It’s no secret that crypto is either awash with fact-free speculative fervour, or preparing for it. If anything at all, it’s an open secret.

Facts over fiction

However, this hasn’t stopped the core value proposition for censorship resistant, sound money so much as delayed it.

Indeed, on the opposite end of fantastical flavour-of-the-month, speculative mania is a grounded monetary network that delivers in silence. Litecoin is that network. And regardless of whether today’s market sees it, migrating economic activity from Bitcoin to Litecoin is a natural outcrop of the original Bitcoin story.

User migration to the Litecoin network

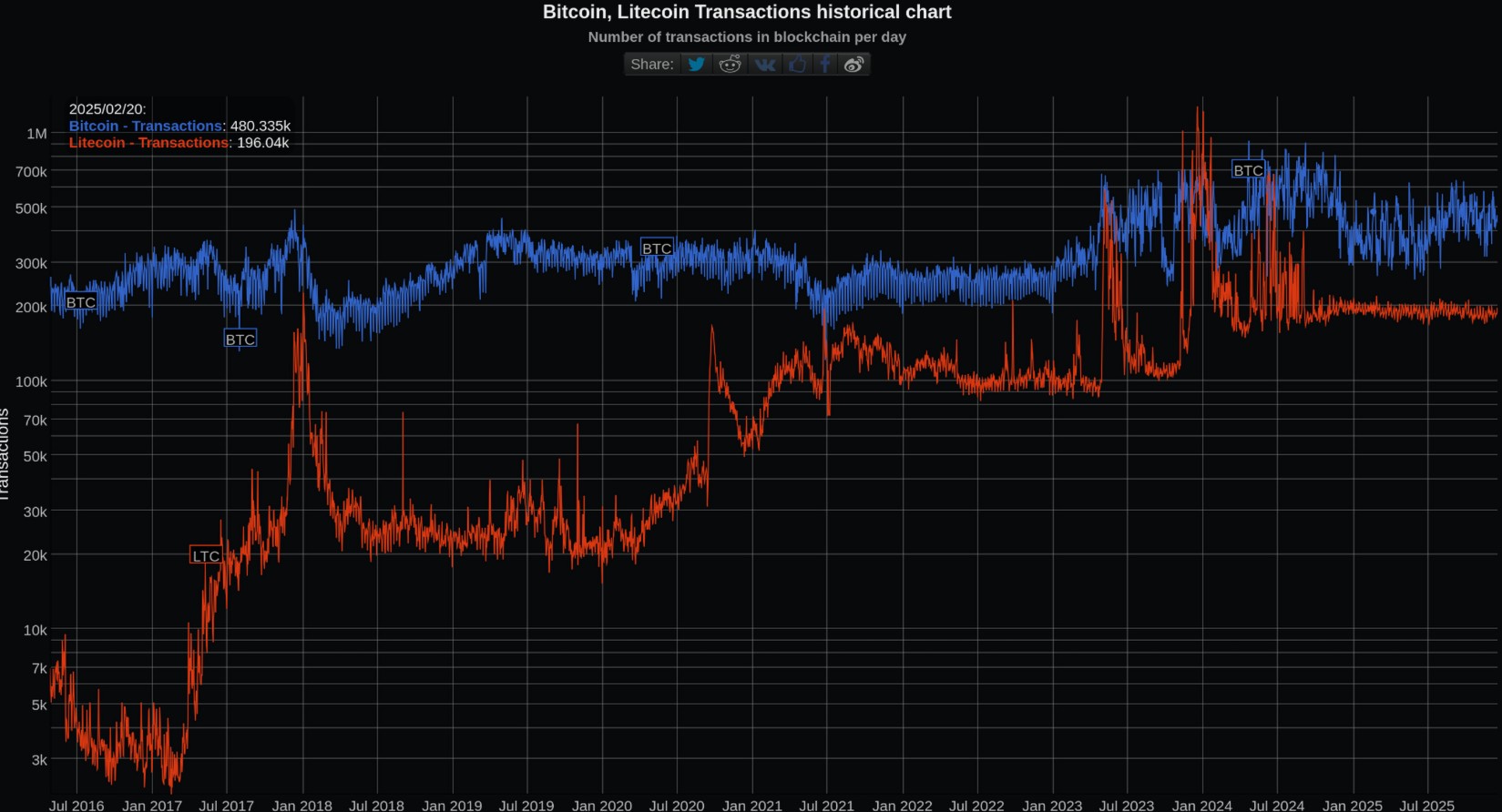

One crucial piece of evidence buttressing the idea of incoming structural repricing for Litecoin lies in the converging transaction trends of the two networks since 2017 (and prior to this year too).

Since then, the Litecoin main chain experienced a staggering 75x increase in daily transaction activity, now consistently registering around 200,000 transactions per day.

Meanwhile, Bitcoin’s transaction activity has modestly increased to around 450,000 transactions per day – doubling in that same time frame.

The reason for this migration is simple: as demand for block space picks up, the cost of using the network skyrockets. During peak times, users have been forced to pay over $120 just to get their transaction confirmed, an untenable situation for everyday usage. This has naturally driven people to seek a more practical solution, with Litecoin being the prime candidate.

By contrast, Litecoin’s 2.5-minute block times and its Scrypt algorithm keep things moving cheaply. Even when the network is busy, a transaction will typically cost less than a cent, making it a far more sensible choice for everyday use.

The key takeaway is that increasing Bitcoin usage displaces users seeking to use its network, which means that over time, lower and mid-value transactions systematically migrate to Litecoin, as evidenced by data from bitinfocharts.

Asymmetric value

Today, Bitcoin has somewhat solidified its role as a digital settlement layer and store of value for large, high value transfers. At the same time, Litecoin has evolved into the preferred network for everyday payments and smaller transactions, functioning as “digital silver” to Bitcoin’s “digital gold.”

Bear in mind, Litecoin neither has a marketing department nor a venture-capitalist gang who can hype up the coin by throwing money at it. The distinction matters because it speaks to the underlying cohort of users who have shown where their confidence lies by consistently choosing Litecoin over other networks.

While this argument is not without its weaknesses since Bitcoin and Litecoin have essentially interchangeable purposes and first principles, the two networks have built sustained economic moats – a feat no other networks have achieved.

In some sense, Litecoin has progressively occupied the rare position that belonged to Bitcoin and Ethereum in the early days, and the more one appreciates this fact, the more intriguing the market capitalisation disparity becomes.

The path of least resistance

Litecoin’s shared foundation with bitcoin, robust decentralised infrastructure and longevity – having survived and operated continuously since 2011 without a single network failure, provides a level of security and reliability that newer, more experimental chains cannot match.

In turn, this makes it the default, lowest-risk alternative for users and capital seeking to escape both bitcoin’s congestion and speculative bloat relative to the only proven alternative in town.

As the second Bitcoin chain, every new Bitcoin user indirectly strengthens Litecoin’s case for monetary adoption, cementing its role in the wider economy.

If you found this article useful, consider sharing it.