While Litecoin exchanges hands at around $100, underlying on-chain data shows robust growth relative to Bitcoin and Ethereum over a five-year period.

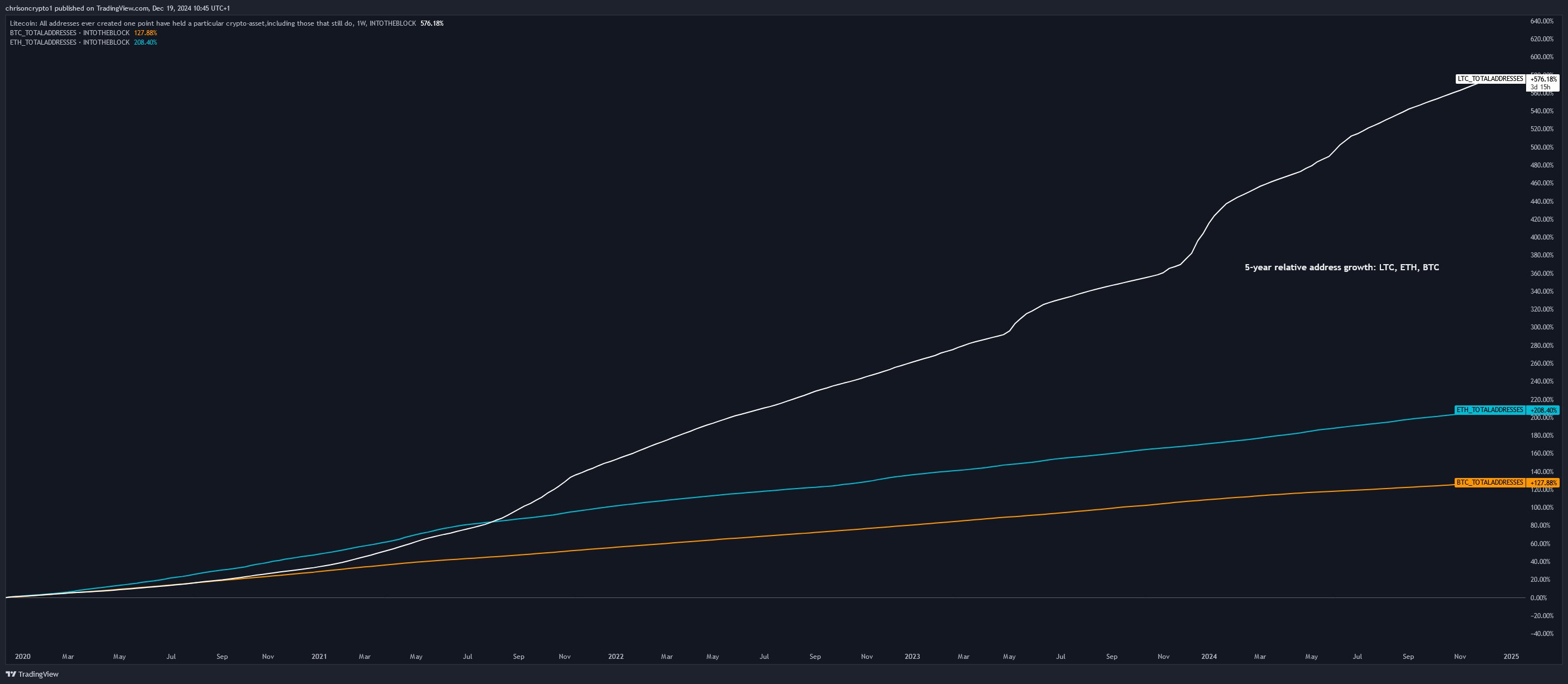

According to on-chain data from the data analytics platform intotheblock.com, Litecoin’s relative wallet growth, which is an estimate of new users joining the network, saw a 576% increase versus Ethereum’s 208% and Bitcoin’s 127% since 2020.

The trend is also apparent on a year-on-year basis, with litecoin addresses increasing by over 40% compared to 14.6% for Ethereum and 9.9% for Bitcoin.

These percentages suggest positive long-term undercurrents for the Litecoin network, surpassing even those of Ethereum. In fact, the total number of addresses on the Litecoin network stands at 334 million, compared to 314 million on Ethereum.

While the address count isn’t a direct indicator of the number of users, it does reflect comparable popularity.

Users choose Litecoin

Despite Litecoin’s dollar price fluctuating in and out of three-digit territory since February 2022, its usage and adoption have continued to grow. Moreover, address creation has accelerated at a faster rate than that of both Bitcoin and Ethereum, a fundamentally healthy sign of an expanding network.

Being the ‘silver’ to Bitcoin’s ‘gold’, Litecoin has varied use-cases, including serving as a store of wealth, a means of payment, or a digital commodity that can be leveraged as a financial instrument, among others.

Historically, Litecoin has benefited from a spill-over effect from increased transaction activity on Bitcoin, in addition to being a cheaper, viable alternative.

However, the Mimblewimble privacy upgrade has provided another incentive for users to choose Litecoin directly. Other factors influencing user growth include the cryptocurrency’s network effects and the financial opportunities associated with them, which includes financial speculation on the network’s true value today.

An investment opportunity

As its own asset, increasingly distinct from Bitcoin, Litecoin exhibits a unique adoption curve, lagging cyclically behind Bitcoin due to it being two years younger.

At face value, the coin limit of 84 million LTC to 21 million BTC implies a 1:4 ratio between the assets. While this ratio suggests potentially astronomical figures in five-digit territory in dollar terms, similar once-unbelievable figures laid the groundwork for Bitcoin’s $2 trillion market cap today.

In 2021, Litecoin reached $420 before entering a consolidation phase, during which time coins were distributed to a growing cohort of users. This apparent market underperformance coincided with significant selling pressure from miners, which amounted to around 6 million coins.

At its peak, this selling pressure equalled $2.52 billion, representing a hefty 9.7% of the total market capitalisation of the asset at the time, separate from other market forces. However, despite this pressure, LTC/USD found support at $40 in June 2022 and has been inching higher ever since.

The consistently higher floor price roughly aligns with the network’s ongoing adoption as both a medium of exchange and as a financial instrument.

In previous bull markets, the phrase ‘price follows fundamentals’ was an all-too-frequent rallying cry for both Bitcoin and Ethereum analysts.

Now, with Litecoin eclipsing the two of them combined in relative growth, the same train of thought suggests asymmetric upside potential when price-discovery kicks in.

Buy, trade and exchange Litecoin on reviewed exchanges here.

Disclaimer: the content on this site is not investment advice. Investing is speculative. Your capital is your responsibility.