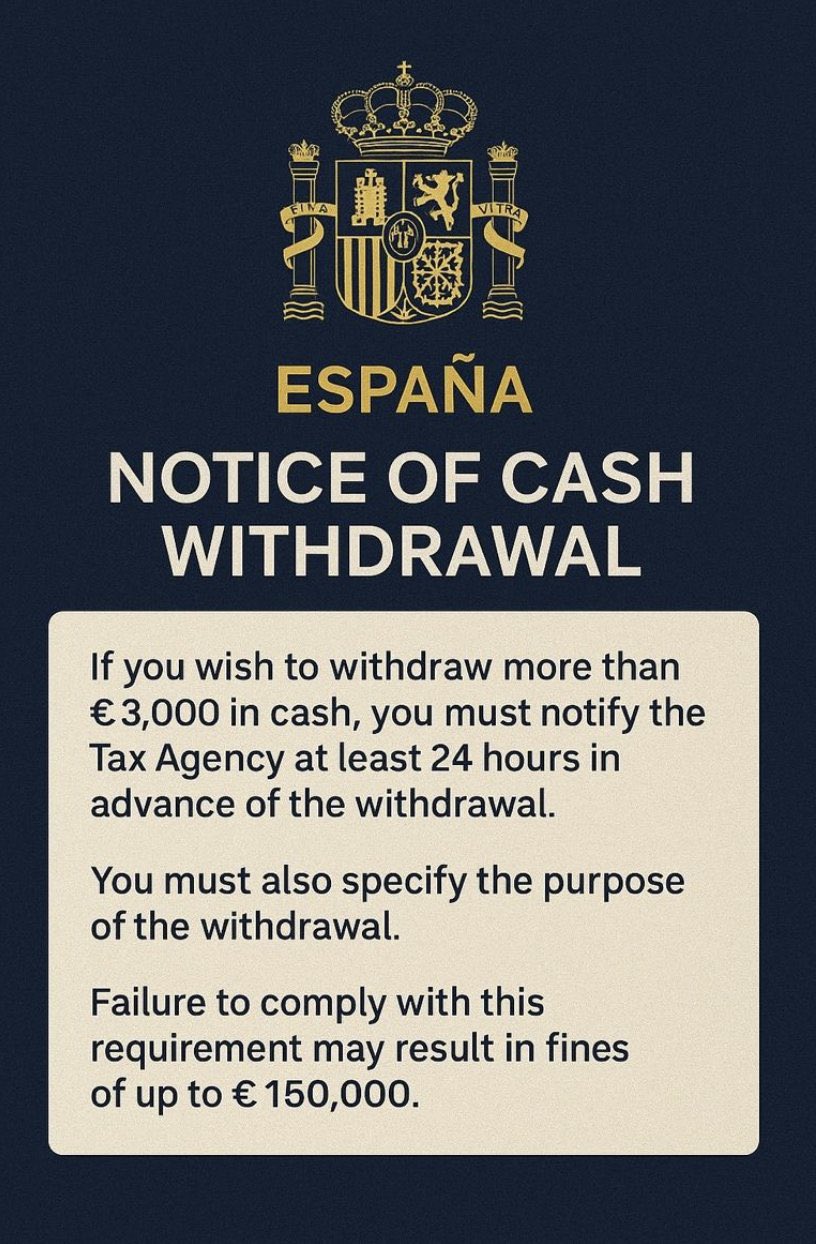

Spain has rolled out a new policy that raises immense concerns. As of April 2025, anyone withdrawing €3,000 or more in cash is obliged to notify the Agencia Tributaria twenty-four hours in advance, while a cash withdrawal of €100,000 or more requires a seventy-two hour notice.

Failure to comply could mean a €150,000 fine, depending on the apparent ‘seriousness’ of the violation.

Discouraging cash withdrawal

The move constitutes a serious breach of financial sovereignty, and inverts the rule of law to ‘guilty until proven innocent’ for everyday citizens.

Naturally, the Spanish government claims the policy is about curbing money laundering and tax evasion, but many rightly see it as a chilling move toward greater control over personal finances, especially with banks now required to report suspicious transactions, even those just below the threshold.

The arbitrary and shifting goal-posts mean that what was an innocuous transaction a month ago is now a criminal offence today, potentially.

Spain’s demands to know why you’re withdrawing your own cash sets a dangerous precedent for incrementally increasing capital controls over your personal finances at the whims of politicians. This is invariably at odds with free market principles and suggests that surveillance and control over your finances is necessary for some ethereal security against money laundering.

Double standards

Yet, it’s often the banks themselves that face significant penalties for failing to uphold these standards.

Danske Bank, for instance, paid £1.8 billion (approximately $2.4 billion) in 2022 to settle a money-laundering case, while Goldman Sachs settled for £5.4 billion (approximately $7.2 billion) over its role in the 1MDB corruption case. HSBC incurred £1.4 billion (approximately $1.9 billion) in fines between 2020 and 2022 for inadequate controls against drug cartel transactions, and Credit Suisse paid £180 million (approximately $238 million) in 2022 for compliance issues.

For these institutions, such fines seem to be merely the cost of doing business—a small price to pay in the grand scheme of their operations. And this is just a glimpse of a much larger pattern of wealth extraction at the expense of fiat money users.

The policy signals a broader erosion of financial liberty as the Eurozone prepares for its digital euro launch in October 2025. This central bank digital currency will track every transaction in real time, far surpassing the intrusion of current cash withdrawal rules. Across the EU, cash usage is being squeezed too, partly under the guise of efficiency. France, Italy, and Belgium have set payment caps as low as €1,000. But such measures seem designed to phase out cash and pave the way for a CBDC that allows for tighter controls around spending by definition.

All in all, Spain’s demand to justify withdrawals is essentially another step towards normalising constant surveillance, chipping away at financial autonomy in the process.

If you found this article useful, share it!