Bitcoin basics for beginners

Bitcoin is the first-ever globally accessible decentralised cryptocurrency currency launched in 2008 in response to the great financial crash. These Bitcoin basics will help you explain Bitcoin to grandma with eye-popping results.

Bitcoin inspired the development of the cryptofinance landscape, giving rise to coins such as Litecoin and Ethereum, both of which are still very popular today. For all intents and purposes, Bitcoin is the native currency of the Internet, and potentially the globe.

Bitcoin basics summary

In this post, I will dive into the Bitcoin basics, frequently asked questions, and start you off on your Bitcoin and cryptocurrency journey. If you’re a newbie, stick around and read till the end. Here’s what I’ll discuss:

- What is Bitcoin?

- Who created Bitcoin?

- Who controls Bitcoin?

- What is the Bitcoin blockchain?

- Who can create a Bitcoin wallet?

- What is Bitcoin mining?

- How do I buy Bitcoin?

- Where do I store Bitcoin?

- Is it safe to send Bitcoin?

- Where can I spend Bitcoin?

- What is Bitcoin Pizza day?

1. What is Bitcoin?

Among other things, bitcoin is completely digital, which is to say that there is no physical form. It can be sent quickly and securely from anywhere in the world provided the two locations have an internet connection. Since it is decentralised and not controlled by any institution, Bitcoin’s price is determined by free market forces and subject to supply and demand economics; which are in turn coloured by bitcoin’s economics.

Bitcoin is stored in digital addresses that exist on the internet. The encryption used to secure the network is called SHA-256 and is often referred to as blockchain technology. Since it is decentralised, the currency is not controlled by any central authority like a government or bank.

Bitcoin is completely open source and thousands of developers have contributed and continue to develop the code on a daily basis. One of the latest major updates was Taproot, which you can read about here.

2. Who created Bitcoin?

During the global economic crisis in 2008, also referred to as the sub-prime mortgage crisis, an entity nicknamed Satoshi Nakamoto decided that it was the right moment to release the first ever decentralised digital currency. Satoshi could be an individual or a group of individuals, but nobody knows for sure.

On October 31, 2008, Bitcoin was introduced with the release of the whitepaper, titled Bitcoin, A Peer-to-Peer Electronic Cash System, by Satoshi.

The Pseudonym, Satoshi Nakamoto keeps the true identity of the Bitcoin inventor(s) hidden. While many pretenders have claimed to be the creator, none of them have provided conclusive evidence and have been dismissed for a variety of reasons – not least because it is very easy to prove that you are Satoshi by moving genesis coins.

During the nascent years, Bitcoin had nearly no monetary value. But a growing active community eventually evolved and began improving the original code using Bitcoin improvement proposals (BIP). In 2010, Satoshi left Bitcoin development and his last known communication dates back to April 2011 – an email conversation.

In the years that followed, the community grew as more individuals began looking at sound money principles and assets which lived up to those values.

3. Who controls Bitcoin?

The Bitcoin basics have some things in common with traditional finance, but the fundamentals are radically different. In traditional finance, it is thought that a bank, government or entity must stand behind a currency in order to ensure economic stability.

This is no longer the case in the 21st century. A few decades ago, the debt-based economies began to take shape, wherein central banks were able to print money without having any link to tangible assets (such as gold or other commodities). By taking this course of action, central bankers created a death spiral of inflationary pressures, such that the purchasing power of fiat currency eroded over time.

It should be noted that before this era, money was not controlled by the state or central banks. And from a first principles level, Bitcoin is a return to this state of affairs, allowing every individual with an internet connection to have complete control over his money.

4. What is the Bitcoin blockchain?

In this Bitcoin basics feature, the goal is to gain sufficient understanding about Bitcoin to explain it to Grandma.

In the simplest terms, the BTC blockchain is merely a public digital ledger that includes all transactions in Bitcoin’s history, and it is divided into blocks of information.

Full nodes (computers) are scattered all over the world and contribute to the ledger’s maintenance and security. This is done through a process that keeps the integrity of the ledger using the SHA-256 cryptographic algorithm.

The open consensus mechanism is maintain by allowing practically anyone to join the network, create a node and preserve the blockchain’s integrity. This is what ensures decentralisation, as so no single entity, be it a bank, a company, or a government, can force the network to change the ledger or to rewrite history.

5. Who can create a Bitcoin wallet?

Unlike the banking system, which chooses who can and cannot use financial services, anyone can create a Bitcoin wallet.

This brings many benefits, the most important of which is easy accessibility and censorship-resistance.

The difference between fiat currency systems and bitcoin is palpable. Banks create policies to which customers must oblige, despite having done nothing wrong. If a client fails to submit to such policies, banks have the authority to shut down their accounts, reverse or freeze payments or any manner of things which is outside of the individual’s control.

This cannot happen with Bitcoin because the user is the sole authority controlling his funds.

In terms of accessibility, anyone in the world with Internet access can obtain, send, store, and transact with Bitcoin. Anyone can open a ‘Bitcoin account,’ (wallet) so to speak, which is basically downloading a digital wallet app.

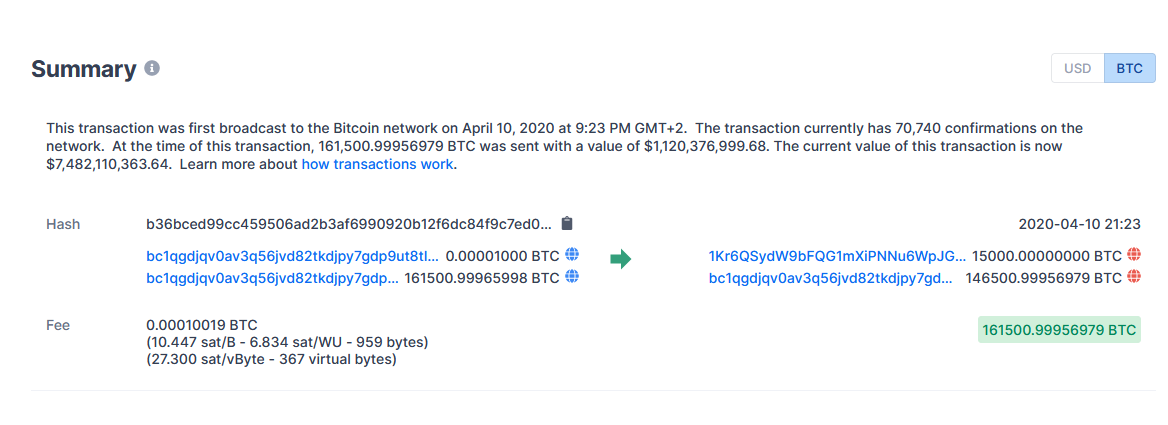

Sending large amounts of bitcoin is also a lot faster and cheaper than sending fiat. On April 1 2020, 161,500 ($1.1 billion at the time) Bitcoin were sent in a single transaction. The transaction cost 0.00010019BTC (about $0.68 cents at the time).

6. What is Bitcoin mining?

Bitcoin mining is a process that ensures network security and that new bitcoin enter circulation in accordance with the protocol’s inflation rate. Whenever Sarah wants to send Bitcoin to Bob, she creates a transaction and signs it with her private key and then broadcasts the payment to the network.

At this stage, miners pick up the transaction, validate it and put it into the next block. This is in turn broadcasted onto the public ledger (blockchain). A blockchain is essentially a chain of data blocks with recorded transactions. As you might imagine, this is where the term blockchain comes from.

When was the first Bitcoin mined?

The first Bitcoin was mined on January 3, 2009. It’s also known by “block number 0” or the Genesis block, carrying a reward of 50 Bitcoins for the miners.

What are miner rewards?

Miners earn two types of rewards – transaction fees for validating the transactions and the second is a block reward.

The miner who manages to solve the aforementioned cryptographic problem receives a block reward, which is the second type of miners’ reward.

As of now, the block reward is 6.25 coins per block and will decrease to 3.125 coins per block post halving (May 2024). Every four years there is a halving event, at which time the reward is cut in half.

So why isn’t everyone mining?

Mining involves solving complex cryptographic problems, based on the proof-of-work hashing algorithm.

In the early days, a personal computer was enough to to mine Bitcoin, but nowadays, as competition has grown exponentially, mining firms are the biggest players that take part in mining Bitcoin.

Notably, the protocol only allows for the creation for 21 million coins, ensuring digital scarcity that cannot be replicated by definition. Once 21 million bitcoin circulate the internet in 2140, there will be no new bitcoins minted and miner compensation will be solely dependant on transaction fees.

This brings us to the next point regarding the advantages of Bitcoin over traditional FIAT currencies.

7. How do I Buy Bitcoin?

The simplest way to get hold of bitcoin is by buying online or through a mobile application. Of course, it’s paramount to purchase bitcoin from a well-known and reputable provider, such as those used on this site.

Is it possible purchase less than one Bitcoin?

Bitcoin has eight numbers after the decimal point. Near infinite divisibility is by design. In fact, the smallest unit of account is 0.00000001 Bitcoin, also known as one Satoshi. However, it’s better to avoid sending that amount of bitcoin as the transaction fee would be higher. The Bitcoin lightning network is a second layer solution designed to handle smaller transactions at zero cost. Alternatively, the Litecoin network has lower fees, quicker transaction times and is also widely adopted.

8. Where do I store Bitcoin?

The same way you keep regular fiat coins in your wallet, you can store Bitcoin in a specialised digital wallet. Every wallet has its public address where coins can be received (similar to a bank account IBAN).

Briefly, the address is a string of digits and English letters about 30 characters long. There is no cost to create a wallet and there is no limit on the number of wallets you can create.

You can either use the native Bitcoin Core (or Litecoin Core) wallet, or use a mobile application such as Wasabi wallet. Alternatively, the safest and most secure option is to buy a hardware wallet, such as Ledger.

9. Is it safe to send Bitcoin?

Sending Bitcoin is completely safe, provided the information is correct. A Bitcoin transaction is a digitally signed order that is secure and encrypted. The transaction is signed by the outgoing wallet (sender) and is broadcasted to the network until it reaches the block explorer.

Can transactions be tracked?

The Bitcoin block explorer is a public ledger that maintains a live log of all Bitcoin transactions. Each block contains many transactions and log commands and once it is closed, the transaction takes place and funds subsequently arrive at their destination.

Technically, fund movements are recorded on-chain and can be tracked. However, millions of hundreds of thousands of transactions take place every week, making it unlikely for someone to track your movements. Additional privacy features exist with certain wallets, such as Wasabi wallet.

Litecoin’s second layer solution, called MWEB, masks wallet values by default, while retaining total decentralisation. This approach is superior to current Bitcoin offerings.

How long does it take to send Bitcoin?

When using the native layer one blockchain, it takes about 10 minutes to confirm a Bitcoin transaction. However, this varies depending on the network traffic and the memory pool. Litecoin’s confirmation times are 2.5 minutes.

Lightning network transactions are much faster and can be used for quick payments.

What is the cost to send Bitcoin?

The only cost to send bitcoin over the network is the transaction fee, which does not depend on the geography or distance travelled.

This fee is added to every order and paid to the miner for his work to close the block.

The cost of transferring Bitcoin is significantly cheaper when compared to other means of transferring money. However, transaction costs vary in the traditional world depending on the country. Instead of having a fixed fee, most digital wallets offer a set of options to process transactions.

The higher the fee, the faster the transfer the transaction (miners which favour higher fees will process your transaction before others).

To emphasize how cheap it is to send vast amounts in Bitcoin, this transaction of $101,000,000 was sent only for as low as a $121 transaction fee, which is roughly 0.00001%.

10. Where can I spend Bitcoin?

Bitcoin is not the world’s reserve currency yet and is still in the process of mass adoption. However, various payment providers allow instant crypto-to-fiat conversions powered by Visa should the need arise.

At the same time, the number of businesses that accept Bitcoin as a means of payment are constantly increasing. Here are seven reasons why accepting Bitcoin and cryptocurrencies as a means of payment will help your business growth.

11. What is Bitcoin Pizza day?

In the hot summer of 2010, when many doubted the very notion of digital money, one of the early adopters named Laszlo Henitz pioneered the crypto payments industry by ordering pizza and paying for it with Bitcoin.

In those days, Bitcoin was worth a few cents, and to order two family pizzas worth $30, Laszlo paid 10,000 Bitcoin.

You might be familiar with the first-ever Bitcoin pizza purchase; which became widely known as the world’s most expensive pizza. To be exact, 10,000 Bitcoin is worth $461 million in today’s terms.

Now that you understand the Bitcoin basics, explain it to grandma and prepare to be riveted by the results!

No information will be seen or construed as financial advice.