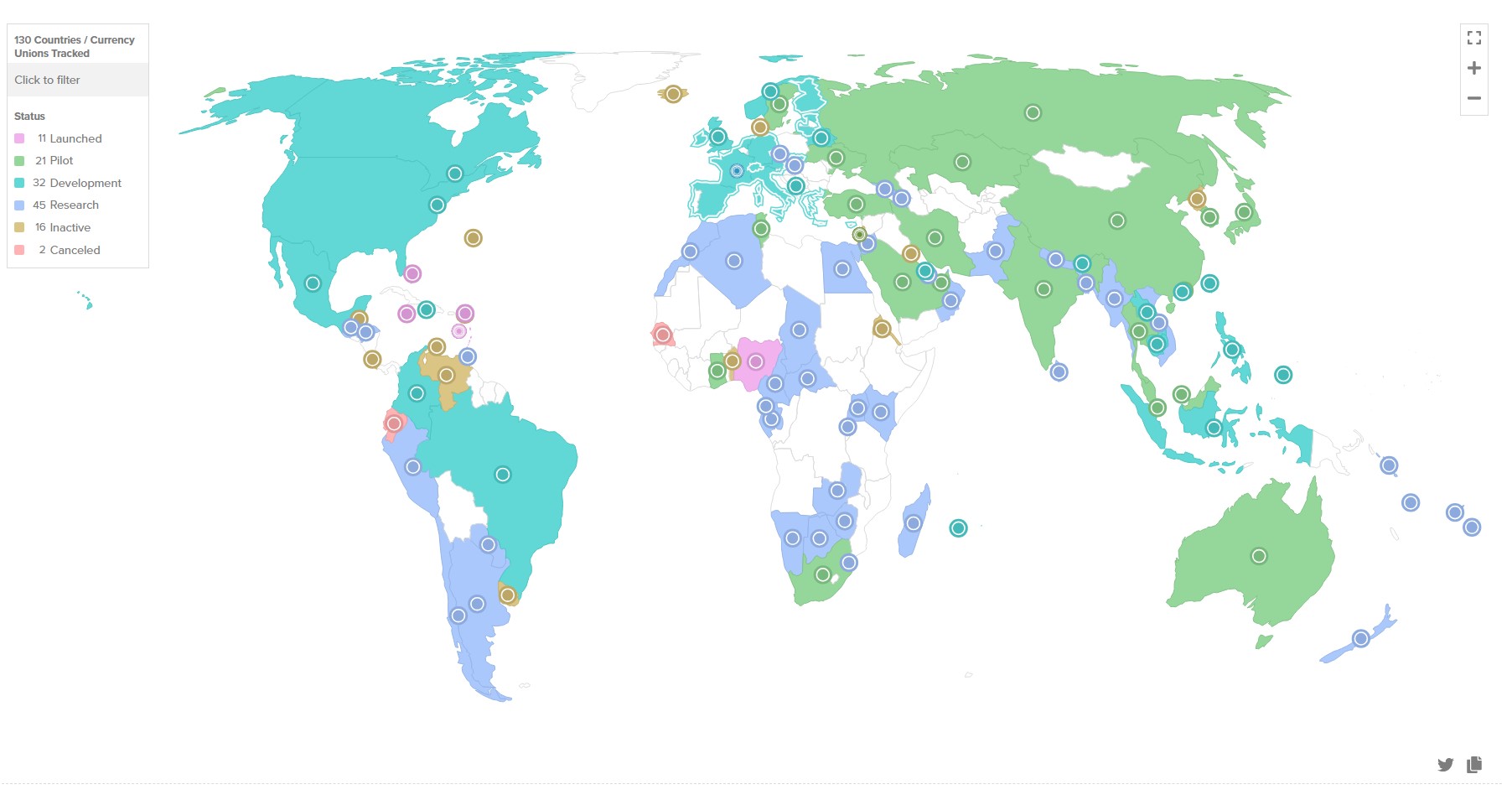

According to Statista data, 130 countries representing a total of 98% of global GDP are exploring CBDCs due to their inherent ability to facilitate direct government surveillance and coercive control over payments.

Aggregated data from Statista and theatlanticcouncil.org reveal that countries all over the world are rapidly accelerating plans for a central bank digital currency.

Key findings from the CBDC tracker site include:

- “130 countries, representing 98 percent of global GDP, are exploring a CBDC. In May 2020, only 35 countries were considering a CBDC. A new high of 64 countries are in an advanced phase of exploration (development, pilot, or launch).”

- “19 of the G20 countries are now in the advanced stage of CBDC development. Of those, 9 countries are already in pilot. Nearly every G20 country has made significant progress and invested new resources in these projects over the past six months.”

- “11 countries have fully launched a digital currency. China’s pilot, which currently reaches 260 million people, is being tested in over 200 scenarios, some of which include public transit, stimulus payments and e-commerce.”

- “The European Central Bank is on track to begin its pilot for the digital euro. Over 20 other countries will take steps towards piloting their CBDCs in 2023. Australia, Thailand and Russia intend to continue pilot testing. India and Brazil plan to launch in 2024.”

- “In the US, progress on retail CBDC has stalled. However, other G7 banks, including the Bank of England and the Bank of Japan are developing CBDC prototypes and consulting the public and private sectors on privacy and financial stability issues.”

- “The US is, however, moving forward on a wholesale (bank-to-bank) CBDC. Since Russia’s invasion of Ukraine and the G7 sanctions response, wholesale CBDC developments have doubled. There are currently 12 cross-border wholesale CBDC projects.”

In Western democracies, the ongoing financial crisis could precipitate the switch to a CBDC regime if enough irrevocable damage is done. Despite the existence of superior, decentralised public money, users would have a central bank account with coupons issued and controlled by the central bank. In certain Chinese districts, citizens with a low social credit score are banned from using public transportation, attending sports venues, concerts, and a laundry list of normal activities.

CHINA – Facial recognition digital ID. What is the definition of a criminal?

▪️Attending a protest?

▪️Disagreeing with the government? ▪️Questioning science?

▪️Believing in biology?

▪️Using too much carbon? Your future looks like this https://t.co/ttSWysTDvL pic.twitter.com/hbOLnONOKX— Songpinganq (@songpinganq) December 27, 2022

Under this regime, central banks will have direct access to individuals, their spending habits, as well as an ‘on and off’ switch to individual finances. This is a sever form of capital control that is both unethical and illegal under current standards.

The emphasis on ‘cross border payments’ to introduce a CBDC does not pass the smell test either. Since the supposed problem of ‘cross border payments’ has already been solved many times over, ECB executives have revealed that introducing a digital euro is not necessarily about the public good.

On the other hand, the allure of direct influence and control over people’s finances appears far more prescient now that sovereign money in the form of Bitcoin and Litecoin is available to all, with no strings attached.

Here are seven reasons why one should begin accepting direct cryptocurrency payments.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!