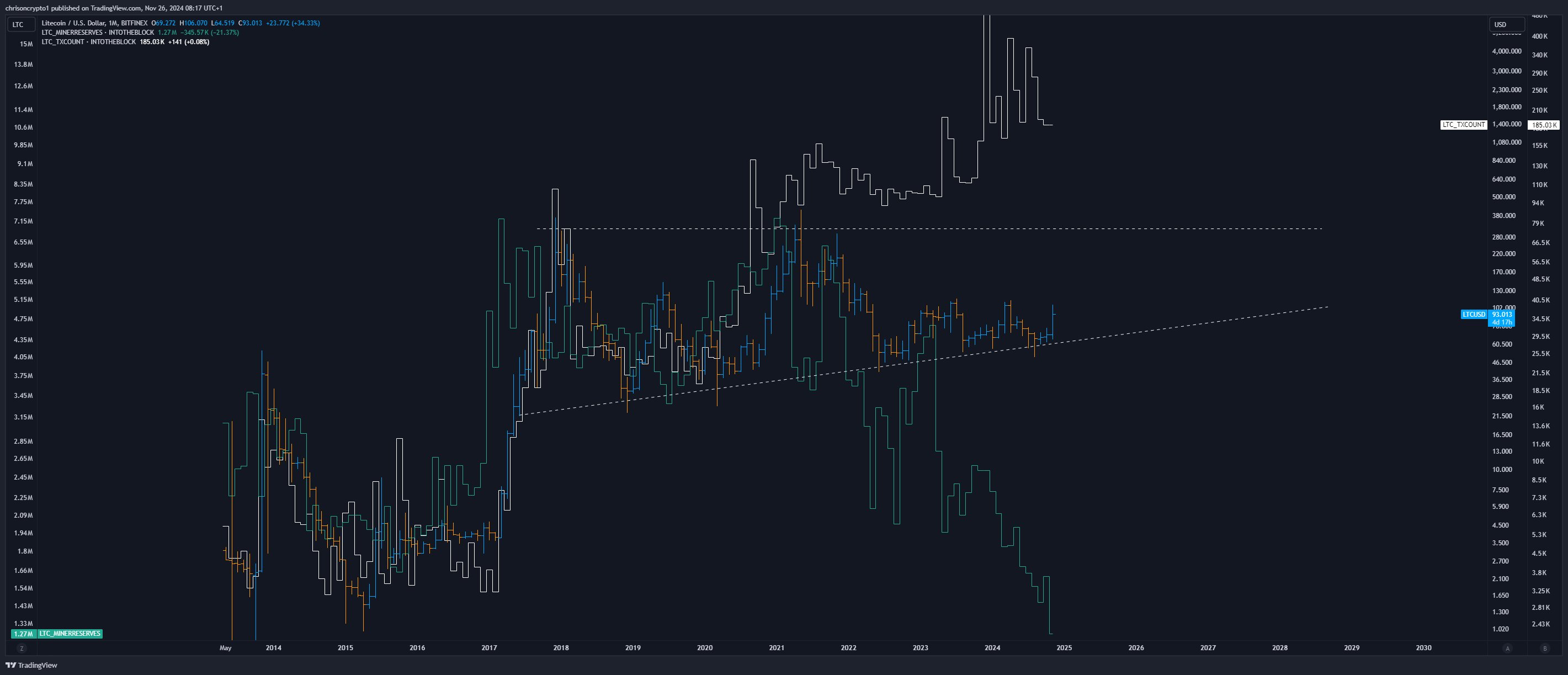

Litecoin miner reserves have plummeted as miners sell their supply at record pace since March 2021, with inventories hitting their lowest levels since November 2015.

Over that period, miner inventories fell from 8.5 million coins to just 1.27 million coins today. The significant reduction shows increasing supply-side constriction from this cohort.

On the one hand, distribution opens the floodgates for lower prices amidst weak market conditions. On the other hand, even modest increases in speculative demand are enough to spark a strong corrective move higher since less coins are available at the current price-range.

With fewer coins in miners’ hands, the market is poised to see an increase in Litecoin’s value as demand increases. This scenario is especially interesting when considered in light of the network’s activity, which has gone in the other direction.

Market implications

While market dynamics are more complicated than what one cohort of participants is up to, miner influence on the market ebbs and flows over time, regardless. These effects include:

- Price impact

The immediate effect of miners selling could result in temporary price suppression, as has been the case historically. However, as supply diminishes over time, especially with the halving reducing fresh coin issuance, asset scarcity could drive prices higher. - HODLer accumulation

Long-term holders (Hodlers) are now in a stronger position, owning significant portions of the available supply, leading to shorter sell-offs and ever-steeper price hikes. - Investor sentiment

While crypto investor sentiment tends to vary widely on a daily basis, savvy investors might see this dynamic as an opportunity to buy Litecoin at cheaper prices given the lowered potential downside risk due to neutered miner influence.

The miner sell-off does not occur in isolation and coincides with broader market trends. This includes institutional interest, as evidenced by Grayscale’s aggressive (LTCN) buying spree and new products that have not yet come to market. Indeed, while Exchange Traded Funds (ETF) for Litecoin are not available yet, they’re expected to launch in 2025. Such flows can significantly influence Litecoin’s price.

In short, while the miner selling trend could raise eyebrows on the face of it, it’s happening against a backdrop of increasing scarcity, growing usage and utility, and black on white institutional interest.

Investors and enthusiasts will be eying the asset closely over the next 6 to 12 months, with some speculators expecting a sharp revaluation of Litecoin that can push into the five figures as strategic pivots come into play.

Buy, trade and exchange Litecoin on reviewed exchanges here.

Disclaimer: the content on this site should not be considered as investment advice. Investing is speculative. Your capital is your responsibility.