Complaints about bank closures have soared in the wake of the Nigel Farage debanking scandal, according to new figures from the Telegraph.

The Financial Ombudsman opened 1,613 new cases regarding bank account closures in the last six months to the end of September, equalling 268 cases per month.

This compares wit 2,708 cases across the entirety of 2022-23, a rate just over 225 per month, and suggests that complaints are rising by a fifth to around 3,200 by the end of 2023.

Revealed by a letter to the Treasury Select Committee (TSC) published on Wednesday, the data shows a growing number of complaints held up by the regulator despite increasing public scrutiny.

The news comes as the committee warned that high-street lenders were closing accounts of small and medium-sized businesses for no apparent reason. Concerns about financial censorship are increasing across both traditional and fintech organisations.

As The Telegraph reports, the committee is investigating the matter following the scandal involving former UK Independence Part leader Nigel Farage and private bank Coutts, a division of NatWest.

Mr. Farage’s account was subjected to politically motivated termination this summer after staff determined that his beliefs did not “align” with the bank’s own ideals “as an inclusive organization.”

The UK’s Financial Conduct Authority (FCA) launched a probe into scandal in August. In September, despite published proof of the politically motivated closure, the FCA said it found no evidence of politically motivated debanking.

The disclosure of judgments issued against Mr. Farage has raised concerns about widespread unlawful bank account closures.

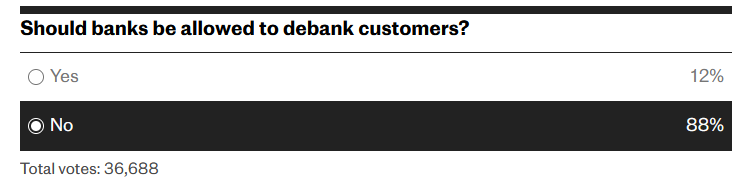

A poll for the Telegraph asking whether banks should be allowed to debank customers received 36,688 votes, with 88% voting against it.

Did you like the article? Share it!